Vroom + Uber = Convenient, Who Loses if UPS Strikes?

Traffic cameras return to the streets, superfast delivery still raising cash

At Modern Delivery, we believe that any one type of delivery can learn from every other form and function of logistics. Restaurateurs and food delivery networks should be learning from grocery stores; grocers should be watching what’s happening in meal kits; those in turn should be keeping an eye on ecommerce and parcels; and let’s not forget about learning lessons from ultrafast convenience, while keeping tabs on emerging vehicles and regulations. Today makes a great case in point, as a number of trends across all those sectors could impact a delivery business of any stripe.

Today:

Vroom Delivery Brings Convenience Stores to Uber Eats

The Biggest Losers if UPS Strikes

Chart Time | Superfast Delivery - Slowing Down or Still Spending?

Traffic Cameras Make a Comeback

3PD | Uber Eats & Vroom Rev Up Convenient New Partnership

Vroom Delivery isn’t a household name, but they’ve quietly established themselves as a marquee player in the world of convenience stores, helping players small and large (including select 7-Eleven & Circle K locations) turn their convenience stores into urban delivery hubs — letting hungry customers get those emergency Slim Jims delivered to their homes. Now they’re dramatically upping their reach with a new partnership with Uber Eats, meaning that not only will stores appear in Eats search results, but store owners can tap into Uber Direct to handle deliveries as well.

The Big Picture: When superfast delivery burst onto the scene a few years ago, it primed consumer interest in making convenience stores even more convenient: bring the Twinkies and prophylactics to my door! What proved trickier was getting a whole new network of dark stores up and running to support moving those items in fifteen minutes, a level of service that perhaps exceeded consumer needs. Now the big delivery marketplaces have filled the void left as Gorillas and JOKR retreat — Uber doing so with partnerships like this, DoorDash augmenting partnerships with its first-party DashMart locations, and Grubhub teaming up with 7-Eleven to offer Grubhub Goods.

LOGISTICS | Who Loses If UPS Strikes?

A strike at UPS is looking more and more likely, as the company has begun training managers to drive trucks and move boxes in the event the Teamsters walk off on August 1st. There are some obvious losers here — workers without a paycheck, the company foregoing revenue, middle managers with bad backs — but what does it mean from the customer level?

The Big Picture: Average Jane and Joe shippers won’t be too affected, as they can simply swap over to FedEx or USPS and they might not even notice a slight change in price or speed. But for midsize companies that have negotiated preferred rates, the price change will be a serious impact to the bottom line. Even more at risk are companies that have integrated more UPS services into their structures: Overstock.com for example uses UPS for returns and reverse logistics, so that will be a huge mess. Meal kits that rely on specialized cold chains will also struggle; we’re sure execs at UPS-reliant EveryPlate are worried right now. Countless brands use UPS for line-hauls and middle mile; that’ll be particularly hard to change up seamlessly, especially as competitor Yellow also looks poised to go belly up. In general, as UPS carries about a quarter of the nation’s packages, there isn’t enough slack to pick it all up: FedEx is already warning it can’t guarantee it’ll accept additional volume.

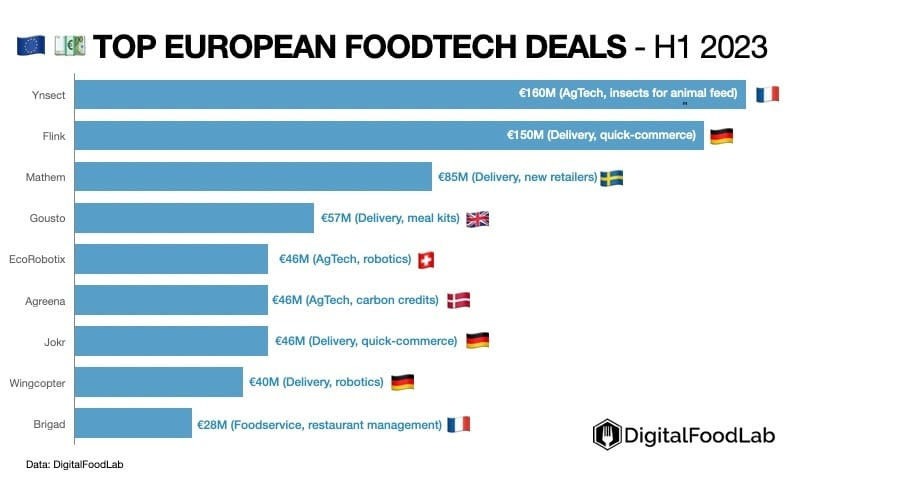

CHART TIME | Instant Delivery - Still Hot in Europe

DigitalFoodLab released some fresh data on foodtech funding, and surprisingly, superfast delivery is still pulling in big bucks, especially in Europe. While players like Blok and Cajoo are long gone, Flink, Nana, Freshtohome, Mathem and Shef are still raising big bucks for a variety of delivery business models. That doesn’t mean all is well, especially for those dead set on delivering candy bars in 15 minutes — Flink’s €150 million raise was a down-round, and a merger with Getir may still be in the cards.

POLICY | Traffic Cameras’ Big Comeback

Nobody likes getting a ticket, so much so that in years past a number of states actually passed bans on automated traffic enforcement. But as traffic safety and congestion management comes back into vogue, red light and speeding cameras are returning to the streets; 335 communities operate the former, and 195 the latter.

The Big Picture: Grumble about a ticket all you want, it’s far better than getting hit by someone speeding to “make the yellow.” From a delivery standpoint, it ties into larger trends around curb management, ensuring reliable access to commercial corridors to load and unload goods. And from an insurance standpoint, you want your drivers on their best behavior anyway! So let’s count this development as a win.

A Few Good Links

Kroger’s delivery membership celebrates first year, $115M in member savings. KFC adds new Chief Digital Officer, formerly ran apps for Marriott. Chipotle expands to Middle East. Taco John’s gives up on Taco Tuesday trademark. Clover walks back $1.50 online order fee. Layoffs hit Uber Freight. TikTok testing shopping / delivery service (guess they read yesterday’s newsletter!) McDonald’s opens “fries only” restaurant down under. UAE-based online restaurant tech startup Growdash raises $750k. DoorDash adds Deliverect and ItsaCheckmate partnership for faster marketplace onboarding.

Got a tip, feedback, or just want to say hi? Reply back to this email.