Subscription Users Drive Uber Eats Profitability

Flexport's drama, Olo loses Wingstop, biggest pizza chains

Uber just dropped a big Q3, showing continued profitability, but also revealing some lessons about margin challenges in the delivery space. Speaking of challenges, things are looking rough at both Flexport and Olo. On a tastier note, we chart the 10 biggest pizza chains.

This week’s edition is brought to you by Cambridge Mobile Telematics.

Today:

Uber One Key to Uber’s Q3 Growth

Flexport? More Like Breakport

Chart Time | Pizza! Pizza! Rankings! Rankings!

Loss of Wingstop Shows Olo’s Weak Spot

FINANCE | Uber Hits $221 Million in Profit for Q3

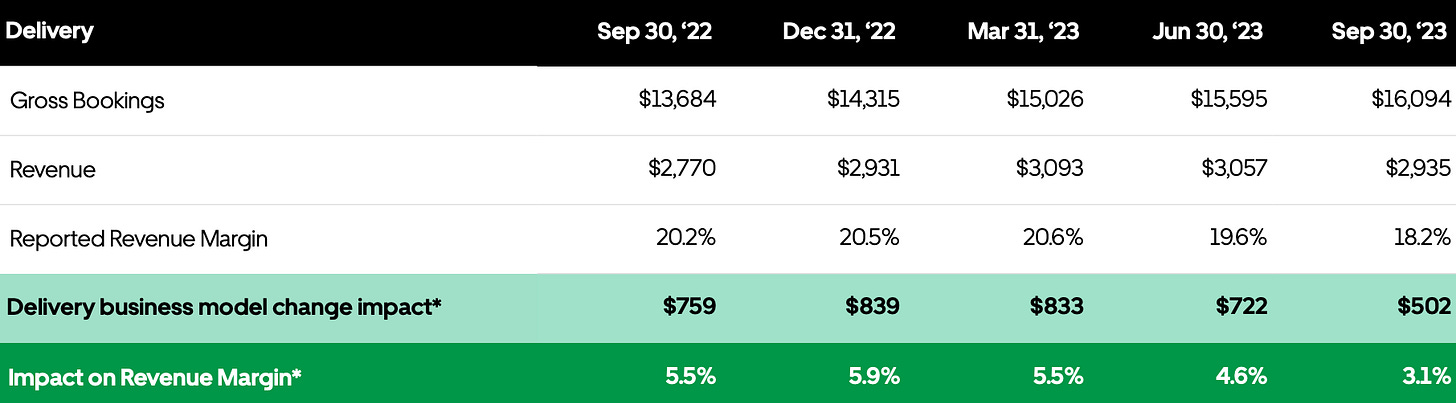

Uber just dropped its Q3 results, showing strong growth in both its mobility and delivery businesses. Overall, gross bookings rose 20% (all figures constant currency) to $35.3 billion, while revenue was up 10% to $9.3 billion. Adjusted EBIDTA rose $576 million YoY to $1.1 billion, while net income (aka true profitability) hit $221 million. One year prior, the company’s mobility and delivery arms did the exact same amount of gross bookings — $13.684 billion. While delivery grew 16% YoY, mobility surged 30%. (Uber’s freight business fell 27% to $1.3B.)

The Big Picture: It’s not just that delivery is falling behind mobility in GBV, but maintaining margins is looking difficult as well. Mobility revenue actually exceeded GBV growth, up 31%; the opposite was true in delivery, where rev only rose 5%. Tellingly, delivery revenue margin fell from 20.2% in Q3 22 to 18.2% this past quarter. Despite that, the company still managed to pull an impressive $413 million in adjusted EBIDTA out of its delivery unit, thanks largely to its Uber One members. Those premium subscribers now account for 40% of delivery gross bookings, as the company expanded its reach to 15 million members across 18 countries. Overall, Uber’s financial results were good enough that it is expected the company will join the prestigious S&P 500.

PARTNER | Save Money and Make Drivers Safer

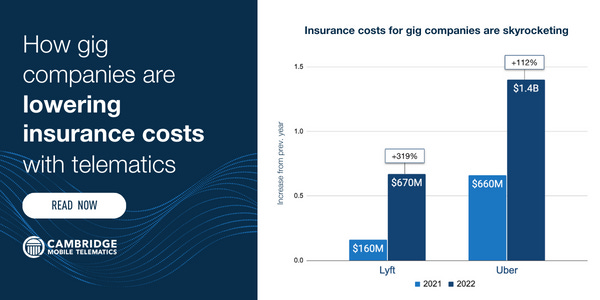

Insurance costs are skyrocketing for gig companies. In 2022, Uber’s insurance costs increased by $1.4B from 2021. Lyft’s insurance costs increased by $670M, contributing 90% to its increase in cost of revenue. To help reduce insurance costs, companies are turning to telematics. They’re making drivers safer through real-time feedback and rewarding their safest drivers.

3PL | Executive Infighting Breaking Flexport

Once a darling of the delivery and logistics world, Flexport looks to be in serious trouble as it heads into the crucial holiday season. Bloomberg Businessweek highlights the in-fighting that’s plagued the company in recent months, starting with CEO (and former Amazon bigwig) Dave Clark suddenly departing in September. Company Founder Ryan Petersen returned to running the ship, but complemented that by both bad mouthing Clark and rescinding a number of job offers. Clark returned fire, saying he had given his “reputational halo to a group that in my opinion didn’t deserve it,” as other C-suiters left the company. As if that wasn’t enough fodder for employees and customers alike, the company implemented a clunky round of layoffs in early October.

The Big Picture: Startup drama would be entertaining but harmless if the company had found its footing, but customers have been pointing out serious deficiencies with the core product. One D2C ecommerce client shared she received zero notifications from Flexport when a delivery failed, leaving it up to her and the customer to sleuth out that the last mile had been outsourced to DoorDash, which dropped it for reasons unknown. Logistics execs for big brands like GoPro have noted that while Flexport’s interface is slick, the startup doesn’t seem reliable enough to handle core tasks. And while the company’s valuation has sunk 82.5% and profitability remains elusive, CEO Petersen seems happy continuing to splash precious cash on acquiring assets from fallen competitors. With the company reportedly subleasing office space for side income, shippers better keep an eye on those delivery rates…

CHART TIME | Pizza! Pizza! Rankings! Rankings!

Pizza: the iconic delivery food! Nation’s Restaurant News just updated its list of the 10 biggest limited service pizza chains in America. We’ve got them charted up above, shown in millions of dollars, with Domino’s leading the pack by a wide margin, followed by Pizza Hut and Little Caesars. (Pizza! Pizza!)

ORDERING | Wingstop Latest Chain to Depart Olo

Wingstop is migrating off of online ordering and delivery management platform Olo by Q1 ‘24, as the chicken chucker looks to build out its own software stack instead. The Texas-based company is sinking $50 million into an initiative it calls My Wingstop, hoping that “hyper personalization” will allow it to achieve a 100% digital sales rate, up from 67% currently. Wingstop accounted for 3% of Olo’s revenue and about 2% of the software company’s active locations. Sandwich slinger Subway also left Olo last year, along with about 5% of the company’s customer base since its 2021 IPO.

The Big Picture: The customer defection news came as Olo was sharing its Q3 results, where the company grew revenue 22% YoY to $57.8 million. But with losses still mounting (another $11.8 million for the quarter,) the company is stuck in a tough position. It needs to continue to invest in development to grow and retain customers (CEO Noah Glass says it spends $90M annually on feature enhancements) but can’t raise rates on either restaurant clients nor end dining customers, lest it face a Toast and Clover style blowback. That has major shareholders like Polen Capital worried the company has an “eroding competitive position.”

A Few Good Links

Lunchbox partners with DeliverThat as it expands catering ambitions. Overall sales growth slows. Boston looks to free up curb space. FedEx sees volume falling, tells pilots to go work somewhere else. Restaurants need to be cautious with price hikes in 2024. Starbucks plans pay raise. Shein eyes $90 billion IPO. Wow Bao expands westward. Shake Shack keen on self serve kiosks. Loyalty programs not just about spending. Olo eyeing card-present transactions. Harbor Freight adds B2B payments with TreviPay. El Pollo Loco crazy for nationwide growth. Sweetgreen’s path to profitability. Chuck E. Cheese hires new CMO (sad he’s not an animatronic.) Instacart FoodStorm nabs Sprouts. Noble Roman’s Pizza coming to 100 gas stations (yum.)

Got a tip, feedback, or just want to say hi? Reply back to this email.