Just Eat Takeaway's Q4: GTV Drops 5%

TuSimple delists, Applebee's Date Night Pass, foodtech funding falters

Happy hump day! We’ve got some good news for folks that want to eat Applebee’s every week of the year, and then some not so good news for TuSimple and Just Eat Takeaway.com stockholders. Womp womp!

Today:

TuSimple Exits Public Markets

Applebee’s Intros Date Night Pass

Chart Time | FoodTech Funding Falters

JET’s GTV Droops In 2024

VEHICLES | AV Trucker TuSimple Goes Private

Struggling autonomous trucking company TuSimple is exiting the public markets, as part of its larger drawback in the U.S. The company has begun a voluntary delisting from the Nasdaq, expected to finish by Feb. 7. Although with its stock languishing around 30 cents a share, the bourse would have eventually kicked it out anyway. When the company IPOed in 2021 it was valued at about $8 billion; today its valuation is a paltry $70 million. Unlike other struggling mobility tech players, it still has plenty of cash on hand — $776.8M as of Q3 — although that means the company is worth less than the cash it contains, not exactly a big vote of confidence.

The Big Picture: While the company is (was?) nominally based in San Diego, its plan is to retrench operations to China and Japan. That first country has been a source of trouble for the company, with the Committee on Foreign Investment, FBI and SEC investigating its Chinese shareholders and the group’s connection to China-based competitor Hydron, eventually leading to one founder’s ousting. While the company once made waves for traveling highways unattended, its since been lapped by competitors like Aurora and Kodiak.

LOYALTY | Applebee’s Launches $200 Date Night Pass

Casual dining giant Applebee’s is launching a new membership program, hoping to incentivize more frequent visits to the “neighborhood” restaurant. Called the Date Night Pass, it costs $200 upfront, and entitles passholders to $30 on food and alcohol-free drinks once a week for a full year. If fully used, that means members get $1560 worth of Applebee’s for less than 13% of the list price. Members will receive a physical card in the mail to use the program.

The Big Picture: While Applebee’s is leaning in to value pricing, it’s also clearly hoping to be thought of as a place where you can do date night (no judgment, it’s a popular enough idea to have its own hit country song.) In terms of making the numbers work, there are two strategies here. The first, is that like a gym membership, patrons may lose interest (or misplace their cards) after the first few visits. And for those that do come repeatedly, the hope is that they find $30 just isn’t quite enough for date night, and they start tacking on high-margin items like booze and desserts. (That $7.59 Triple Chocolate Meltdown looks mighty profitable.) While we’ve seen 3PDs roll out their own membership programs, and brands like Domino’s have frequent buyer discounts, might it be time for more brands to offer similar pay-once, get X delivered for free all year types of promos?

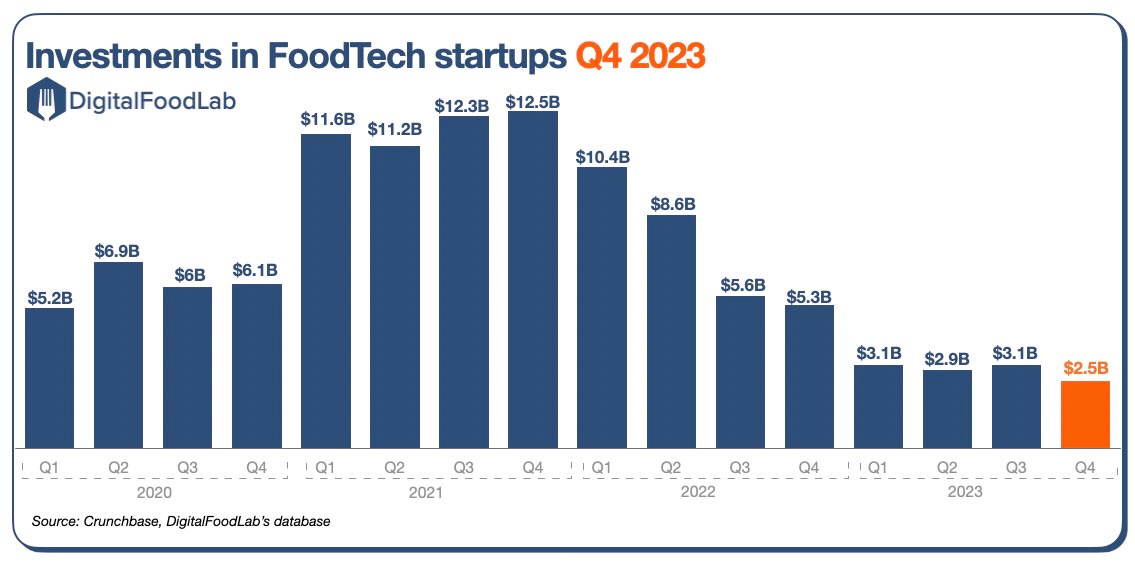

CHART TIME | FoodTech Funding Falters

Our friends at DigitalFoodLab have charted foodtech funding last quarter, and it shows that while the industry still pulled in a whopping $2.5 billion in funding, that’s down significantly from the go-go days of 2021. Looking at 2023 overall, the biggest hauls went to Butternut, Atlas Agro and IndigoAg, with Indian instant delivery player Zepto coming in fourth, raising a fresh $200M. 40% of funding went to North America, 28% to Europe, 24% to APAC, 6% to South America and 1% to Africa. Guess there weren’t many startups in Antarctica…

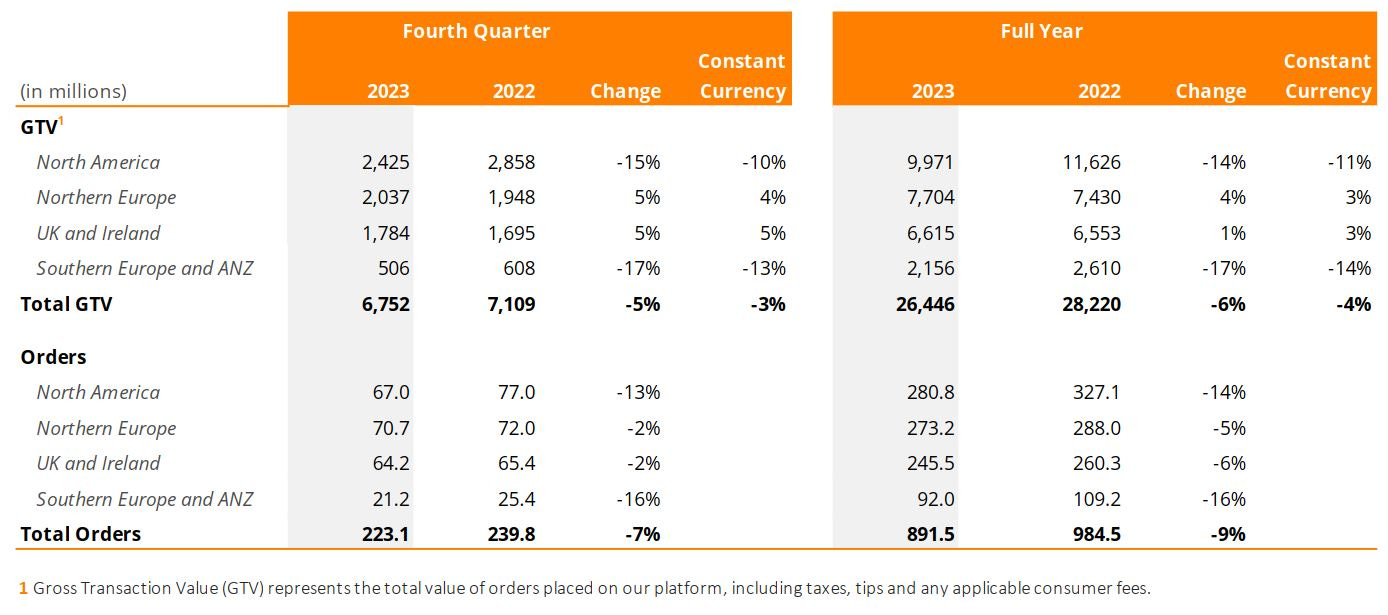

FINANCE | Just Eat Takeaway.com’s Q4 Sees GTV Down 5%

While its full year financial statement is yet to come, international 3PD Just Eat Takeaway.com released its Q4 trading update, with the per-market results a real mixed bag. Gross transaction value fell 15% in North America (10% in a constant currency basis) and 17% in Southern Europe / ANZ (13% constant currency) while it was up 5% in Northern Europe (4% CC,) and 5% in the U.K. and Ireland. Overall GTV was down 5% (3% CC) for the quarter, and 6% (4% CC) for the year.

The Big Picture: The company’s 2020 acquisition of Grubhub continues to weigh on it, with JET noting “Management, together with its advisers, continues to actively explore the partial or full sale of Grubhub. There can be no certainty that any such strategic actions will be agreed or what the timing of such agreements will be.” Orders actually fell more than GTV, suggesting AOV is inching up. Despite those headwinds, JET estimates its 2023 adjusted EBITDA was €320 million and its free cash flow was around breakeven for the second half of the year.

A Few Good Links

British egrocer Ocado sees 2023 retail revenue hit £2,357.5M, up 7% YoY. Sweetgreen opens in Kirkland. Jollibee expands Common Man coffee concept. Mountain Mike’s Pizza heads to Texas. CA cuts climate funding 7%, leaves transit money intact. NY hopes to advance three city transit projects. Price increases slow highway building. GXO Logistics Supply Chain cuts 211 in Memphis. Mercatus and Stor.ai merge. Sphera buys SupplyShift to improve Scope 3 emissions tracking. Bonchon names new CEO. Top 5 cities for resto. growth: Vegas, Austin, Nashville, Tampla, ATL. Shipt kicks off year two of its LadderUp! accelerator. Kroger-Albertsons merger closure pushed to summer. DoorDash lauds bill introing portable benefits in Virginia. Swiggy sees Instamart as revenue driver. ICYMI: Nimbus CEO shares shared kitchen growth secrets.

Got a tip, feedback, or just want to say hi? Reply back to this email.