Waymo & Vayu Launches Recharge AV Deliveries

EU calls Delivery Hero a cartel, Albertsons delivers digital growth, Serve stock up

Hot new hardware, juicy government investigations, stocks popping for no good reason, and legacy players growing their delivery biz? Today’s Modern Delivery truly has something for everyone, so let’s dig in!

This week’s edition is brought to you by Gigs.

Today:

Big AV News from Waymo, Vayu, Tesla, Cruise and Kodiak

EU Investigates Delivery Hero, Glovo as a “Cartel”

Chart Time | Serve Stock Pops

Digital Sales Show Promise for Kroger, Albertsons

AV | New Funding & Products from Waymo & Vayu

The AV space continues to heat up, starting with news that Alphabet is doubling down on Waymo, with plans to commit an additional $5 billion into its robotaxi and autonomous delivery subsidiary. Waymo also revealed some fresh hardware, thanks to its partnership with Zeekr: the purpose-built 009 van, outfitted with Waymo’s sixth-gen tech stack, is now popping up on SF roads. It’s not just the big guys that are turbocharging the space, Vayu Robotics unveiled its new Lidar-free delivery bot, capable of driving both on-street and in-store. Led by ex-Apple SPG, Lyft and Velodyne execs, the company recently raised $12.7M in funding, and can deliver 100 pounds of goods at speeds of up to 20 MPH.

The Big Picture: Just about every AV player seems to have some news this week. Starting with GM, the OEM noted it plans to no longer build its autonomy-specific Origin vehicle for Cruise, instead sticking to its Bolt EVs in the face of “regulatory uncertainty.” On the other end of the caring-about-regulations spectrum, Elon Musk announced that Tesla’s own robotaxi prototype will be revealed on 10/10, amidst a rough quarterly report that saw EPS fall 43%. Meanwhile, AV trucking player Kodiak also scored a big deal to provide a “driver-as-a-service” for Atlas Energy.

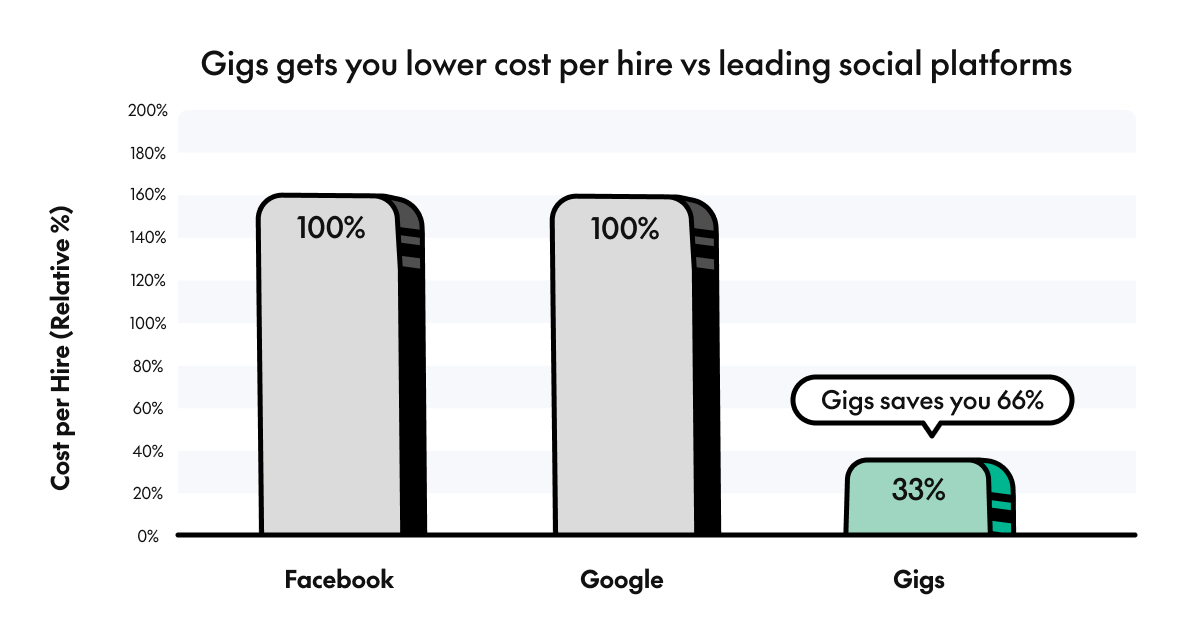

PARTNER | Gigs Gets You a Lower Cost per Hire

Gigs empowers companies like Gopuff to hire gig and hourly workers (either gig or W2) at the lowest possible cost per hire. We specialize in high-volume, high-churn roles such as warehouse workers, delivery drivers, and general labor positions. Our extensive network ensures we quickly reach the right applicants in any market. We consistently deliver hires at a lower cost than Facebook and Google, making us the most cost-effective solution for your hiring needs.

Learn more at getgigs.co/employers.

POLICY | EU Investigates Delivery Hero, Glovo for “Cartel” Behavior

The European Commission’s inquiry into Delivery Hero and Glovo is getting serious, with the EU’s executive arm noting it had opened an antitrust investigation to assess whether the two companies breached competition rules by “participating in a cartel in the sector of online ordering and delivery of food, grocery and other daily consumer goods.” The commission is specifically concerned that, prior to Glovo’s acquisition, the two may have “allocated geographic markets and shared commercially sensitive information (e.g., on commercial strategies, prices, capacity, costs, product characteristics).” The Commission is also concerned the two agreed not to poach each others employees, suppressing wages, and that the practices were abetted by Delivery Hero's minority share in Glovo. The commission will now carry out an in-depth investigation, “as a matter of priority.”

The Big Picture: This move has been a long time coming, with Delivery Hero announcing earlier this month that it expected to be fined as much as 400 million euros ($433M USD.) Prior, the EU raided Delivery Hero / Glovo offices in Berlin and Barcelona in 2022 and ‘23. While the EU notes its the first time the Commission has looked into anti-competitive agreements in the context of a minority shareholding by one competitive operator, there are similar precedents in other regions, such as the USDOJ’s 2010 High-Tech Employee Antitrust Litigation against U.S. tech and entertainment giants, where intermingled control of Apple, Pixar and Lucasfilm may have been a contributing factor. Delivery Hero has published a response, noting that it’s fully cooperating with the investigation.

CHART TIME | So Much the Efficient-Market Hypothesis

Serve Robotics’ stock popped late last week, after Nvidia filed a Schedule 13G, noting it held 10% of the delivery bot player’s shares. But this wasn’t a new transaction by Nvidia, the chipmaker has been an investor for quite some time, and that was even reiterated in Serve’s S-1 prior to its public listing. But evidently if you’re a day trader looking to ride some vaguely AI-related hype by association, such nuance is immaterial…

GROCERY | Delivery Drives Growth for Albertsons, Kroger

Mega-grocer Albertsons Companies released its quarterly results yesterday, with net sales hitting $24.3 billion, up $200M from the year prior. Net income fell to $241 million, way down from 2023’s $417M, driven in part from higher merger-related costs, employee costs and tax changes. Things looked better on the app side of things, with digital sales up a whopping 23%, and the company’s retooled loyalty program growing 15% to 41.4 million members.

The Big Picture: Albertsons’ merger dance partner Kroger also recently released its quarterly results, with revenue creeping up two tenths of a percent to $45.269 billion, and net income down 1.56% to $947M. Similarly, delivery sales looked to be a bright spot, up 17% YoY, with overall digital sales climbing 8%, and digitally engaged households up 9%. The grocer looks to be improving its economics, having closed three of its Ocado-powered, automated fulfillment spokes, so it can focus on “higher customer density and better order level profitability.”

A Few Good Links

Pizza problems: Midwestern Pizza Hut franchisee bankrupt, Blaze Pizza franchisee fined $277K for 28 underage child laborers. Stalking horse bidder to buy Red Lobster. Are national food holidays good for biz? What did the RNC mean for resto operators? Newsweek names top rated retailers. Flashfood releases tool for indy grocers to increase food access. Lyft prez Sverchek stepping down. Zaxbys creates e-commerce arm. California mandates e-forklifts. SEC reveals trucking ponzi. Deliverect debuts marketing intelligence tools for restos. Sacre bleu — Wingstop opens pop-up in Paris. Cookie deliverer Tiff’s Treats opens beaucoup new stores. Bollinger readies electric Class 4 truck with new warranty. Par buys Task for $206M. British taxi-hailer Karhoo enters second bankruptcy. Yay for more sustainable packaging: beyond the big Federal push, Starbucks leads city-wide initiative in Petaluma, which sounds a bit like DeliverZero but for bevvies.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.