Uber Hugs iFood & Prosus Chows Down on JET As Consolidation Wars Continue

Shipt integrates new retailers, grocery delivery surges, Talabat's strong Q1

It seems every huge delivery and ridehailing app is trying to merge with one another, buy out the competition, or form a strategic alliance. Today we’ve got industry heavyweights duking it out in Brazil, America, Europe and the Middle East — let’s get to it!

Today:

Uber & iFood Form Brazilian Partnership

Target Adds Shipt Free Deliveries to Circle 360 Members

Chart Time | Grocery Delivery Sales Surge

Prosus Advances JET Deal, Talabat Grows in Q1

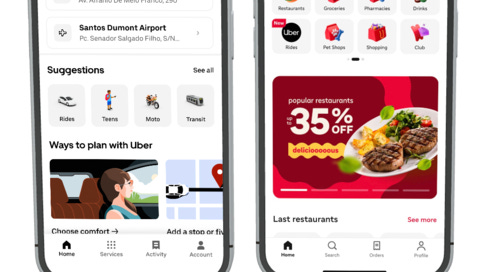

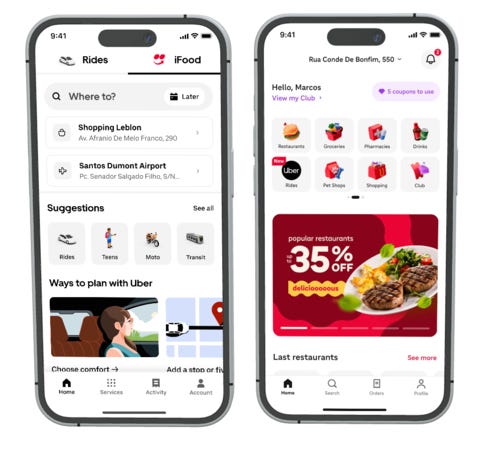

PARTNERSHIPS | Uber & iFood Intermingle in Brazil

Uber is teaming up with Prosus-owned iFood in Brazil, deeply interlinking the two firms’ ridehailing and food delivery apps in a bid to stay one step ahead of the competition. “We are thrilled to partner with iFood in Brazil,” said Dara Khosrowshahi, CEO of Uber. “Today, only around half of iFood and Uber customers in Brazil use both platforms. So this partnership represents a big milestone in our mission to help people go anywhere and get anything at the tap of a button.” Uber users will gain in-app access to iFood’s restaurant, grocery, pharmacy and convenience deliveries, while iFood customers can book Uber rides from within iFood’s app; the two companies will also explore ways to integrate their membership offerings.

The Big Picture: Brazil represents one of the biggest market opportunities for Uber, alongside India and Turkey (where it just bought Trendyol Go for $700M.) But building out a new Uber Eats presence in the country of 211 million is an expensive proposition: iFood already handles 120 million orders per month; Rappi is doubling down on its “Turbo” 10-minute delivery brand; DiDi is spending $180M to relaunch 99 Food; and Meituan is pouring a whopping $1 billion to launch its KeeTa brand in the South American nation. With this much money already pouring into the market, a partnership looks rather prudent…

MEMBERSHIPS | Shipt Adds Free Access for Target Circle 360

Target-owned Shipt is making a play for more bullseye shoppers, as Target Circle 360 members can now take advantage of zero markups across Shipt’s assortment of (non-alcohol vending) retailers. Previously Circle 360 members could get free same-day delivery from Target, but this adds access to complementary retailers like CVS, PetSmart, Lowe's Home Improvement and more, and grocers like Hy-Vee, Lowes Foods and Giant Eagle. To drive adoption, Target is throwing in an extra $20 off first orders for existing Circle 360 members that have yet to try Shipt.

The Big Picture: Target retooled its membership programs last year: Circle 360 costs $99/year or $10.99/month, while basic Circle is free; Target has gained 13 million members since April ‘24. The Minneapolis-based retailer will need to keep its premium members engaged as it looks to offset tariff-related headwinds; the company’s Q1 results are due this week and analysts don’t have high hopes.

CHART TIME | Grocery Delivery Surges

Brick Meets Click has released April’s online grocery sales stats, with the market growing a whopping $1.3 billion YoY, and up $100M from the month prior. Delivery saw the healthiest gains, thanks in part to continued adoption of membership programs. For example, two-thirds of Walmart’s online grocery shopping households are now members of Walmart+, and those member shoppers outspent non-members by over 40%.

FINANCE | Prosus Formally Launches Offer for Just Eat Takeaway

Three months after first revealing its appetite for expansion, Prosus has formally launched its €4.1 Billion euro ($4.6B USD) acquisition offer for Just Eat Takeaway.com, as it seeks to create a Europe-based food delivery champion. The EUR 20.30 per share in cash represents a premium of 63% to JET’s closing share price on Feb 21, and a 49% premium over the 3-month volume weighted average price; JET’s management and supervisory boards have unanimously recommended the offer, which will be taken up for discussion at on July 8th, with completion expected by year’s end.

The Big Picture: Food delivery has entered a consolidation phase, with DoorDash looking to scoop up Deliveroo. Netherlands-based Prosus makes sense as an acquirer, as it specializes in rolling up online businesses (it just bought a LatAm online travel site, for example.) But the conglomerate’s many tentacles could also complicate this deal; it already owns 22% of Delivery Hero, which may worry European anti-trust regulators. Still more 3PDs are linking up in their own ways: Talabat is partnering with Bolt in the UAE to link their food and rides offerings. Talabat just posted strong Q1 results: revenue rose 34% to $846M, while adjusted net income came in at $99 million, helped by the acquisition of instashop from Delivery Hero.

A Few Good Links

Owner.com raises $120M from restaurant industry titans. Didi eyes relaunch in Hong Kong. DoorDash launches Preferred Integrations Program for POSes, brings portable benefits pilot to Maryland, quantifies growth of booze delivery. Tariffs weigh on restaurant sales. Inflation expectations jump to 7.3%. Trump announces return of “reciprocal” tariffs. Port of Long Beach notches record cargo, as retailers pull forward orders. Wolt launches self-serve ad platform. Toast offers menu pricing insights. The economics of Wing & DoorDash’s Charlotte launch. Amazon opening robotics fulfillment hub in VA. Uber releases details on OpenTable partnership. Square releases fancy table-side POS. SF DoorDash driver pleads guilty to $2.5M fraud scheme. Bad rat: Chuck E. Cheese sued over sexual harassment. Automation and AI catches eyes at National Restaurant Assoc. show. Progressive Grocer debuts 2025 industry report. Stord buys UPS’ Ware2Go. Rite Aid shutters 95 stores. Cava same store sales climb 10.6%, with a digital rev mix of 38%. Chobani buys Daily Harvest. HK’s Lalamove heads to UAE.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.