Wonder Scores Fresh $100 Million Strategic Investment

DoorDash Accepts HSA+FSA, May Mobility Series D, Toast Q3

It’s another big day for the money — with Wonder hauling in $100 million in strategic investment from Nestlé. AV player May Mobility also gobbled up $105M in largely strategic capital, showing a route forward in this tough capital environment. Plus DoorDash is taking a new type of subsidy dollar, and Toast’s Q3 was a bit stale.

This week’s edition is brought to you by Cambridge Mobile Telematics.

Today:

Wonders Secures Cash, Partnership from Nestlé

DoorDash Taps Into HSA/FSA Dollars

Chart Time | VCs May Love AVs

Toast Grows, But Investors Cool

STARTUPS | Wonder Secures $100M, Strategic Partnership w/ Nestlé

Delivery mega-startup Wonder secured a fresh $100 million in funding from food giant Nestlé. Wonder will use the investment to expand WonderWorks, its B2B division that works with hotels, stadiums and offices to offer meal options on-site. While Wonder will provide the hardware, the new partnership allows them to offer Nestlé ingredients and food products, like its Sweet Earth veggie burgers, Nescafé coffee and Stouffer’s Italian entrées. “This strategic partnership will allow us to bring an innovative and new-to-market solution to our customers as they look for ways to scale their operations. It can help them improve food quality, drive labor efficiencies, and open up additional revenue streams,” said a Nestlé representative.

The Big Picture: For Wonder, this gets the company one step closer to being the “mealtime super app” that its Founder Marc Lore envisioned, as part of the lofty ambitions that got the startup a $3.5 billion valuation in 2022. More practically, it also refills the company coffers after it doled out $103 million for meal kit maker Blue Apron five weeks ago. While the company gave up on cooking in trucks (see its old hardware here) the New Jersey-based brand will operate 10 delivery-enabled food halls by EOY, with plans to open 20 more in 2024.

PARTNER | Save Money and Make Drivers Safer

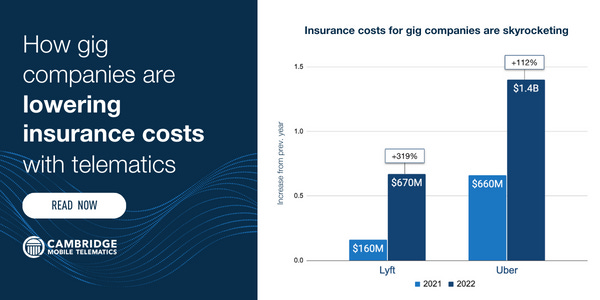

Insurance costs are skyrocketing for gig companies. In 2022, Uber’s insurance costs increased by $1.4B from 2021. Lyft’s insurance costs increased by $670M, contributing 90% to its increase in cost of revenue. To help reduce insurance costs, companies are turning to telematics. They’re making drivers safer through real-time feedback and rewarding their safest drivers.

3PD | DoorDash Taps Into HSA, FSA Dollars

Quick, when’s the last time you saw that weird HSA debit card your company gave you when you started the job? Well, DoorDash is hoping you remember where it is (or at least the numbers on the front) as the delivery giant announced it now accepts HSA (health savings account) and FSA (flexible spending account) benefit payments for eligible items. DoorDash has over 30,000 HSA/FSA eligible products including over-OTC medicine, Covid test kits, first aid supplies, menstrual products, sunscreen, home diagnostics devices, and fertility tests. Participating retailers include Albertsons, Bartell Drugs, CVS, DashMart, Dollar General, Hy-Vee, Meijer, Rite Aid, Safeway, Walgreens, Winn-Dixie, Vons and 7-Eleven.

The Big Picture: For 3PDs, unlocking new subsidized consumer dollars is a key to staying one step ahead of inflation. September saw Uber Eats roll out SNAP and FSA payments; Instacart’s has accepted SNAP in each state since August and rolled out Medicaid / Medicare acceptance last month. DoorDash did its own SNAP / EBT launch back in late June.

CHART TIME | There’s Still Money for May Mobility

Despite a tight fundraising environment and a number of negative stories out there about autonomous vehicles, evidently VCs are still gaga for AVs. Ann Arbor-based May Mobility just closed a $105 million Series D, led by NTT Group and joined by Toyota Ventures, Aioi Nissay Dowa Insurance Co., State Farm Ventures, BMW i Ventures, Cyrus Capital and Trucks Venture Capital. As part of the round, NTT got exclusive rights to deploy May’s Toyota-powered autonomous shuttles in Japan. While the Series D was a tad smaller than last year’s Series C, it’s the midsize-city, transit-focused model that brought in its first $120k pre-seed round back in 2017.

FINANCE | Toast Revenue Grows 37% to 1.03 Billion

Restaurant POS, order management and delivery dispatching tool Toast put out its Q3 results, with headline revenue growing 37% YoY to a cool $1.03 billion. ARR climbed 40% to $1.218 billion, gross payment volume was up 34% to a whopping $33.7 billion and gross profit rose 50% to $226 million. Net losses slimmed from $98M a year ago to just $31 million. Total locations increased 34% to approximately 99,000, with net new locations of over 6,500 for the quarter.

The Big Picture: You’d think big growth and an easy glide path to profitability — the latter so elusive in the category — would be enough to keep investors satisfied. And yet the stock dropped nearly 20% on the news, despite the company projecting a positive adjusted EBIDTA of $38-48 million for the year, up from earlier forecast. But with Toast noting a “modest slowdown” in same-store transactions, starting back in September, the market is worried that hungry folks, and the companies that rely on them, are growing a bit satiated.

A Few Good Links

Fast food chains are shrinking dining rooms and adding asphalt as Americans head to the drive-thru — but are restaurants responding to consumer preferences or creating them? Why investors are sweet on Salted. Cava revenues up 50% to $174M. Dutch Bros income rises 740% to $13.4M. GoTab named 29th fastest growing company in N. America. Restaurant apps ranked. Getir gobbles up FreshDirect.

Join us at our 11/14 Happy Hour in Downtown LA.

Got a tip, feedback, or just want to say hi? Reply back to this email.