Lots of international developments today, with a big pullback in major Commonwealth markets, as well as some competitive developments in Asia. Plus, Yoshi Mobility shows VCs still have gas in the tank, and what can we learn from when the TNCs left Austin?

Today:

Ola Says Cheerio, G’Bye Mate

Yoshi Mobility Fills Tank w/ $26M

Chart Time | When The Apps Go Offline…

Korean 3PDs Go All-In on Free Delivery

INTERNATIONAL | Ola Exits UK, Australia, New Zealand

Six years after its big international expansion, India-based ridehailing heavyweight Ola is killing off its non-domestic operations, as it exits the United Kingdom, Australia and New Zealand. The move comes as the company looks to improve profitability for an upcoming IPO, with the group hoping to haul in about $662M. In India the company not only operates the country’s largest cab service, but it also sells electric mopeds, and has recently retooled its food delivery platform to use the government-backed Open Network for Digital Commerce (ONDC,) which is meant to empower merchants to have more control of their storefront listings on competitive platforms.

The Big Picture: While Ola didn’t offer food delivery in the UK or ANZ, its retrenchment is still going to impact those local markets. In the United Kingdom, Bolt will keep battling Uber for TNC dominance, while four platforms duke it out for deliveries. In Australia and New Zealand, however, this move might really tip the scales in Uber’s favor, as they’re left as the only meaningful ridehailing player in Australasia. Picking up all of Ola’s share means way more app sessions, which will pull deliveries from DoorDash, Just Eat Takeaway.com’s Menulog, and Melbourne-based EASI among consumers who don’t like to app-hop. And while Delivery Hero might not have Australian operations to worry about, they’re also getting bruised this week. Foodora, its main European brand besides Glovo, is pulling out of Slovakia, about one year after being rebranded from Foodpanda.

FINANCE | Yoshi Mobility Fills Up On $26M Series C

Nashville-based Yoshi Mobility just topped up its tank with a fresh $26 million in Series C funding. The round was lead by GM Ventures and Bridgestone America, has participation from Universal Motors Agencies and Shikra Limited, and values the company at $200M+. The company claims to have 10Xed its revenue since its late 2020 Series B pulled in $23 million.

The Big Picture: Yoshi now divides its business into three categories — preventative maintenance, EV charging and virtual vehicle inspections — as it works with both consumers (who generally opt in to subscriptions to handle refueling) and fleets (including brands like Everytable, Yearly Co, Turo, Uber and Arrive Logistics.) While you can see the appeal of the strategic investments from OEMs, Tier 1s and oil supermajors, we hope everyone knows that “moving fast” on a GM integration means you might be scheduled for a tech integration about the same time those 2030 EVs hit the road…)

CHART TIME | When The TNCs Go Home

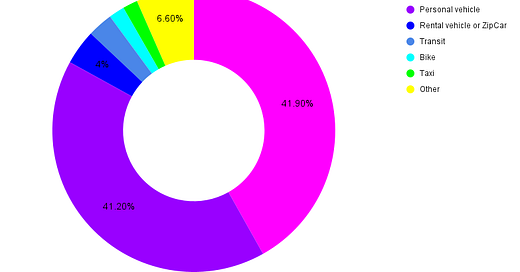

With Uber and Lyft still duking it out with Minneapolis over whether they leave the city, it’s worth taking a look at what happened last time the TNC biggies left a major city. When they left Austin, 41.9% of users ended up at one of the new competitors like RideAustin and Fasten, while almost as many — 41.2% — just ended up back in their own cars. But two factors might make things different this time: higher dependence on food delivery and greater non-auto mode share in the Twin Cities.

OPERATIONS | New Delivery Tactics Overseas

Food delivery players in competitive international markets keep evolving their operations in their never-ending battles for market share and an operational efficiency edge. In Korea, Yogiyo just ended delivery fees for all orders over 15,000 won (~$10.99.) It’s also nixing order minimums for Yogi Pass X users, its premium subscription tier. A few time zones to the west, Zomato is trialing pop-up hubs to serve office parks and corporate campuses in India. Aimed at locations with at least 100 orders per day, these stations will allow workers to walk the meal to the consumer after it’s been staged at a temporary kiosk.

The Big Picture: Yogiyo’s move looks to be in response to similar updates from the competition. Coupang rolled out free delivery for $4/mo WOW subscription users in late March, while last week Baemin killed fees for all customers who opt-in for multi-order dispatching (meaning food may arrive a bit more slowly, as the courier might drop off another meal first.) Korean deliverers tried raising fees last year, but it looks like that strategy is out the window after consumers reacted by pulling back on usage. As for Zomato’s development, Meituan has experimented with similar setups in China.

A Few Good Links

Orders.co launches credit card chargeback fighting assistant, priced at about $100/mo. Transit ridership up 16% in 2023. XeroE turns to HSR for urban freight in Europe (we’ve seen JR make this move on the Shinkansen as well.) Wow Bao builds Dim Sum Palace in Roblox. Grocers team up to launch venture fund. Click-and-mortar on the rise in Europe. Cool job alert: Director, Automation Engineering - Drone Delivery at Walmart. Jessica Alba steps down as Chief Creative Officer at The Honest Company. More states turn to digital driver’s licenses to fight fraud. Teamsters bow out at SoCal LTL Dependable Highway Express. Ghost Kitchens, a very prosaically named ghost kitchen operator in India, buys competitor Shy Tiger Brands. Bite raises $9M for resto kiosks. ShipBob expands to Western Canada. Kiwibot acquires AUTO Mobility Solutions. Robomart launches Autonomous Retail Collective. Fast food speeds up. Cruise resumes manual driving operations in PHX.

Got a tip, feedback, or just want to say hi? Reply back to this email.