NYC Creates Department of Sustainable Delivery

Fantuan eats Chowbus, Deliveroo's strong Q4, restaurant openings surge

Wow, we take one day off and the world goes crazy with delivery news! With so many stories — new regulatory bodies, big acquisitions, record openings, and an important financial statement — there are still some developments we couldn’t quite get to. So make sure you check out all the links at the bottom as well!

Today:

NYC Launching Department of Sustainable Delivery

Fantuan Swallows Chowbus

Chart Time | Record Restaurant Openings

Deliveroo Bounces Back in Q4

POLICY | NYC Creates Department of Sustainable Delivery

When a city delivers a new department, is it impolite if you don’t tip? NYC Mayor Adams just announced the creation of the Department of Sustainable Delivery, set to centralize the regulation of app-dispatched delivery, as well as the vehicles that make those operations possible. The agency won’t spring up overnight, but will instead start with a task force (yay) to study what exactly should fall under DSD’s purview. Meera Joshi, the city’s Deputy Mayor for Operations, told Streetsblog that the agency wouldn’t necessarily call for registering / licensing workers, but companies like Uber, DoorDash & FedEx may need to pay "permitting and licensing fees" to operate in the city, as well as ensure all workers are using safe, certified vehicles. Workers may be required to carry IDs like the city's free IDNYC card.

The Big Picture: Domestically, NYC has been on the vanguard in terms of regulating urban delivery. The city has pushed laws to raise driver wages, to regulate ebikes and their batteries, to create safe street infrastructure, and is even trying to move urban deliveries out of bikes and onto ferries. But those kinds of rules have come from a hodgepodge of different agencies: DCWP, DOT, TLC, DCA, NYCT, etc. The hope is that by centralizing the regulation of this booming sector, it’ll be clearer to both the operators and their workers what the rules are, who’s affected, when to do what, and how much things cost. While initial reactions are mixed, Uber’s Josh Gold seems optimistic: “Streamlining and universally applying regulations makes sense so not just third-party delivery apps but all companies, restaurants, grocery store delivery, and other businesses that utilize micro mobility devices will operate under the same standards.”

GROWTH | Fantuan Gobbles Up Chowbus

Vancouver-based Fantuan is buying up Chicago’s Chowbus food delivery biz, combining two 3PDs that specialize in Asian cuisine. While the Chowbus brand will remain to focus on its burgeoning POS system, the combined food delivery ops will cover 60% of the American Asian food market. “We are in a similar industry, but each has a particular demographic coverage,” said Fantuan Founder Yaofei Feng. “Now we cover more in Canada and they are more in the middle and eastern sides of the United States. We wanted to get better penetration and acquire more customers so we sat down and had a conversation.”

The Big Picture: Chowbus was founded in 2016 and raised $108 million from investors that include FJ Labs, Hyde Park Angels, and Prysm Capital. Fantuan was started two years earlier, and while it’s only raised $90M, almost half of that came in a Series C just last month. As part of the consolidation, 20 Chowbus employees, who manage the startup’s ICs, will be transitioning to Fantuan. Chowbus’ POS arm counts 1,000+ restaurants as customers.

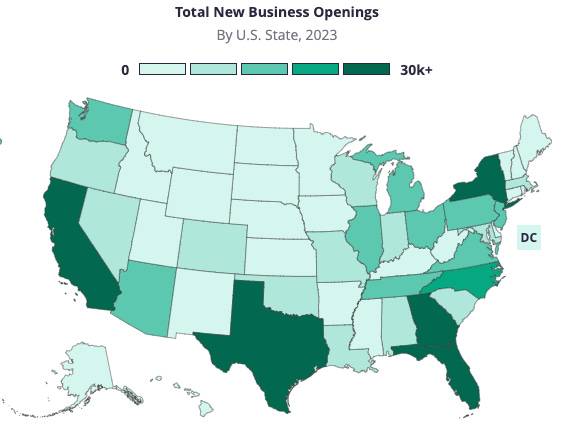

CHART TIME | Restaurants Roaring Back

Restaurants are never an easy business, but Yelp is reporting that 2023 was a record year for new restaurant (and new business, in general) formation. The U.S. on the whole averaged 16.1 new restaurants per 100,000 people. California saw the largest absolute number of new restos, while Oregon did best on a per capita basis (but notably, the Beaver State did pretty meh for other types of new businesses.) Top new restaurant types were Mexican, followed by bars, sandwich joints, breakfast & brunch, and food trucks.

FINANCE | Deliveroo Beats 2023 Earnings Estimates

London-based 3PD Deliveroo released its Q4 trading update, noting that Adjusted EBITDA would be slightly ahead of the £60-80 million it had previously estimated. GTV was up 4% in Q4, 3% for the year, with revenue growth just a bit behind. The company saw stronger performance in its U.K. & Ireland home-turf, where both order and GTV per order crept up, while its international markets saw orders fall 7% for the year, partially offset by increased GTV per.

The Big Picture: Outside of the British Isles, Deliveroo operates in France, Belgium, Ireland, Italy, the UAE, Qatar, Kuwait, Singapore and Hong Kong. In that latter market, we just showed how KeeTa is making inroads with its new value-oriented service. In many of those other regions it competes with Delivery Hero (and subsidiary Talabat) as well as Just Eat Takeaway.com. JET exiting France should give Deliveroo some breathing room there. In fact, given how much more JET struggled in Southern Europe last quarter, Deliveroo’s modest decline comes off as a relative win.

A Few Good Links

Cargo bike and electric van powered logistics startup Fin buys Urb-it, scoring deals with Alibaba and Zara, aims to quadruple growth rate. Self-driver Aurora cuts 3%. Startup Canoo celebrates selling USPS six electric vans (when you put out a press release about something you can count on one AI-generated hand, things can’t be great…) GDP up 3.3% while inflation cools to 1.7%. Gen Z eating more pizza. Progress made on electric tugboats, maybe we’ll see them in that aforementioned NYC maritime delivery project. Marqii offers new dashboard for restaurant merchants. Stuart teams up with UrbanPiper. Feds seek to expand access to groceries in underserved areas. FedEx, UPS offering discounts to temper rate hikes. Kodiak, Ryder launch AV truckport in H-town. Walgreens considering sale of Shields Health. SF sues to stop robotaxis. Tock launches experience reservations. Boozer ReserveBar partners with Delivery.com

Got a tip, feedback, or just want to say hi? Reply back to this email.