Instacart & Amazon Deliver Robust Quarterly Earnings

Gopuff launches GoXL, DoorDash's economic impact

We’re in the midst of earnings season, with Instacart and Amazon both showing strong growth, while a number of familiar restaurant brands (both tech-forward and not-so-forward) look to be faltering. On the product front, Gopuff is eyeing larger SKUs, Amazon wants to Prime-ify the boondocks, and DoorDash has some juicy new stats. Let’s get to it!

Today:

lnstacart Posts Best Quarter in 2.5 Years

Amazon Eyes Rural Expansion

Chart Time | DoorDash’s Economic Impact

Gopuff Gets Bulky with GoXL

3PD | Instacart Orders Surge 14%

Instacart delivered a rosy Q1 earnings report, noting that total orders grew 14% to 83.2 million, beating estimates of 81.1 million; that’s the company’s biggest gain since Q3 ‘22. GTV climbed 10% to $9.1 billion, while net income came in at $106 million and Adjusted EBITDA at $244 million. Advertising & other revenue hit $247 million, up 14% year-over-year, representing 2.7% of GTV. Average order value decreased 4% YoY to $110, driven by the addition of restaurant orders and lowered basket minimums for Instacart+ members. IC is looking to keep the growth going, as it just bought grocery tech platform Wynshop, which it can use as a wedge (like Caper Carts) to gain access to additional supermarkets.

The Big Picture: The grocery segment is looking resilient despite economic headwinds; Sprouts Farmers Market just saw same-store sales climb 11.7%, with net sales rising 19% YoY to $2.2 billion. CVS saw same-store sales climb 14.2%, revenue grow 7% and adjusted operating income rise 54.9% to $4.6 billion, a stark turnaround after a number of weak quarters. Things are getting a bit choppier on the restaurant side: McDonald’s saw sales fall 1%, with a bigger dip domestically; Wendy’s also notched a loss in revenue; Yum Brands grew 5%, driven by strength at Taco Bell and KFC, while its digital sales mix sat at 55% of total sales; Wingstop cooked the competition, with net profit jumping 221%.

FINANCE | Amazon Net Sales Climb 9%

Amazon dropped off a big Q1 earnings report of its own, with net sales increasing 9% to $155.7 billion. Operating income rose a cool 20% to $18.4 billion, with net income rising a nice 69% to $17.1 billion. While the company is so far navigating the newly tariff-ying environment well, the real question is how much consumers “pulled forward” previously planned purchases to get ahead of new taxes and restrictions.

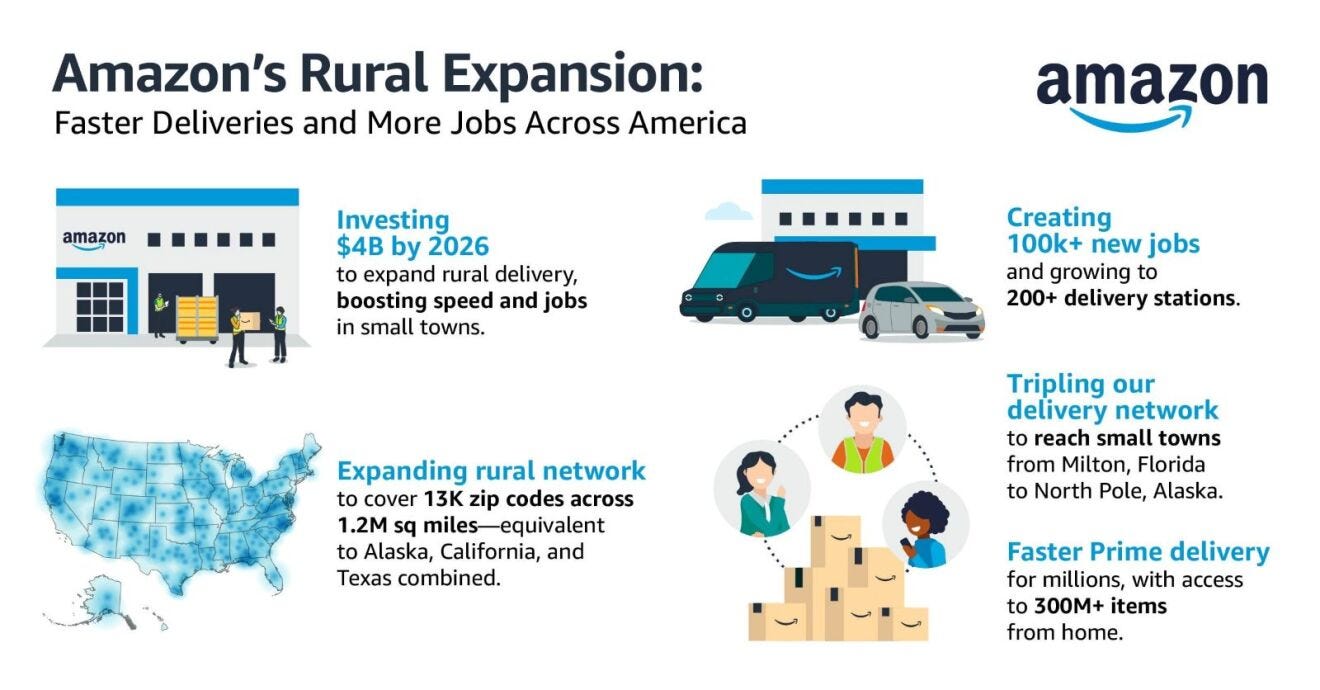

The Big Picture: The Everything Store is clearly betting on continued growth, as the company also just announced it’s investing $4 billion in building out its rural delivery capabilities, as it aims to increase Prime penetration to the booniest of boonies. To do that, Amazon is opening 200 new delivery stations, while beefing up its DSP, Amazon Flex and Hub Delivery networks. The ecommerce giant now represents a whopping 28% of total domestic parcel volume, besting UPS and FedEx, while trailing USPS by 3 percentage points.

CHART TIME | DoorDash’s 2024 Economic Impact

DoorDash released new data, quantifying its economic impact for merchants, couriers and consumers. On the merchant front:

85% said that without DoorDash, they would have lower overall revenue and 89% said without DoorDash, they would have lower customer growth

88% said it has helped them reach new customers they otherwise wouldn’t have been able to access

78% said DoorDash has helped them establish a bigger presence in their local community

85% would recommend partnering with DoorDash to other businesses

PRODUCT | Gopuff Goes After Bulk Orders

Okay, it’s not quite “big and bulky,” but Gopuff is trying to pump up its cart size, both physically and economically, with the launch of GoXL. This adds 300+ bulk-sized SKUs with low per-unit pricing, available for delivery in as little as 15 minutes. "Now more than ever, customers are seeking ways to stretch their dollar further," said Carly Bickerstaff, VP of Merchandising at Gopuff. "So, we're leveraging Gopuff's unique model to quickly deliver on our customers' needs by launching a bulk assortment and cutting prices to deliver even greater value when it's needed most."

The Big Picture: Gopuff notes that Basically Large Roll Soft Toilet Paper is priced at $11.99 for a 12-pack, Smucker’s Uncrustables PB & Grape sandwiches drop from $1.99 each to just $0.99 each when purchased in 10-pack, and Chobani Nonfat Greek Yogurt falls a scant 12% when bought as a four-pack. But the question is… who needs 12 rolls of toilet paper in 15 minutes? You can beat those Smucker’s prices at a mainline grocer, Target or Walmart, and they’ll deliver it to you aaaalmost as quickly; what’s the competitive advantage for Gopuff here?

A Few Good Links

Wombi’s subscription cargo e-bikes expand to San Jose. Zomato winds down 10-minute delivery. Consumer spending at restos projected to fall 7%. OnTrac makes play for UPS Ground Saver customers. More Americans turning to gig work amidst economic uncertainty. Brazil’s iFood ups delivery fees. Grubhub partners with Nash. Uber and WeRide eye 15 new markets. Waymo scales up AZ factory as its fleet size hits 1,500. GM beats guidance but pulls forecast due to tariff uncertainty.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.