Instacart Readies for September IPO

Delivery robotics in 2024, LMD usage rises, HungryPanda holiday

Money, money, money! That’s what’s on the mind of Instacart, as it gets ready (again) for an IPO. Cash is also a big worry for delivery robotics startups, as a number of companies figure out the best path towards surviving and thriving. Oh, and happy international delivery rider appreciation day; did you get us anything?

Today:

Instacart Readies for September IPO

The State of Delivery Robotics

Chart Time | LMD Usage Hits New Record

Happy International Delivery Rider Appreciation Day!

3PD | Instacart Just Weeks Away from IPO

Instacart is reportedly reviving its plans to go public, with an IPO set to his as soon as September. The company had previously planned to go public via a direct listing last year, before pulling the plans in the face of a softening stock market. By opting for an IPO process, the company may be hoping that a first-day “stock pop” may help it reclaim some of the valuation its lost over the past few years. The company, which has raised $2.74 billion in venture financing, was valued at $39 billion in 2021, $24B in 2022, and around $13-15B earlier this year.

The Big Picture: As economic sentiment has improved, so too has the stock market — but new listings have been a bit slower to recover. In 2021, 745 companies raised $241 billion; so far this year only 109 listings have raised $14 billion. With interest rates remaining high, that backlog is only just now starting to clear out; recent high-performing food and tech IPOs like Cava’s and VinFast’s have given investors newfound appetites.

AUTOMATION | Delivery Bots Roll Towards a Rocky 2024

It’s been a rocky few months for the delivery robotics space, as players that raised billions of dollars retrench, while smaller contenders fold completely. For the wide array of companies that remain — a diverse field that includes Cartken, Coco, Delivers.AI, Kiwibot, Motional, Ottonomy, Refraction, Serve, Starship, Tiny Mile, Waymo and possibly Yandex — there are still a number of undecided questions. Will the industry find success with remote-piloting or complete autonomy? (Companies on both sides of that spectrum have teased profitability.) Should the sector follow standards like ISO 4448 and MDS 2.0? What’s the ideal size and storage capacity of a sidewalk bot, of an on-road bot? And most importantly: which companies will make it to 2024?

The Big Picture: It’s a momentous month for the delivery robotics space, as Serve barrels towards a public listing. That startup was originally born as a skunkworks project inside of Postmates. When Uber acquired its erstwhile delivery competitor, it spun the robotics upstart out, but it still maintains a 16.2% stake; Nvidia owns 11%. While the company is growing 30% YoY, it still has a ways to go to get out of the red. But just as the market looks ready for Instacart once more, perhaps the delivery bot space is going to see a new round of investor enthusiasm?

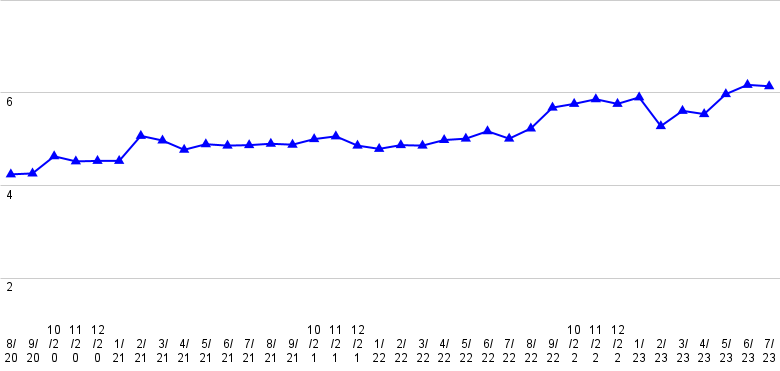

CHART TIME | LMD Hits Record Diversification In Face of Strike

As shippers looked on at the looming UPS strike last month, they responded by diversifying their mix of last mile delivery carriers. The average shipper worked with 6.17 carriers in June, a record, closely followed by 6.14 in July. As brands usually beef up their LMD mix in the run up to the holiday season, not over the summer, only time will tell if this chart continues to rise in the coming months.

MARKETING | HungryPanda Declares 8/18 A Holiday

Specialty 3PD HungryPanda is getting on board with the “too many holidays” trend, as it declares that today is “International Delivery Rider Appreciation Day.” Why today, you ask? Because if you squint, 818 “resembles the silhouette of a rider's bicycle with bags on top” (their claim, not ours…) They also note that “eight” sounds like “ate” (🤯) but oddly the company, which specializes in Asian food delivery, does not call out that the number 8 is considered lucky in Chinese cultures, also due to its homophonic properties.

The Big Picture: Will a made up holiday be enough to keep HungryPanda’s workforce happy? The company is also giving out “Panda Care Boxes,” distributing rider stations with food and water, and introducing a new voice system in its courier app that allows riders to select a virtual companion to join them on future delivery trips. (Who asked for that?) HQed in London, HungryPanda works with over 80,000 couriers, 100,000 merchants, 6 million users, and is aiming for $1 billion in GTV in 2023.

A Few Good Links

Grubhub wins trade secrets lawsuit. Just Eat runs £15 signup promo with cash-back partner. Taco Bell looks to dedicated 3PD pickup parking + grab and go shelves in new builds. Grocers add new screen tech to engross in-store shoppers. Estes bids $1.3B for Yellow’s carrier terminals. Rite Aid appoints new CMO, Lidl US replaces CEO, Denny’s nixes President. Trader Joe’s says no to self-checkout. Delivery robots robbed. Prime adds delivery charges in the U.K. Amazon unveils new ground delivery service, will also start charging vendors that don’t use its in-house fulfillment.

Got a tip, feedback, or just want to say hi? Reply back to this email.