Gig Worker Strike Snarls Valentine's Deliveries

Instacart & Lyft's fiscal fortunes, Vromo acquisition rumors

Wow, what a news day! We’ve got some financial results really worth perusing from Instacart, Lyft AND Delivery Hero. Plus, what to make of Vromo’s buyout by a PE-backed restaurant group? But before we get to that, let’s take a look at today’s gig worker strike.

Modern Delivery will be off Friday, returning next week.

Today:

Valentine’s Strike Hits U.S., U.K. Deliveries

Instacart Expands Buybacks, Shrinks Workforce

Chart Time | Lyft Lifted by Errant Keystroke

Vromo’s Curious New Ownership

LABOR | Gig Workers Strike from Coast to Coast to Coast

If you were expecting roses and a Big Mac today, you may be waiting a while… gig workers are on strike across the U.S. and the U.K. Organizers like Justice for App Workers, Delivery Job U.K. and Rideshare Drivers United are hoping to snarl food deliveries in major cities, and TNC rides to critical destinations like airports, as part of their fight for better pay and benefits. With London currently in the middle of the evening peak period, a casual AP survey showed 7 in 8 couriers plan to keep their apps off from 5 to 10 P.M.

The Big Picture: Similar labor actions in the past have tended to be too brief to do much besides generate media coverage. “These types of events have rarely had any impact on trips, prices or driver availability and we expect the same [today],” noted Uber spokesperson Zahid Arab. That said, there are a few factors that could push more workers to take action today: drivers in the Northeast are already teed off about having to work in this week’s winter storm; gas prices are still fairly high in select coastal markets even while surcharges have dissipated, and recent strikes in London and Brighton seemed to effectively snarl restaurant dispatching.

FINANCE | Instacart Cuts After Earnings Fall Short

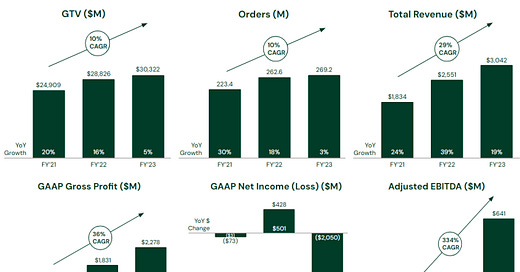

Instacart finished off the fourth quarter with $803 million in revenue, bringing its total year rev to $3.042B, up 19% YoY. GTV climbed 5% YoY to $30 billion, with orders up 3% to 269.2 million. While the company’s GAAP gross profit rose to $2.3B, its GAAP net income swung to a $2.1 billion loss, based off of increased stock-based compensation. Adjusted EBITDA (we love adjusted ebitda, don’t we folks…) of course rose to $641 million.

The Big Picture: Stock watchers found those numbers underwhelming, and analysts were particularly concerned by a slowdown of its vaunted ads business, which grew only 7% in Q4. Incentives and promos also cut into transaction revenue growth, as the company slashed rates to keep up with both rival 3PDs and alternatives like Walmart and Amazon. To keep investors satiated, the company announced an additional $500 million in share buybacks, and it cut headcount 7%, equating to about 250 employees. While delivery workers are unaffected, the company will lose COO Asha Sharma, CTO Varouj Chitilian and Chief Architect JJ Zhuang. IC now projects Q1 GTV to come in between $8B and $8.2 billion, slightly besting analyst consensus at $7.92B.

CHART TIME | Typo & Strong Results Send Lyft Shares Skyward

Lyft shares rocketed off a typo in an earnings release, where the company initially said it was projecting a margin expansion of 500 basis points (5%) for 2024; in a follow up call the company corrected that to just 50 bp. While stock soared 60% pre-open, it’s still up about 30% so far today, with investors liking that EPS came in at 18 centers per share. Revenue for the year was up 8% to $4.4B and GBV rose 14% to $13.8B.

OPERATIONS | Inspire Brands Buys Vromo

Inspire Brands, the private equity holding co that’s gobbled up Arby’s, BWW, Sonic, Jimmy John’s, Mister Donut, Dunkin’ and Baskin Robbins, just made a very different kind of acquisition: it bought delivery tech startup Vromo. Formerly named WeBring, the eight year old Irish company looks to increase fulfillment rates and reduce delivery times by letting restaurants mix in-house fleets and 3PDs, with the latter often used to pickup overflow orders. Jimmy John’s in particular could use the help, with the country’s second largest sandwich chain (by store count) having come out very publicly as anti third party delivery. But much has changed since that declaration in 2019, and the company’s aging tech, and lack of 3PD distribution, seems to be slowing growth.

The Big Picture: While Inspire’s need is real, the acquisition of Vromo is an interesting choice. Vromo’s sweet-spot is smaller restaurant groups; the largest chain in its case studies only has 79 locations; Jimmy John’s has nearly 3k, while Inspire overall controls 31,000+ restos. Also interesting, the price: while Inspire shelled out $11.3 billion for Dunkin’, the rumor mill has this acquisition in the very low eight figures. Usually you’d see new growth stage venture capital at that range, not a PE buyout. While Vromo leadership had no comment, competitors are already talking. One common refrain: expect to see a lot of FUD in the coming months, especially with sales reps trying to peel off customers by asking operators if they really want management at Arby’s, Dunkin’, Buffalo Wild Wings and co. to see all your sales data…

A Few Good Links

Delivery Hero’s official FY23 matches last week’s pre-release, investors happy with cash flow and Ostberg’s sentiment about holding on to Foodpanda. Official numbers on Drizly layoffs: 168 Bostonians cut. CA fast food workers forming non-majority union. BK says smaller franchisees are better. Resto staffing improves. ArcBest intros autonomous forklifts. HopSkipDrive touts high EV fleet share. Restaurant Brands Int’l sees Q4 profit surge to $508M. Bollinger picks first EV class 4 truck dealership. Say hello to the Taco Bell Crispanada. FTC suit against Amazon set for Oct. 2026 trial date, gives company ample time to root for creeping fascism to sweep the country.

Got a tip, feedback, or just want to say hi? Reply back to this email.