Uber Sues DoorDash

DoorDash, Delivery Hero, Wendy's, RBI & McDonald's 2024 results, January egrocery sales

What’s that… an edition of Modern Delivery on Presidents’ Day? We figure this year you might welcome the distraction, in case your mind is tied up thinking what the leaders of yore would think of the wanton, illegal gutting of the administrative and regulatory state. (On the flip side, Andrew Johnson would perhaps have admired the current chaos, as would anyone that thinks “air travel is just too darn safe.”)

If there’s one thing we can still rely on, it’s financial reports! Today we’ve got plenty of them, from both the delivery heavyweights and the fast food giants. And we’ve got a juicy lawsuit too, for good measure. (And if you haven’t already, do check out Ottomate’s recent interview with Coco’s Zach Rash, as he teases the news that his delivery bots are profitable in LA.)

Today:

DoorDash & Delivery Hero Post Strong Q4s

Wendy’s & RBI Out-Deliver McDonald’s

Chart Time | Grocery Deliveries Surge

Uber Sues DoorDash

FINANCE | Delivery Hero & DoorDash Ended 2024 Strong

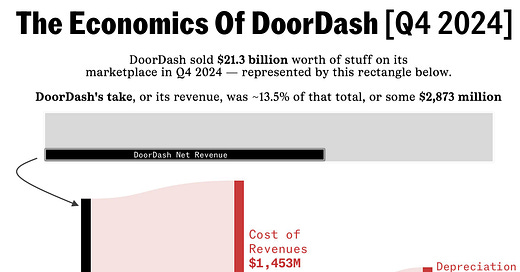

With 2024 now further and further away in the rear view mirror, we’ve got more financial results to digest from the multinational 3PDs. DoorDash saw total orders climb 19% YoY in Q4, hitting 685 million, while GOV spiked 21% to $21.3 billion and revenue was up 25% to $2.9 billion. For the entire year, revenue climbed 24% to $10.7 billion. Growth was milder for Delivery Hero, which saw GMV climb 8.3% YoY to 48.8 billion euros ($51.1B USD.)

The Big Picture: Despite hitting gargantuan scale, the delivery giants are still struggling to make reliable annual profits. While DD made a bit of money in Q4 (see chart,) for the full year the company still saw a $38M loss from operations. DH also saw strength in Q$ in particular, driven by its non-Asian markets, but it’s still teasing metrics like adjusted EBITDA and free cash flow, as opposed to true profitability.

EVENTS | Delivery & Mobility Comes Together at Curbivore 2025

Industry Dive just called Curbivore one of the “9 industry trade shows to attend in 2025.” Returning to the Downtown LA Arts District this April 10th and 11th, Curbivore brings together the world’s foremost fleet operators, restaurateurs, regulators, retailers, startups, technologists and policy makers to discuss the intersection of transportation systems, small business, urban design and commerce.

FINANCE | Wendy’s & Burger King Outdo McDonalds

The Burger Wars are getting spicy! Wendy’s saw Q4 revenue climb 6.2% to $574.3M, while full year rev hit $2.24B and net income was $194.4 million. Burger King parent co. RBI saw sales grow 26.2% in Q4, with annual revenue hitting $8.4 billion and net income hitting $1.7B. Things looked a bit flabbier for McDonald’s; the Golden Arches saw revenue fall a few million bucks in Q4, while for the year it only rose 2% to $25.9 billion, and net income fell 3%.

The Big Picture: These rising and fall fortunes were largely driven by changes in same store sales: RBI and Wendy’s saw them climb, while Mickey D’s fell; that divergence hasn’t happened since 2016. McDonald’s also saw some weaknesses in its digital game, with loyalty member growth slowing to 30%, down from 45%+ the year prior. RBI, on the other hand, credits much of its growth to its “Fuel the Flame” program: $700M investment in digital operations and ads. Wendy’s grew digital sales nearly 40%, hitting 19% of its overall mix.

CHART TIME | January eGrocery Sales Hit $10 Billion

Online grocery sales are starting the year strong — climbing 17.6% to $10 billion the year prior (and $9.6B in December.) Delivery showed particular poise, growing over a billion bucks to $4.1B for the month, likely a post-pandemic record. Mass retailers like Walmart saw especially strong growth, eating into share from supermarkets and hard discounters.

LEGAL | Uber Sues DoorDash Over Delivery Exclusivity

Uber has filed suit against DoorDash, alleging the latter delivery giant penalizes restaurants that consider jumping ship. The suit claims DD threatens retailers with financial penalties or the removal / demotion of the businesses’ search position in-app, inducing the restaurants to make exclusive arrangements with DoorDash Drive, its first-party delivery service. Uber has requested a jury trial in California Superior Court, in San Francisco.

The Big Picture: The 3PDs have been fighting for first-party market share since 2020, when Uber launched “Direct,” four years after the debut of DoorDash Drive. Over 90 of the 100 largest chains have an exclusive or preferred contract with DoorDash Drive, including Papa Johns and Burger King. “Most restaurants have no meaningful option to resist DoorDash, given the power it wields through the DoorDash App in Third-Party Delivery,” claims Uber’s suit. A DoorDash spokesperson rebuts that “their claims are unfounded and based on their inability to offer merchants, consumers, or couriers a quality alternative.”

A Few Good Links

Portland launches RFI for micro-delivery hub pilot. European delivery, ridehail and scooter giant Bolt launches in Canada as Hopp. JD.com launches zero commission food delivery. Boston wants delivery apps to provide drivers with liability insurance. Aviant launches food delivery drones for Stockholm’s foodora. Lanch secures $27M for social media focused fast food. DD reveals most loved restaurants. Shein IPO valuation may fall $30B. Ionna moves forward with EV charging network. Yelp net revenue climbs 6%.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.