Instacart Launches Whole Foods Canada, DoorDash Scores Ahold Delhaize

Chipotlanes serve up growth, Yum stumbles, AVs hit 9 million miles

Ahh, did you miss us? As a reminder, Modern Delivery is publishing on a slightly reduced schedule until Curbivore.

Now back to business… we’ve got big grocery launches from both Instacart and DoorDash, some telling financial results from Chipotle and Yum Brands, and a few big AV breakthroughs. Read on!

Today:

Instacart & Whole Foods Canada, DoorDash & Ahold

It’s A Chipot-lay-up!

Chart Time | Yum Brands’ Indigestion

AVs Hit Golden State Milestone

3PD | Instacart, DoorDash Sign New Grocers in U.S. & Canada

Today our shopping cart runneth over with new grocer news. Starting things off, DoorDash just announced a partnership with Ahold Delhaize USA, the American arm of the Dutch-Belgian grocery giant. As the 10th largest supermarket in the country, Ahold operates under the Giant Food, Food Lion, Martin’s, The GIANT Company, Hannaford and Stop & Shop banners, all of which will be live on DD by March. Up north, Instacart signed on Whole Foods Canada as a partner, with most of the Amazon owned stores already live, and the rest launching in the next few weeks.

The Big Picture: DoorDash’s partnership with Ahold Delhaize means 99% of monthly active American consumers now have access to a grocery or convenience retailer in the DD app. The partnership integrates Ahold’s loyalty programs as well as DashPass. Ahold also has a previous partnership with Instacart, dating back to 2019. As for IC’s new partnership, it’s a bit smaller, as Whole Foods only operates 14 markets in the Great White North. Nonetheless, it’s impressive that Instacart has made its way into Amazon’s rather protective ecosystem; perhaps Bezos’ world domination plans stop at the 49th parallel.

FINANCE | Chipotle Crushes Earnings’ Estimates

Burrito and bowl juggernaut Chipotle just released its 2023 financial results, and wow what a scorcher. Total revenue increased 14.3% to $9.9 billion; comparable restaurant sales increased 7.9%; and operating margin was 15.8%, an increase from 13.4% the year prior. Earnings per share beat estimates by a healthy 66 cents. While other chains like McDonald’s and Starbucks have seen foot traffic decline lately, Chipotle not only boosted the customers per store, it squeezed a bit more cash out of each customer.

The Big Picture: The SoCal restaurant group’s tech innovations are also starting to pay off. Of the 271 new locations it opened last year, 238 featured a Chipotlane: a digital pickup lane geared towards speeding up online order pickup by both guests and 3PD couriers. By the end of this year, the company expects to have over 1,000 deployed nationwide. The company also continues to make progress on its automated makeline, powered by its investments in Hyphen. For 2023, digital sales made up 37.4% of overall food and beverage rev.

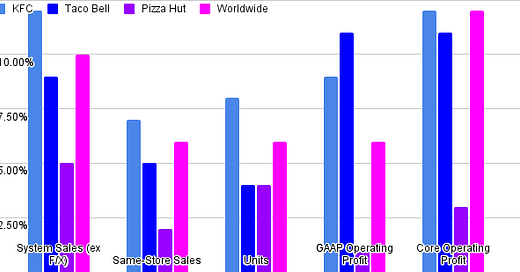

CHART TIME | Nobody Wants Pizza?

Yum Brands just released its financial results, and evidently the world’s bellies can’t quite make up their mind. Overall, the company brought in $2.04 billion of revenue, under estimates of $2.11B. But things really slowed down in the fourth quarter, as global conflicts stymied peoples’ love for fast food. All in all, KFC carried its finger lickin’ weight, while Pizza Hut was a doughy mess.

AUTONOMY | AVs Hit 9 Million Miles in California

Last year, all permitted autonomous vehicles logged a cumulative 9,068,861 miles while in self-driving mode in California, an impressive milestone. Of those, over 1/3 were completely driverless, while the rest had a safety driver onboard. Of the 1,603 vehicles in the state, Cruise has (or perhaps had) 510, Waymo counted 438 and Zoox came in third with 281. Zoox also gets accolades for going the most distance between disengagements, while Waymo covered the longest distance overall. Also noteworthy: Apple’s AVs traveled 452,744 miles, up 261% from the year prior.

The Big Picture: While most of these brands are currently more focused on ferrying people, each has its own cargo ambitions as well. Waymo has worked with Uber Eats and UPS, Cruise has teased a version of its Origin vehicle geared towards delivery, and while Zoox claims it’s only focused on taxiing humans, its ownership by Amazon suggests it might have some goods-movement ambitions down the line. The AV ecosystem in general seems to be heating back up, with Starship closing a whopping $90M in new funding to fuel its campus delivery ambitions and Volocopter claiming it will launch air taxi service this year, albeit not yet fully automated.

A Few Good Links

Grubhub expands hospitality push with 70-unit My Place Hotels. Grubhub and JOCO launch new bike courier lounge in NYC. Uber Eats reveals full Super Bowl ad. DoorDash doles out $500k in Impact Grants. Just Eat Takeaway.com nominates new CFO. KFC retools rewards program. Target eyes Prime-style memberships. Sweetgreen tests new protein. Truck lobbyists fail to repeal excise tax. Shrimply divine! Ford beats Q4 estimates. Penske revenue up 6.2% YoY. CloudKitchens loses CFO. Alibaba stock tumbles. MustHaveMenus launches new display marketing tools. USPS looks to slash GHG emissions by 2030. Bollinger B4 qualifies for IRA incentives of up to $40k per vehicle. Resto sales forecast at $1.1 trillion in 2024. Pizza Hut launches Valentine’s themed Goodbye Pies. Dorito’s teases Canadians’ inability to watch Super Bowl commercials. Any I Think You Should Leave fans out there? Peterbilt and Kenworth recall trucks because they forgot to build a good steering wheel that doesn’t fly off while you’re driving.

Got a tip, feedback, or just want to say hi? Reply back to this email.