Grubhub VP Poykayil Talks up "One-Stop Shop for Customers’ Demands"

Instacart studies food health, Arrival departs Nasdaq, top pizza styles

We’re kicking the week off with an exclusive interview with PJ Poykayil, Grubhub’s Vice President of Logistics. PJ’s got unique insights into how to keep millions of orders moving smoothly each week, as well as must-read thoughts on where the industry is headed next. And once you’ve digested that story, stick around for some more big new from Instacart, Pizza Hut and Arrival.

Today:

Grubhub VP of Logistics PJ Poykayil Shares Insights

Arrival Delists as EV & Logistics Startups Struggle

Chart Time | Pizza Preferences by State

lnstacart Funds New Food as Health Research

INTERVIEW | Grubhub VP of Logistics PJ Poykayil

Modern Delivery: PJ, thanks for taking the time to chat with us; the logistics of food delivery is such an important and under-appreciated space. Why don’t we start with the basics: as the VP of Logistics at Grubhub, what do your responsibilities entail?

PJ Poykayil: I oversee Grubhub’s delivery operations and ensure our network of drivers runs smoothly in our markets across the country. My team and I make sure we have the right supply of drivers in a given area to meet demand and that we are intentional with how we dispatch drivers so that a customer’s food is delivered as quickly and efficiently as possible. It all comes down to execution, and not many people truly understand the complexity that’s involved for a customer to order from a restaurant on Grubhub and have their meal arrive in 30-40 minutes.

MD: Grubhub handles millions of orders per week. How do you keep that fine-tuned machine running?

PP: Forecasting. Food delivery is such a hyper-local business and demand varies from market to market, so we’re always analyzing markets on a local level to balance driver supply and customer demand. We first start with forecasting demand, which includes knowing which days and mealtimes tend to be more popular. We then estimate the total number of drivers we’ll need for those times and execute it by matching drivers that are nearest to the restaurants customers are ordering from. This ensures drivers receive orders that are near them and that customers get their food delivered promptly. My team measures the metrics for every step of the process daily so that we can constantly iterate where and when necessary.

MD: You have an interesting background, having worked at both Amazon and Wyndham, seemingly with a focus on analytics and data. How did that prepare you for the current role?

PP: I’ve spent the last 20 years working in data and analytics in the hospitality, airline and e-commerce industries. While they are vastly different from food delivery, the concept of supply and demand is the same. What’s different is the time you have to make sure you get it right. For food delivery, we only have 20-40 minutes to complete an order, whereas in the other industries, you’re working with longer periods. In my prior roles, I used data and analytics to make informed decisions that the business could implement at scale, which is what I’m doing now as well. If you can interpret data and turn it into actionable insights, a change in industry is less of a jump since the core principles are the same.

MD: Your experience at Wyndham and USAir made us think of another connection: how have travel rewards and loyalty programs influenced delivery membership programs like Grubhub Plus?

PP: Our loyalty program, Grubhub+, is influenced by what our customers tell us they want to see. Food delivery is an area with high order frequency — our customers order from us multiple times a week— and the rewards we provide need to be worthwhile. Our customers have told us that they want more value, recognition and elevated service from their subscription program, which is why we relaunched Grubhub+ over the summer with lower service fees and credit back on every pickup order. The program will continue to iterate as customer’s wants and expectations evolve.

MD: If there’s one thing that restaurateurs, customers, and cities could do to improve the logistics and operations of food delivery, what would it be? What are some of the ways Grubhub sees itself improving the delivery logistics experience?

PP: On the restaurateur side, having designated pick-up and waiting areas is helpful for drivers who come into restaurants and don’t want to crowd the dining space. For customers, it comes down to making the handoff as seamless as possible. This starts with giving their driver clear drop-off instructions in the delivery instructions section right before checkout. It’s there that customers can write where to leave their food or how to find their address. For drivers, these notes are helpful so that they maximize drop-off efficiencies.

Improvements that have to come from cities are trickier. That said, having designated parking spots for delivery workers would be helpful from a congestion standpoint. Plus, these spots free up quickly since drivers pop in and out within a few minutes to get an order. On the Grubhub side, we see a lot of value in bundling orders — if and when it makes sense. Meaning, if we have two orders going to the same high rise or same street, we will have a driver pick up and deliver both orders. This effectively saves time and reduces costs while improving the customer experience.

MD: We’ve seen food delivery get more automated, whether it's robots and drones, or ordering kiosks. How does Grubhub view that trend progressing?

PP: We see a place for automation as new solutions are created to solve for more use cases and challenges. It’s important that whatever innovations we implement not only fit into our broader product and service offerings, but also benefit the customer in some way. Offering robot delivery to our campus partners makes sense given those environments are notoriously difficult for cars to navigate due to one-way streets and areas on campus that don’t allow cars. Robots can get to hard-to-reach areas, which makes them a fit for campuses. Students love them too, and robot deliveries have more than tripled in the past year, driven by both expansion on existing campuses as well as new campus adoption.

MD: Finally, what’s one thing in the whole world of delivery that you’re most excited about?

PP: The delivery space is increasingly becoming an area that has evolved to be a one-stop shop for customers’ demands. Just a few years ago, it was impossible to think that you could get toilet paper, groceries and beauty products delivered to your home within an hour. Nowadays, it’s expected and customers are demanding and expecting to get everything they need delivered to them from one platform. The opportunity for marketplaces and delivery companies is endless.

FINANCE | Arrival Delisted as Logistics Startups Stumble

Troubled EV van maker Arrival looks to be headed towards bankruptcy, with the company announcing its delisting from the Nasdaq, effective Tuesday. The British co. turned heads when it secured a contract with the Royal Mail back in 2017, followed by a huge €400M ($440M USD at the time) contract with UPS to supply up to 10,000 electric vans. That supposed momentum led the company to a public listing via SPAC in 2021, with a valuation that peaked at $13 billion. After that, things took a turn for the worse, with the company struggling to bring its “micro-factories” online and a repeatedly retrenching product lineup, all while cash got tighter. Now the company’s market cap is about $11M — maybe they can sell that neat domain name to scrounge up a few bucks?

The Big Picture: It’s been a tough start to the year for the EV and neo-logistics space. Aurora Innovation just slashed 3% of its workforce. Polestar is cutting 15% of its staff, meaning about 450 people are being shown the door. Rumor has it Faraday Future and Canoo are making cuts as well. Deliverer Veho reduced headcount 19%, despite revenue nearly doubling last year. Meanwhile, Flexport is cutting about 500 workers (20%) just a few months after big layoffs in October, even though it just raised $260M in new investment from Shopify. FourKites, Uber Freight and Flexe also look to have made some incisions. With freight volume still shaky, expect to see more names added to this somber list…

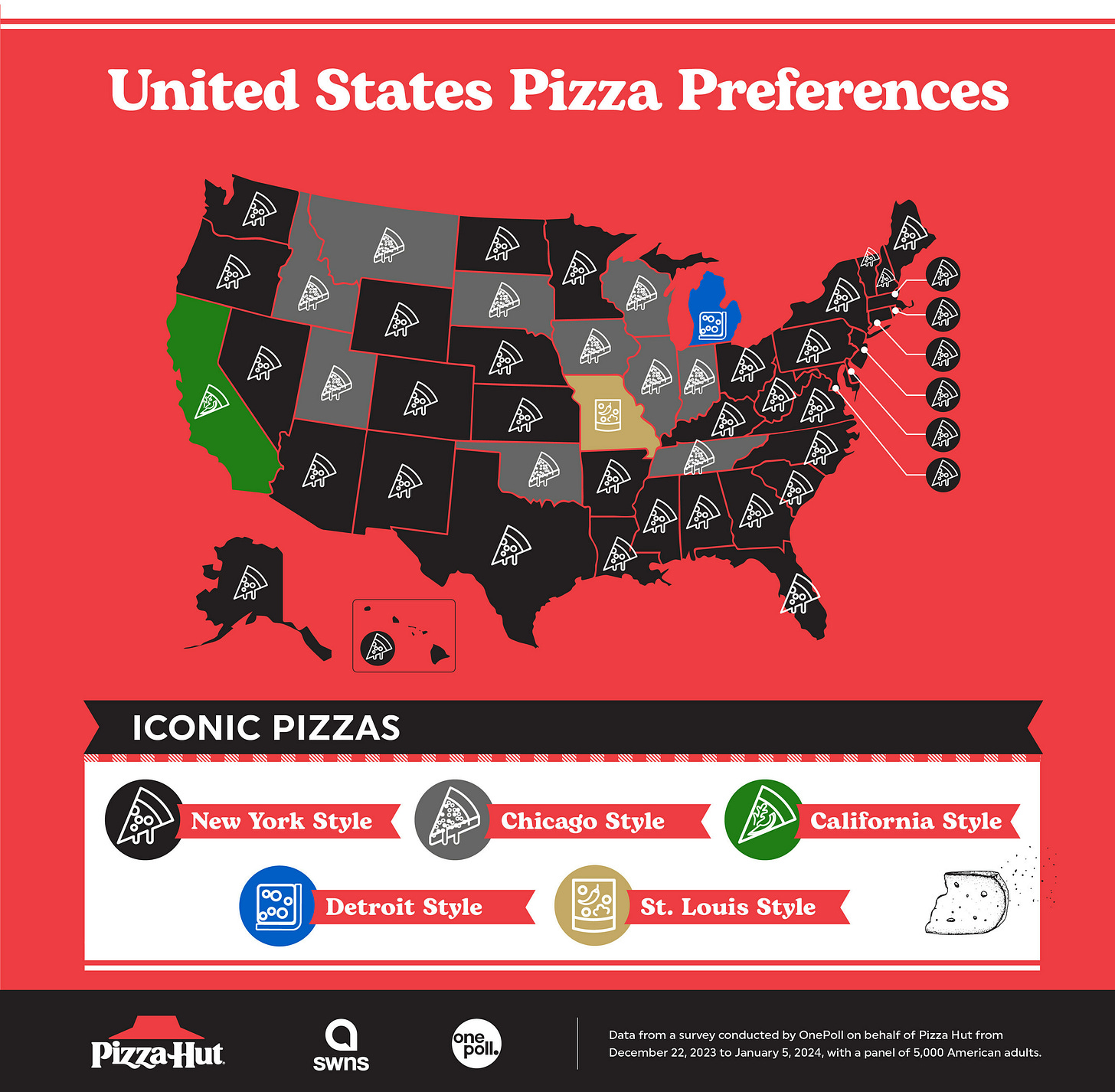

CHART TIME | Pizza Preferences by State

On to a cheerier subject: pizza! Pizza Hit has mapped out which style of the delivery-friendly food gets the most smiles in each state. The regional pies should be no surprise: California likes its namesake-style pizza with funky toppings, Missouri likes St. Louis-style which is yeast-free and cut into squares, while Michigan enjoys Detroit-style ‘za which is thick and chewy. The rest of the country is split into a bitter civil war between New York-style (thin crust) and Chicago-style (deeeeeeeep dish, honestly it’s basically delicious tomato pie.) The weird thing is that Pizza Hut kind of falls into none of those categories? They used to be famous for “pan pizza” which was close to Detroit-style, but today the default “hand tossed” is closer to New York-style, but still too thick to really qualify.

3PD | Instacart Partners with Universities to Study Food as Medicine

Instacart is pushing further into healthcare and wellness, as it just announced a partnership with five research universities to study and scale the impacts of food as medical interventions to improve health outcomes while reducing costs. Partner institutes include Meharry Medical College, The Ohio State University, Duke Clinical Resarch Institute, University of Kentucky and University of Pennsylvania; topics to be studied include improving food access for marginalized communities, coordinating care for cardiovascular-kidney-metabolic (CKM) syndrome and encouraging the purchase of fruits and veggies by patients with obesity and diabetes.

The Big Picture: IC has been pushing further and further into the health space. It started with a clever way to grab new funding streams, in August the company became the first 3PD to accept SNAP in every state. Then the company added Medicaid and Medicare payments, tapping into even more subsidy dollars. Since then the company has worked to expand its Fresh Funds food health initiative, adding medical providers in Chicago, DC and New York. These new studies should help Instacart make the case to even more health organizations that they should work together, creating some very sticky partnerships.

A Few Good Links

Getir names new leadership for its U.S. ops, post-FreshDirect acquisition. Would ByteDance buy Chinese 3PD Ele.me from Alibaba and would Alibaba want to sell? Delivery workers nervous about NYC’s new Dept. of Sustainable Delivery. Progressive rebrands fleet insurance program. Home Chef partners with food blogger Monique Volz. Indian EV TNC BluSmart raises $25M. What went wrong at Cruise. Flipkart Co-Founder leaves board. In-n-Out closes Oakland location, the first time the chain has ever retrenched, but the “rising crime” rationale (excuse?) doesn’t seem to match the fact that local robberies are down the past decade. Amazon gives up on iRobot purchase. Apple hardware VP heads to Rivian as iCar looks increasingly doubtful. How to build a digital resto. RTO boosts catering. Papa John’s loses int’l COO.

Modern Delivery will be off on Tuesday, returning Wednesday.

Got a tip, feedback, or just want to say hi? Reply back to this email.

Sorting fact from fiction:

I work one block from the closed Hegenberger Rd Oakland In-n-Out and it's in a parking lot where the main anchor tenant moved out years ago, leaving behind a litter of takeaway joints, salons and phone shops. It was always a little seedy but when the Cane's Chicken opened up and brought massive queues of cars, then it also brought opportunistic thieves of all kinds in big numbers.

Lots of crime in this specific location, but not nearby. We haven't had a single car break in, mugging or robbery at our office one block north, although some of our coworkers have been robbed while picking up lunch at In'n'Out or Canes.