Uber Eats Buys Foodpanda Taiwan, Adds Features

DoorDash expands Ulta partnership, Serve revenue up, eGrocery sales surge

Gosh… we go away for a couple of days and the delivery world just goes crazy! So let’s quickly catch you up to speed with the latest and greatest announcements from Uber, DoorDash and the wild world of robotic deliveries.

This week’s edition is brought to you by Nickelytics.

Today:

Uber Buys Foodpanda Taiwan, Adds New Features

DoorDash Glams Up for Ulta Beauty

Chart Time | April eGrocery Sales Surge

Serve Robotics Drives Towards Growth in Q1

3PD | Uber Goes Big in Taiwan with Foodpanda Acquisition

Uber’s doubling down on key markets, as it looks to buy up Foodpanda’s Taiwan operations. The $1.25 billion deal sees Uber shelling out $950 million in cash to Foodpanda owner Delivery Hero, as well as the purchase of $300M in newly issued DH shares, priced at 33 euros apiece, which represents a 30% premium for the Berlin-based company. Over the past year, the Taiwan market represented around 1.6 billion euros in transaction value for Delivery Hero, which managed to break even in the region; Uber now expects the subsidiary to add $150 million annually to its adjusted core profit.

The Big Picture: Uber Eats and Foodpanda had fought to a draw in Taiwan, with both capturing just around 50% market share. That seemed to be a comfortable stalemate for both, as order discount rates were low, allowing Delivery Hero to eke out that aforementioned breakeven. If regulators approve the deal, Uber Eats will have a lot of pricing power in the market, which is already the case for their mobility services, as TNC competitor Grab doesn’t serve the country.

Uber had big news for the rest of the world as well, as it rolled out a slew of new features at Go-Get 2024. On the delivery front there’s a new “lists” feature that allows users to share menu favorites with one another, a new partnership with Costco, and a discounted rate ($48/yr) on Uber One for students. Other reveals include Uber Shuttle van service to destinations like airports and concert venues, scheduling features for UberX Share, and the ability to appoint caregiving users in the app. Separately, the company is partnering with Blitz Motors to offer electric mopeds to couriers in the United Kingdom.

PARTNER | OOH That’s Moving Forward

Nickelytics specializes in leveraging the power of car wraps, gig-economy drivers and robotics. Nickelytics offers brands and agencies a comprehensive platform to amplify their advertising reach. Transform robots into high-impact advertising assets to capitalize on events and college campuses. We make it easy to capture coveted audiences that are traditionally hard to reach - by focusing on engaging out-of-home channels and giving you the analytics to retarget smoothly. It’s time for OOH to move forward.

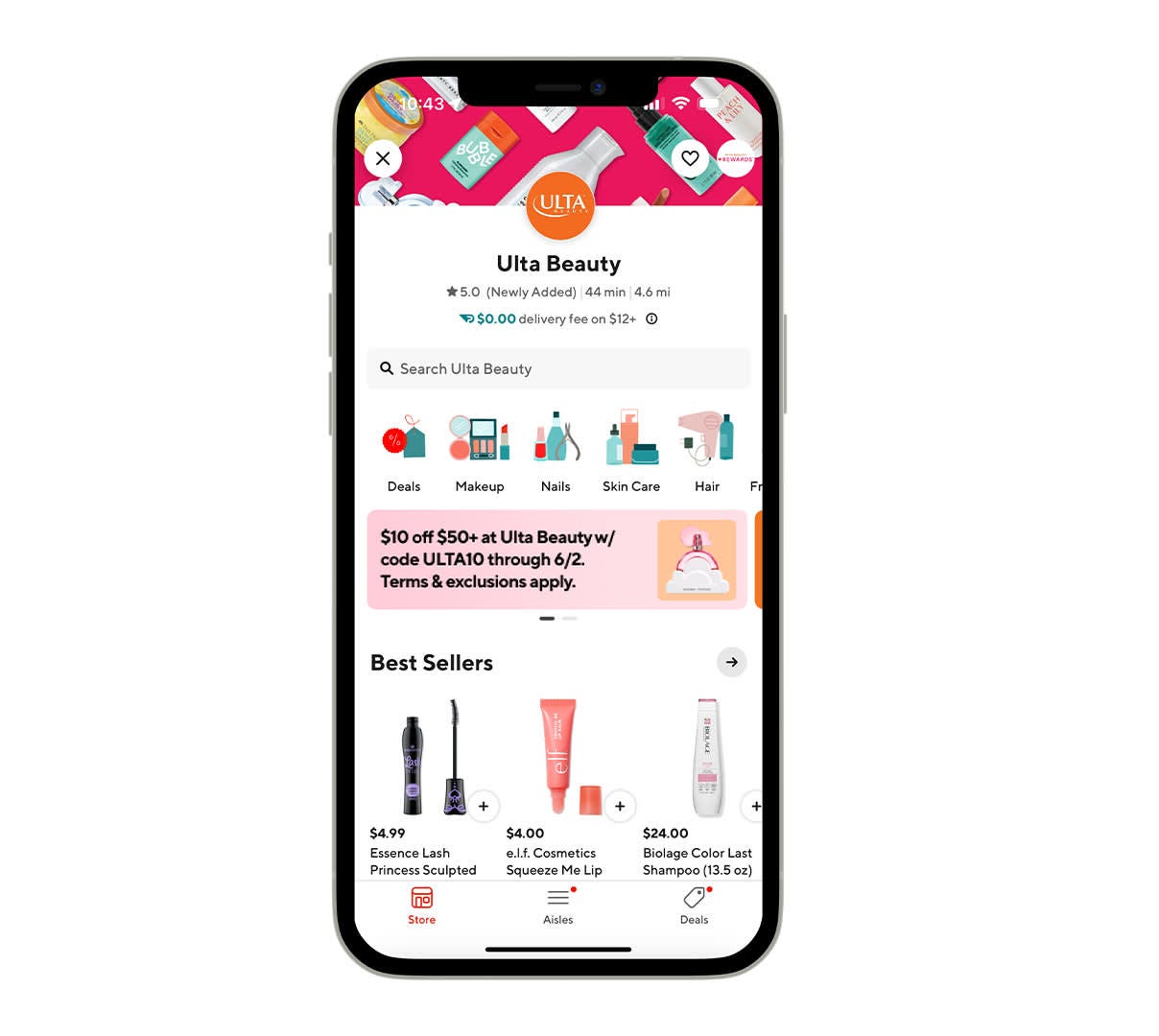

PARTNERSHIPS | DoorDash Adds Ulta Beauty’s 1350 Locations

DoorDash is expanding its partnership with Ulta Beauty, the nation’s largest cosmetics and fragrance retailer. DD will now cover 1,350 stores in all 50 states, giving it effectively complete coverage of the retailer’s footprint. Ulta stocks 25,000+ products from over 600 brands. To kick off the announcement, the two companies are offering consumers $10 off orders of $50 or more, with Ulta orders also qualifying for the usual DashPass discounts.

The Big Picture: DoorDash first partnered with Illinois-based Ulta back in November 2021, at the time limiting the collaboration to markets like Atlanta, Boston, Chicago, Los Angeles, Houston and that internationally recognized capital of cosmetics: Boise. With the partnership now expanded, this is the first time all of DoorDash’s users can order from a beauty retailer across all 50 states. Ulta is not available on Uber Eats or Instacart, although some of its white labelled products are via distribution deals through 3PD-hopping brands like Target.

CHART TIME | April eGrocery Update

April delivered the goods for the online grocery sector, with sales jumping to $8.5 billion, up $300M compared to last year, and up an even more impressive $500M over the previous month. Mass retailers saw their orders rise 500 basis points, while consumer cross shopping between traditional grocers and hard discounters also grew.

AUTONOMY | Serve Quarterly Revenue Nears $1M Mark

Serve Robotics reported its first quarterly results as a public company, pushing forward a sector that’s been reeling the past few weeks. The company’s revenue rose to $946,711, up from just $40,252 a year prior, with $850,000 of that from its licensing deal with Magna International. Daily active robots climbed from 23 to 39, while daily supply hours rose 97% to 300. The company now has $34.2 million of cash and cash equivalents on hand.

The Big Picture: Was Motional’s big cutback a sort of nadir for the autonomous delivery space? Other competitors seem to be firing on all cylinders, with AV middle-mile leader Gatik signing a vehicle production partnership with Isuzu, and raising $30M in the process. Meanwhile, Waymo declared that its commercial operations are now ferrying 5,000 paid customers or meals per week. And sidewalk bot competitor Starship Technologies celebrated one year of operations in Finland, where it has now made over 150k deliveries, with a heavy emphasis on groceries.

A Few Good Links

Zomato achieves first full year profit. Walmart ecommerce sales climb 21% in strong Q1. DoorDash shares more data on NYC courier pay effects. Pizza Hut names new CMO, Sbarro claims new President. Jack in the Box MarCom VP moves to Del Taco. Ohio restaurateurs push legislation to raise minimum wage in bid to fend off ballot initiative. Bolt cuts back in Nigeria as it plans to launch scooters in America. Hot Ones launches delivery partnership through Mealco. Gopuff trims 6% of staff. Massachusetts AG takes TNCs to court over worker classification. Walmart opens next-gen fulfillment center. Trader Joe’s shares pricing strategies. Will Uber buy Instacart? Cracker Barrel starts $700M brand overhaul. Olo partners with Tray. EV+ partners with CBRE. Red Lobster bankrupt. Shein employees work 75 hours per week. Long John Silver’s launches new app. Just Eat Takeaway.com adopts all annual general meeting resolutions. VDC still believes in virtual brands.

Got a tip, feedback, or just want to say hi? Reply back to this email.