Uber Eats & Instacart Join Forces for Food Delivery

Bolt IPO nears, Minneapolis pay law still rankles TNCs, Japan's delivery aversion

No need for a big intro today, you ought to get straight to the industry-shaking news from Uber Eats and Instacart. But then stick around for big updates from Bolt, Minnesotan legislators and Japanese data hounds!

This week’s edition is brought to you by Yoshi Mobility.

Today:

Uber + Instacart = Wowza

Bolt Runs Towards IPO with €220M

Chart Time | Japan’s Delivery Laggardness

Minneapolis’ Pay Means Uber & Lyft Walk Away

3PD | Instacart Chooses Uber Eats to Power Resto Delivery

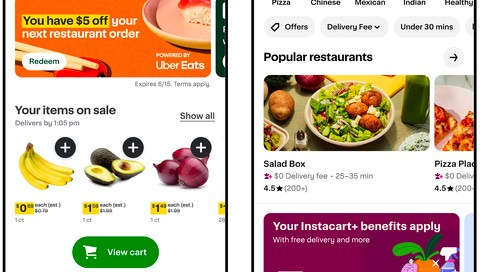

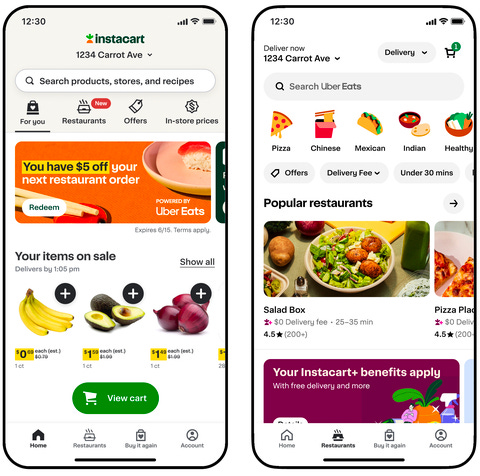

Now here’s an announcement that might just change everything… Uber Eats and Instacart have formed a strategic partnership to bring UE’s merchants to IC’s customers. Powered by a new “Restaurants” tab in the Instacart app, hungry IC users will be able to scroll through hundreds of thousands of Uber Eats-listed restaurants, check out in-app, have the meal delivered by Uber’s couriers, and even use their Instacart+ memberships to get free deliveries on orders of $35 and up.

The Big Picture: This must have been quite the deal to hammer through, given that the two companies have become fierce rivals on the grocery side of the biz, not to mention in growing verticals like fashion and beauty. Delivery warriors in both camps likely put down their swords and insulated hot bags when they saw that this solves a big problem for both firms. Instacart, which has a market cap of about 7% of Uber’s, has long been dogged by its inability to deliver restaurant meals, which is a far larger market. And Uber, despite its profitability and prowess, has been languishing with a domestic market share that’s only a bit better than 1/3 the size of DoorDash’s. Now not only does Instacart have a way to get its users some pad thai or pizza, but Uber Eats gets to be just one click away for IC’s 7.7 million monthly active users.

PARTNER | Virtual Vehicle Inspections Are Changing the Game

Getting a car inspection can be a hassle. What if it could be done in minutes and virtually?

Originally designed for rideshare & carshare partners, Yoshi Mobility has expanded its service to meet a broader demand for DOT inspections among fleet operators. Fast, hassle-free inspections for maximum convenience. Click here to simplify your inspection process going forward.

FINANCE | Bolt Raises €220 Million as IPO Nears

European mobility and delivery biggie Bolt has secured a new €220 million ($235 million) credit facility, in a move that provides the Estonia-based company with “additional flexibility as we work towards being IPO-ready.” Bolt offers “Rides,” its TNC service, as well as “Food,” for meal deliveries and “Market” for groceries, alongside subsidiaries for scooters, e-bikes, carsharing and corporate mobility. All told, it has 150 million customers across 45 countries, largely in Europe, Africa and LatAm. Its lenders are Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, JPMorgan, LHV Pank and Luminor.

The Big Picture: Bolt, which last raised €628M at a €7.4B ($7.97B) valuation in 2022, is getting deliciously close to an IPO. The company has always maintained lean operations compared to some of its more profligate competitors, losing just €72M on €1.26 billion of sales in 2022. The company has previously estimated it would break even at some point in 2024 and hit the public markets in ‘25. Overall, the IPO flood gates look to be slowly reopening: GM-backed self driving firm Momenta has also filed its listing paperwork, Chinese EV giant Zeekr may cash in as much as $5B in its own listing and we’re even back to seeing earlier stage firms like Wayve close whopping $1.05 billion Series Cs.

CHART TIME | Delivery Sales in Asia

New data from Measureable AI compares the 3PD markets across Asia, where different countries have very different attitudes towards food delivery. Delivery revenue in Hong Kong is 63% that of Japan’s, despite the fact that HK’s population is just 7.3 million, while Japan’s is 125.1M. Part of the divide may be Japanese traditionalism, but we bet it also matters that over 60% of orders are discounted in Hong Kong, while it Japan it’s only 17%.

POLICY | Revised MN Rates Still Too Rich for Uber, Lyft

The game of chicken between Minneapolis area policymakers and the big TNCs continues, as city and state leaders have unveiled a revised wage package, after previously agreeing to delay implementation of their earlier proposal that was passed in March. The newly revised policy would pay Minneapolitan drivers $1.27 per mile and 49 cents per minute, down from the earlier plan of $1.40 per mile / $0.51 per minute. Governor Tim Walz has not expressed his support for the new deal, while Uber and Lyft say they will still leave the market if those rates hold. “I think they’re bluffing,” countered House Majority Leader Jamie Long, DFL-Minneapolis. “They’re operating in Washington state at rates that are above what we’re proposing.”

The Big Picture: That’s a half truth. In Washington state, drivers make $1.31 per mile and 38 cents a minute. In Seattle proper the rate is an impressive $1.55 per mile and 66 cents per minutes, but as we just heard, it took a whoooole lot of policy work to get there. Germane to that comparison is of course that the general minimum wage in Seattle is $19.97/hr, almost 30% higher than Minneapolis’ $15.57. The cost of living in Minneapolis is also about 35% lower than it is in Seattle…

A Few Good Links

How ecommerce is saving brick and mortars. Shopee Malaysia launches on-time guarantee. Amazon pushes to make U.K. deliveries sustainable. Gold Days of Grubhub+ returns May 13 to June 9. Delivery pilot doubled Starbucks’ late-night sales. The 10 fastest shrinking restos. Covenant names ex-Waabi exec as COO. Amazon extends transition period for low inventory fee. Amazon closes SF grocery fulfillment center. Square premieres resto ordering kiosk. House looks to crack down on dangerous USPS contractors. DeliverThat partners with Cartwheel. Kazakh and MENA QSR operator Americana Restaurants sees net income fall 52%. Nikola wholesaled 40 fuel cell trucks in Q1. Lucid delivered 1,967 vehicles. Demand for busses rises.

Got a tip, feedback, or just want to say hi? Reply back to this email.