Grubhub Speeds Indoor Delivery with Amazon Key

Amazon launches new grocery brand, Uber Eats' Foodpanda acquisition in trouble, egrocery sales surge

We’re starting the week off with double the Amazon news: one announcement means Grubhub drivers have easier access to apartment towers and residential communities, while the other shows the shopping giant is still hungry for grocery growth. (And we’ve got new data showing just how important that market is!) Plus, a 3PD acquisition in Asia looks to be in trouble.

This week’s edition is brought to you by Curbivore 2025.

Today:

Grubhub Deploys Amazon Key Nationwide

10th Time’s the Charm — Meet Amazon Grocery

Chart Time | Online Groceries Sales Boom

Taiwan Opposes Uber Eats, Foodpanda Deal

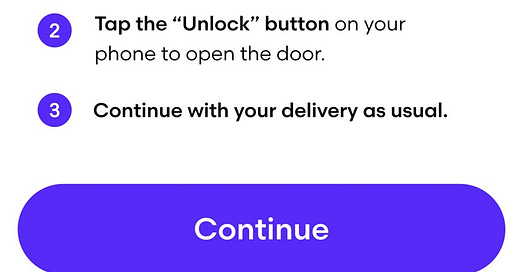

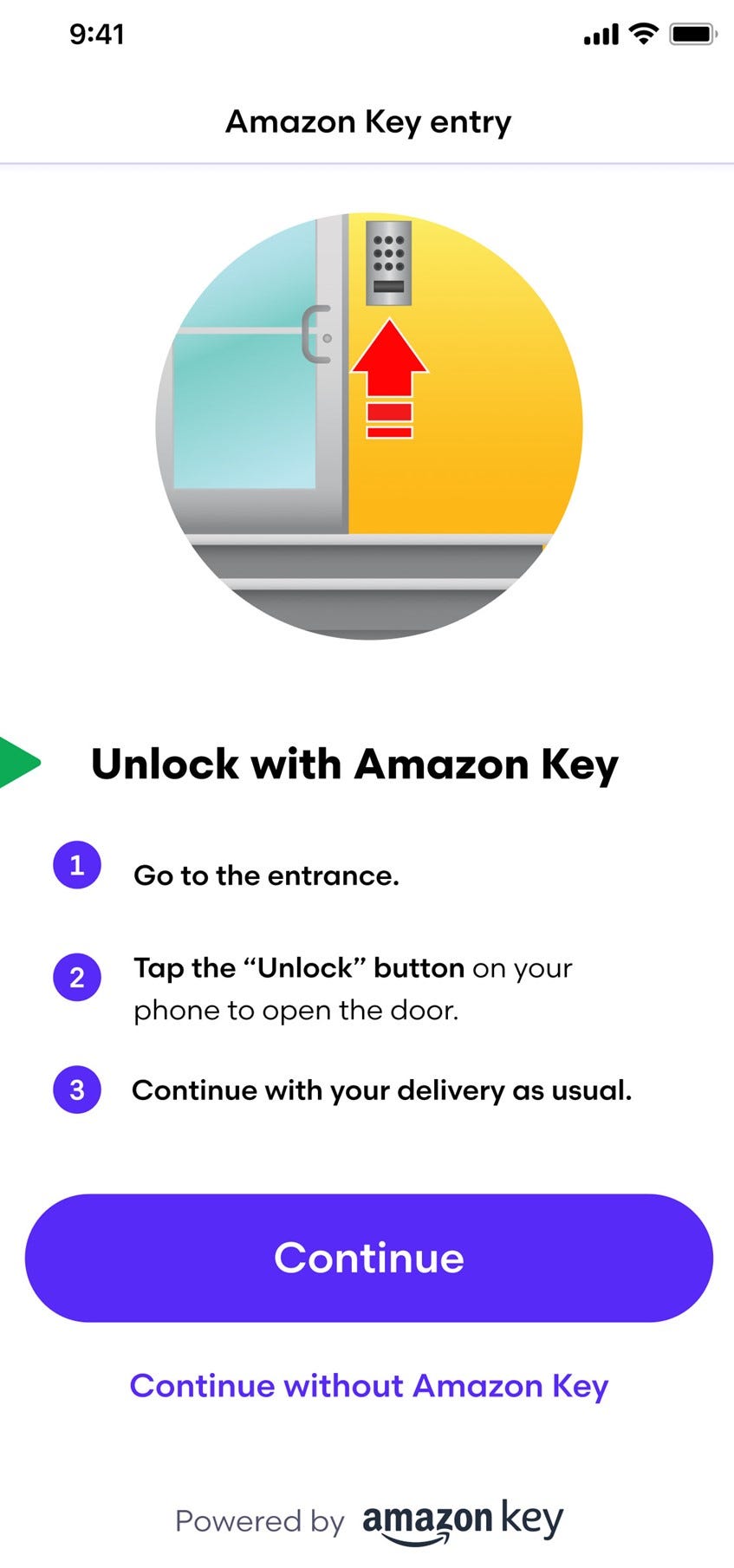

PRODUCT | Amazon Key Lets In More Grubhub Couriers

Amazon and Grubhub just announced the wide-scale deployment of an Amazon Key integration, allowing the latter’s couriers one-click access to gain authorized entry to common areas of Amazon Key-enabled buildings and gated communities, seriously speeding up delivery times. “For years, Amazon Key has transformed how Amazon deliveries are made within restricted-access buildings, providing a seamless experience for building staff and delivery drivers alike. We're excited to now extend that same convenience to Grubhub," said Kaushik Mani, Director of Amazon Key. "As online shopping continues to grow, the influx of packages presents new challenges for delivery drivers and building management... Our customers have asked for an expanded service that accommodates third-party delivery companies, and we're thrilled to meet that need, making delivery access more efficient and manageable for everyone involved."

The Big Picture: In an email to Modern Delivery, Amazon noted that an earlier pilot of the partnership reduced delivery partner care team calls by over 50 percent, and order cancellation rates by 22 percent; 72% of Grubhub drivers reported Amazon Key provided quicker access to delivery locations. Grubhub and Amazon have been intertwining more and more tightly for years now, with Prime members getting Grubhub+ for free; GH parent co. Just Eat Takeaway.com is surely hoping they can get Amazon to buy up its struggling North American operations. While this new integration may give Grubhub a leg up over its 3PD competition, other solutions, like Walmart InHome, brings a customer’s orders all the way to his or her kitchen.

EVENTS | Delivery & Mobility Come Together at Curbivore 2025

Industry Dive just called Curbivore one of the “9 restaurant industry trade shows to attend in 2025.” Returning to the Downtown LA Arts District this April 10th and 11th, Curbivore brings together the world’s foremost fleet operators, restaurateurs, regulators, retailers, startups, technologists and policy makers to discuss the intersection of transportation systems, small business, urban design and commerce.

Score your Early Bird Tickets now and save.

GROCERY | Amazon Launches Yet Another Grocery Brand

If at first you don’t succeed, try, try again. That seems to be the shopping giant’s approach to groceries, as it launches yet another supermarket brand: Amazon Grocery. The company’s first location, in Chicago, is colocated in a high rise that also hosts an Amazon-owned Whole Foods. The new store is a scant 3,800 square feet, hosting about 3,500 SKUs. Per store photos, checkout seems to be performed via traditional scan-it-yourself style self-checkout. While the store can be used to process Amazon returns, the company has yet to share details on how it’ll be used for deliveries.

The Big Picture: If you want to buy groceries from Jeff Bezos, your options now include: Amazon Grocery, Amazon Fresh, Amazon Go, Whole Foods, Whole Foods Market Daily Shop, plus defunct offerings like Amazon Prime Pantry and 365 by Whole foods Market. By opening their newest brand in the same space as a Whole Foods, Amazon is looking to capture shoppers who want say a Diet Coke or some Oreos to wash down their organic kale. No wonder Whole Foods founder John Mackey had to resort to taking molly to “let go of my hurt and anger toward Amazon…”

CHART TIME | Online Grocery Sales Surge

No wonder Amazon keeps throwing money into grocery markets, the sector is once again growing like gangbusters. Online grocery sales hit $9.5 billion last month, up a huge 27% YoY, albeit down $400M from August. For all of Q3, sales came in at $27.4 billion, up 13.8% from the year prior.

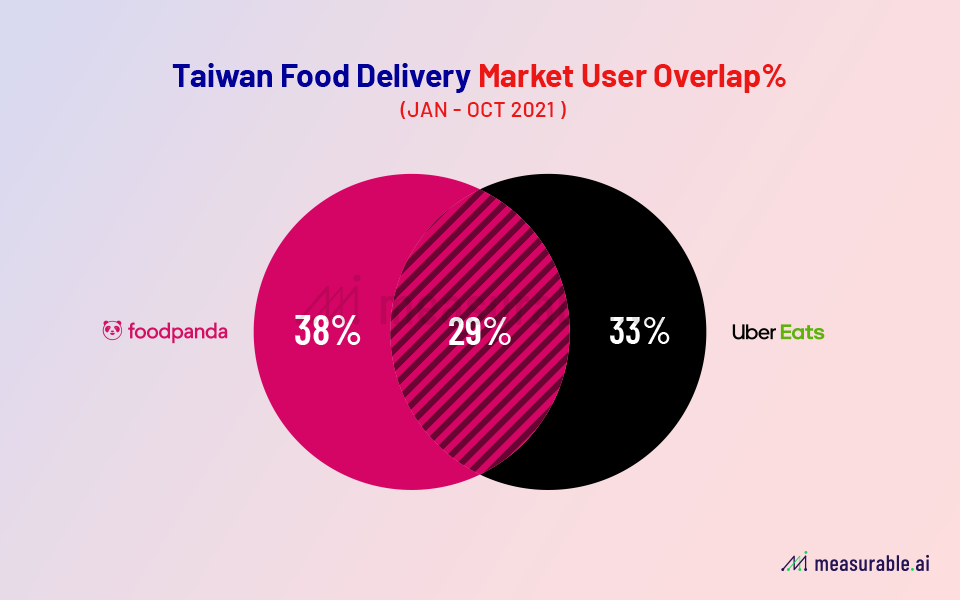

POLICY | Taiwan’s Regulators Oppose Uber Eats-Foodpanda Merger

Taiwan’s Ministry of Labor notified the country’s Fair Trade Commission that it officially opposes Uber Eats' proposed acquisition of rival meal deliverer Foodpanda. It seems the two brands may be playing “hide the ball,” as the Fair Trade Commission is evidently still awaiting both companies to submit all the required documents before it can begin regulatory review.

The Big Picture: This deal always seemed destined for a political fight, as a combined Uber Eats + Foodpanda would have a near monopoly on third party food delivery in the nation of 23 million. If the $1.25 billion deal falters, that could be a real blow for Delivery Hero, the struggling multinational 3PD that would see about a 50% boost to cash on hand from the transaction.

A Few Good Links

Deliveroo and Cookidiction launch product tie-in for Venom: The Last Dance. Tressie Lieberman rejoins Brian Niccol at Starbucks, serving as new Global Chief Brand Officer. Instacart Health and Foodsmart tout telenutrition weight loss outcomes. Jake Paul to franchise Dog Haus, join board. Yum! Brands loses chief legal and franchise officer. McDonald’s looks pretty greasy after Trump stops by a Pittsburgh-area franchise. Kenny Rogers Roasters lives on in Singapore. (Does anyone else remember the recurring MadTV skit about the brand?) TGI Fridays eyes bankruptcy. TomTom powers IVECO commercial nav solution. GM invests in lithium production. US supply chain re-shoring to North America. Port of LA volume nears $1 trillion per quarter. Japan drafts food waste reduction rules, encouraging restaurants to let customers take home leftovers. Domino’s raises funds for St. Jude Children’s. Panera Bread launches MyPanera Week. Pony AI files for IPO. Uber pushes injured rider to arbitration. South African TNC Shesha turns to an interesting new marketing strategy: violence.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.