Uff Da! Uber, Lyft to Stay in Minnesota

Wolt launches double orders, Target misses target, delivery ordering trends

It’s another big week for gig work policy… with a compromise in MN perhaps serving as a vanguard for other debates in CA and WA. Plus, we’ve got international product launches, new trends to gawk at and a hot mess at Target. Read on!

This week’s edition is brought to you by Nickelytics.

Today:

Minnesota, TNCs Reach Compromise

Wolt Double Orders Go Live in Finland, Israel

Chart Time | The Latest Delivery Trends

A Not So Rosy Target Q1

POLICY | TNCs to Stay in MN After Pay Compromise

Talk about Midwestern nice… after much ballyhooing, the big two TNCs are opting to stay in Minnesota, thanks to changes in state policy. MN’s new pay law is a compromise, offering drivers $1.28 per mile and $0.31 per minute, similar to the recommendations from an earlier state report, way up from what drivers were earning earlier, and also markedly down from the rate Minneapolis was trying to impose: $1.40 per mile and $0.51 per minute. The part of the law that makes the TNCs happy is that it overrules any cities from passing further pay increases, although with 95% of trips happening in the Minneapolis-St. Paul region, it’s safe to say that the apps weren’t all too worried about new policies popping up in Funkley (population: 12.)

The Big Picture: Is compromise the name of the game with gig pay laws this year? Over in California, the state Supreme Court seems hesitant to overturn Prop 22, the voter initiative that established a “meet in the middle” approach to gig worker pay and benefits. (Although the court may at least strike the portion of the law that requires a seven-eights majority to amend it.) Up north in Seattle, change is in the air as well, as the city council appears likely to undo its PayUp legislation, which only went into effect in January, and gave gig workers a host of new protections and raises. Among other changes, CB 120775 would reduce gig worker pay from 75 cents to 34 cents per mile. (Check out our earlier, in-depth coverage of PayUp.)

PARTNER | OOH That’s Moving Forward

Nickelytics specializes in leveraging the power of car wraps, gig-economy drivers and robotics. Nickelytics offers brands and agencies a comprehensive platform to amplify their advertising reach. Transform robots into high-impact advertising assets to capitalize on events and college campuses. We make it easy to capture coveted audiences that are traditionally hard to reach - by focusing on engaging out-of-home channels and giving you the analytics to retarget smoothly. It’s time for OOH to move forward.

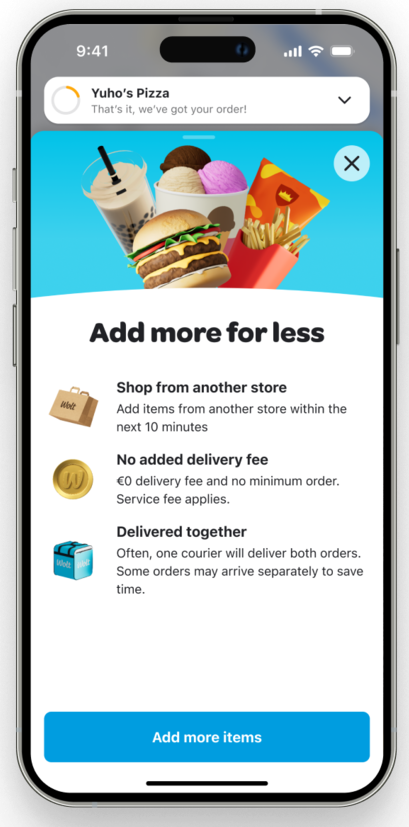

OPERATIONS | Wolt Brings Double Ordering to Israel

It’s a mitzvah — DoorDash-owned Wolt is bringing its “Double Order” to the Israeli market, a few weeks after first launching it in Finland. Here’s how it works:

Customers place their initial order as per usual, with the app then suggesting nearby merchants that can be added to the order.

Customers have 10 minutes to add additional products to the order.

Depending on the market, the additional order will likely incur zero, or limited, additional delivery fees, and no order minimums.

The Big Picture: Deep delivery heads will note that Double Order sounds just about the same as DoubleDash, the double ordering system that Wolt owner DoorDash introduced way back in 2021 (maybe it’s time to merge those two code bases?) While it’s environmentally friendly, many merchants don’t love that diners get their food a bit slower, leading DD to push usage towards adding less sensitive items like beer and liquor. And speaking of the Middle East (ok, this is a stretch,) check out this fun stunt by Deliveroo over Dubai: the first app-centric delivery by traditional abra boat.

CHART TIME | Hot Trends in Delivery

DoorDash has released its fourth annual Restaurant Online Ordering Trends Report, highlighting fun new ways folks are making use of delivery. While the full report is full of fun data, we’ll call out this one, the top holidays for booze delivery: Christmas, NYE, T-Giving, Xmas Eve, T-Giving Eve, Black Friday, July 4th, Cinco de Mayo, Labor Day, and Halloween. Okay the Black Friday one is kind of weird, but we guess if you’re going to go get into a fight at Walmart for a cheap TV, you may as well be hammered…

FINANCE | Target’s Rocky Transition to Digital Retailing

Target released its Q1 results this morning, and with the stock currently down about 6.5%, it’s safe to say the results weren’t as rosy as its logo. Store comparable sales fell 4.8%, while digital comparable sales rose 1.4%. That added up to digitally originated sales climbing to 18.3%, but still resulted in an overall fall in comp sales of 3.7%. All in all, revenue was down 3.1% to $24.5 billion and net income fell under 1% to $942M.

The Big Picture: This was the first time since 11/2022 that Target’s missed earning expectations, coming in 3 cents per share below consensus. After raising prices for many quarters, customers are now pushing back, leading to some margin pressure. While rival Walmart is able to fall back on groceries — which account for 60% of U.S. sales — that category only represents 20% of Target’s revenue. While the acquisition of Shipt was meant to help the retailer grow its grocery share, recent comments by Chief Growth Officer Katie Stratton suggest that Shipt shoppers are also growing very price conscious.

A Few Good Links

Dallas turns to curb management to revive moribund entertainment districts. Cocktail Courier buys booze deliverer Thristie. Utah launches delivery by Bell helicopter (why?) FarmboxRx said no to VCs that wanted pivot to meal kits. Instacart CFO remarks drive stock wobble. DD unveils restaurant accelerator participants in Twin Cities and DC. McD’s struggles with CosMc’s speed. Move your order pickup lockers outside. 30% of Americans rely on side hustles to make ends meet, ouch. Ports of LA, LB nab $112M. Brix buys Clean Juice. Vehicle supplier Spartan Radar names new CEO. Turo drops new S1-A. CitiPod starts crowdfunding. Wolt shares vision for Europe.

Got a tip, feedback, or just want to say hi? Reply back to this email.