Robotaxis Grind to a Halt in San Francisco

Tip nudging boosts earnings, Instacart SNAP expansion, fighting food inflation

Is it Monday already?! Well, we know one thing for sure: you had a better weekend than the embattled robotaxi startups, who perhaps celebrated their regulatory win a little too hard. If that doesn’t give you a hardware hangover, keep reading to see how the delivery giants are boosting tips, fighting for SNAP benefits, and pushing back on inflation.

Today:

Robotaxis Seize up in San Francisco

Tip Nudging Boosts Courier Earnings

Chart Time | Fighting Food Inflation

Instacart First Deliverer to Accept SNAP in All 50 States

AUTONOMY | Robotaxis Grind to a Halt in San Francisco

You would think they would want to be on their best behavior! Autonomous vehicle startups celebrated a win late last week, when the CPUC approved Cruise and Waymo’s 24/7 operation across San Francisco, despite heated protests from a number of advocacy groups. After scoring the politicized policy victory, the AV operators seemingly celebrated by… accidentally shutting their cars down in the middle of a busy street. As drinkers and diners were trying to get around North Beach on Friday night, they encountered a street jammed by 10 disabled Cruise vehicles. Officials speculate the AVs were immobilized when the local 5G LTE network was overloaded due to revellers leaving the Outside Lands festival a few miles away; that’s small comfort to people on the ground that were stuck in between the vehicles, unable to communicate with these beached electronic whales.

The Big Picture: Both Cruise and Waymo intend to not only autonomously ferry passengers, but food and packages as well. Cruise has piloted deliveries with Walmart, one of its key investors, while Waymo has a partnership with Uber Eats. Most of the other full-size AV players have similar partnerships as well: Motional & Uber Eats, Baidu & Walmart, Pony.AI & Meituan, Zoox & Amazon. More players continue to pour additional vehicles into the space; just this morning, Robomart announced it’s raised a fresh $2M for its semi-autonomous “store-hailing” vans, which bring a selection of a partner brand’s groceries, prepared foods, or retail goods directly to an interested customer’s doorstep.

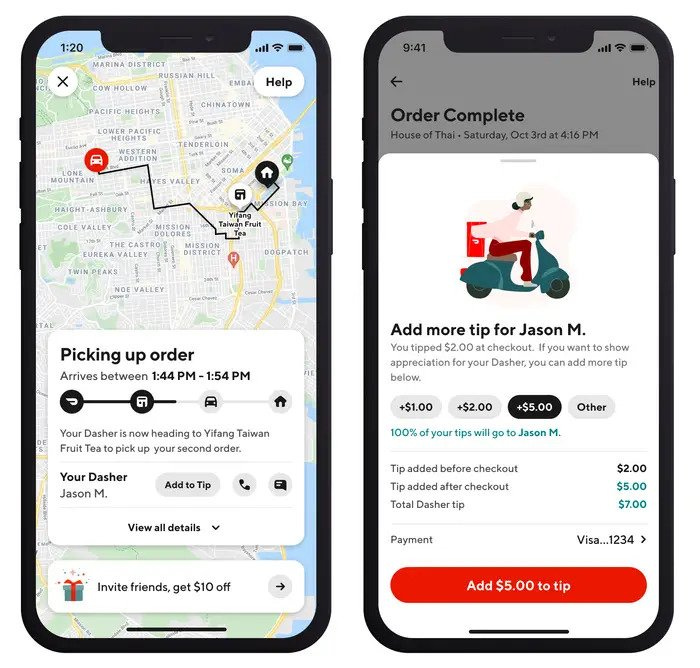

CX | Apps Roll Out Tipping Nudges To Boost Earnings

If someone schleps your food across the city for you, you gotta reward them an extra 15-20% on top of the sticker price! Seems simple enough, but evidently some customers still haven’t received the memo. More and more delivery apps — including Uber Eats, Instacart, Starbucks and most recently DoorDash — are updating their UIs to make it all the more obvious to customers that tipping ain’t exactly optional. DD’s latest change means that customers who do not leave a tip will see a “nudge” on the app, reminding them to do so for the next 30 days.

The Big Picture: The 3PDs and delivery apps aren’t doing this solely out of the goodness of their hearts, it also reflects an update to how pricing and payments work. While DoorDash has recently tweaked payment options, including releasing “earn by time” mode, some short orders pay as little as $2, making tips essential for worker livelihood. Courier Sergio Avedian, who also blogs at The Rideshare Guy, added that he’s seen base pay fall to $1.50 per order on some apps, adding "We are literally working for tips."

CHART TIME | Restos & Retailers Battle as Food Inflation Cools

The Bureau of Labor Statistics released its monthly inflation reports, and food prices are cooling, making for a chart that shows an eerily almost-perfect normal distribution. In July, “food at home” (groceries) had a consumer price index change of 0.3, moving the annual rolling average down to 4.9%. For “food away from home” (restaurants) the CPI inches up by 0.2, but higher increases earlier this year means folks are still looking at a 7.1% jump YoY. Either way, prices are coming down considerably from the extreme increases consumers were facing late last year, as grocers and restaurateurs shave down margins to compete for customers.

3PD | Instacart SNAPs Up Low Income, Back to School Shoppers

Instacart just became the first of the major third party delivery players to accept SNAP benefits in all 50 states and DC, as it teamed up with Albertson’s Safeway banner to accept SNAP (Supplemental Nutrition Assistance Program) benefits at seven grocery stores in Alaska. While the other 3PDs try to make inroads into Instacart’s supermarket turf, this stands out as one area where the grocery-deliverer’s head start remains: it’s worked with the USDA since the agency launched online SNAP benefits, whereas DoorDash looks to only accept it in a few regions, and the other 3PDs are fully incompatible.

The Big Picture: While Uncle Sam recently cut back on SNAP benefit payments, these remain a huge necessity for million of hungry Americans: more than 80% of beneficiaries are working families, people with disabilities, or the elderly, while about 2/3s are households with children. 41.2 million Americans, representing about 12% of the country, make use of the program. While Walmart snaps up 25.5% of the benefit spending nationwide, it’s an important source of revenue for brands that include Whole Foods, high-end grocers like Erewhon, and even some farmers’ markets. With markets both physical and digital gearing up to do battle for back-to-school shopper dollars (gotta pack those lunches!) — expect to see this move make a bigger impact on Instacart’s reach than its new “You've Got This, Parents” ad campaign.

A Few Good Links

Grubhub begins e-check payments in DC over misleading marketing tactics. Amazon turns to generative AI to improve product reviews. Gopuff highlights giving back to its hometown of Philadelphia. Food delivery comes to the airport. Nikola recalls battery-electric trucks over fire risk. Anti-McDonald’s expands to Venice Beach. Toast CEO shares lessons learned from fee debacle. Why some couriers hate delivering from Mickey D’s. Try that in a sidewalk bot: San Franciscans having sex in robotaxis (link safe for work.)

Got a tip, feedback, or just want to say hi? Reply back to this email.