Just Eat Takeaway Sells to Prosus, Forming Fourth Largest Deliverer

DoorDash & Grubhub add partners, Domino's & Walmart Q4 results

Wow, just after selling off its American arm, Just Eat Takeaway.com has a new owner of its own. We’re starting off the week with other huge stories — new partners for DD & DH, interesting growth dynamics at Domino’s and Walmart — in fact this week is gonna be so newsy we’re back on our 3X schedule.

This week’s edition is brought to you by Gridwise.

Today:

Meet JET’s New Owner

DoorDash & Grubhub Add Partners

Chart Time | Domino’s Eyes DoorDash

Walmart’s Good but Not Good Enough Year

FINANCE | Just Eat Takeaway Sells to Prosus for €4.1 Billion

Beleaguered 3PD heavyweight Just Eat Takeaway.com has a new owner, as the Amsterdam-HQed deliverer agreed to be acquired by Prosus, which is dual headquartered in Amsterdam and Johannesburg, in an all-cash deal. JET’s fetching €4.1 Billion ($4.3B USD) for itself, working out to €20.30 per share, a 49% premium to its average price over the past quarter and a 22% premium to the 3-month high.

“We are excited for Just Eat Takeaway.com to join the Prosus Group and the opportunity to create a European tech champion,” said Fabricio Bloisi, Prosus’s CEO. “Prosus already has an extensive food delivery portfolio outside of Europe and a proven track record of profitable growth through investment in our customer and driver experiences, restaurant partnerships, and world-class logistics, powered by innovation and AI. We believe that combining Prosus’s strong technical and investment capabilities with Just Eat Takeaway.com’s leading brand position in key European markets will create significant value for our customers, drivers, partners, and shareholders.”

The Big Picture: Prosus may not be a household name, but it owns a bevy of digital businesses, including large stakes in Tencent and numerous classifieds / shopping sites. Prosus’ food delivery holdings span 70 countries, including a full stake in LatAm’s iFood, 28% ownership of Delivery Hero, 4% of Meituan, and 25% of Swiggy. This tie-up turns Prosus into the world’s fourth largest food deliverer; but is a bit of a letdown for the acquired company, as JET formed in 2020 when Takeaway.com bought Just East for ~$7.8B, after rejecting a £5.1b offer from Prosus. While JET just jettisoned Grubhub for $650M, its stock is down almost 80% from its all time highs.

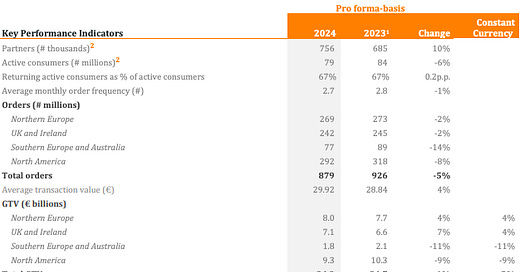

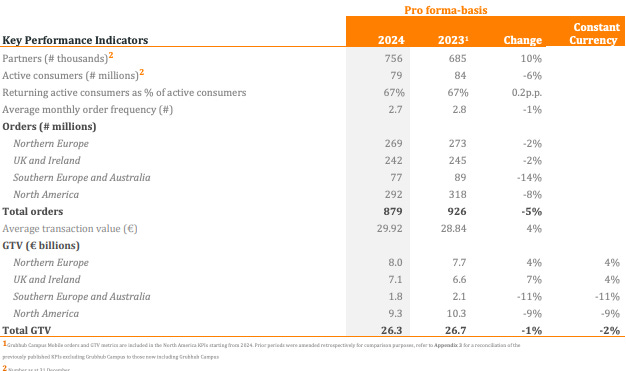

JET just released its FY24 results as well, showing GTV growth of 2%, a revenue decline of 1% and a net loss of €1.645 billion.

PARTNER | Ride Share and On-Demand Deliveries Changing, Here’s What You Need To Know

Ride Share and On-Demand Deliveries Changing, Here’s What You Need To Know

The rideshare and on-demand delivery landscape is evolving rapidly—with rising costs, shifting consumer behavior, and a surge in retail and grocery delivery redefining how people and goods move. The 2025 Gridwise Annual Gig Mobility Report reveals key insights for restaurants, grocery stores, retailers, mobility firms, and investors.

Rising Costs & Consumer Behavior: Rideshare fares are up 7.2%, and 72.3% of consumers may cut back if prices keep rising.

Delivery Demand Surge: DoorDash retail deliveries up 34.1%, Uber Eats up 46.6%, and Macy’s retail deliveries skyrocketed by 4,500%.

Driver Earnings Under Pressure: Uber drivers are down 4% at $23.33/hr, and Lyft drivers are down 6% at $23.23/hr.

The Gig Mobility industry is at a turning point.

Get the full report now and discover what’s next for on-demand delivery and rideshare.

3PD | DoorDash Adds Markets, Grubhub Adds Walgreens

DoorDash has signed on a handful of new regional grocery stores, as the 3PD looks to lock down all the supermarket options for those that eschew the big chains. Now available in its app are: Angelo Caputo’s Fresh Markets, with 10 locations around Chicago; Festival Foods, with 42 stores in Wisconsin; Marc’s, with over 60 markets in Ohio; and Woodman’s Food Markets, with 19 locations in Wisconsin and Illinois.

The Big Picture: While DoorDash may have tied up basically all of the big brands at this point, Grubhub is still playing catchup. The third place 3PD just got a bit closer to parity thanks to a new partnership with Walgreens, which has 8,500 stores across the country, including those flagged as Duane Reade. The pharmacy chain has offered delivery via DoorDash and Uber since at least 2021, after earlier pilots, and operates a first-party delivery option as well.

CHART TIME | Domino’s Goes Cold

Same-store sales growth at Domino’s screeched to a near halt in Q4, after a stronger performance for the rest of the year. In 2024, delivery represented 46% of sales, while takeout grew to 54%. Domino’s has extended its exclusivity agreement with Uber Eats to May 1st, but expects upcoming partnerships with the other 3PDs to drive $1 billion in incremental sales. Full results here.

FINANCE | Walmart Grew but Amazon Grew More

Walmart released its full year financial results, with the shopping behemoth growing revenue 5.1% to $681 billion and operating income 8.6% to $29.3 billion — talk about slim margins! Global ecommerce grew 16%, led by store-fulfilled pickup and delivery, while global advertising jumped 27% to $4.4 billion. Global ecommerce penetration hit an impressive 18%, while a whopping 93% of the United States is now reachable by Walmart’s same-day delivery arm, with 2.3 billion orders being delivered in the same or next day.

The Big Picture: That may be some impressive growth, but it wasn’t enough to keep up with Amazon. The ecommerce giant finally overtook Walmart in sales in the fourth quarter, with net sales up 11% to $638 billion and operating income surging to $68.6B. For Q4 alone, amazon revenue came in at $187.8B, overtopping Walmart’s tiny $180.6 billion in rev. Amazon’s market cap is about 3X that of the Bentonville Big Boxer.

A Few Good Links

DoorDash Canada releases new ad campaign as it hope to catch up with Uber Eats in the Great White North. Instacart releases Classroom Carts to encourage donations to LA-area schools. Uber releases Ski, studies business travel trends and hypes growth in Bangladesh. IC Ads hit one-mil products delivered. Grubhub 2025 Restaurant Leadership Council. Starbucks cuts corporate heads. Just Salad hits unicorn status. Lola raises for cake delivery. Tusk closes on $2M for alternative carrier management. Australian reservation platform Now Book It comes to Canada. Panda Express dominates mobile pickup. Trump looks to sell off USPS, which posted a profit in most recent quarter. Schnucks adds late-night delivery via Instacart. Kroger’s Instacart-powered express delivery matches in-store prices. Mass deportations would wrench supply chains. Hooter’s eyes bankruptcy — guess the experience doesn’t translate well to delivery, does it? Deliveroo expands exclusivity agreement with Nando’s, adds specialty grocer Bayley & Sage. Flexport adds AI tools. Wolt adds early payouts. Toast GPV hits $159.1B, GAAP net income a more modest $33M. Musk’s DOGE lays off NHTSA team in charge of overseeing Tesla.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.