DoorDash Teases Unified Search, Enhances Starbucks Partnership

Instacart's Q3, Swiggy's IPO and online grocery sales surge

We’re starting the week off right, with huuuuge numbers from Instacart, Swiggy and the online grocery sector in general. But before we get to that, let’s dig into some juicy new announcements from DoorDash.

This week’s edition is brought to you by Curbivore 2025.

Today:

DoorDash Delivers Starbucks, Product Enhancements

lnstacart Lookin’ Good in Q3

Chart Time | Grocery Sales Surge

Swiggy’s Strong IPO

3PD | DoorDash Adds Holiday Features, Deeper Starbucks Partnership

Is it the holidays already? DoorDash is rolling out new product features, aimed at grabbing a bit more of holiday shoppers’ share of wallet. For the lazy gift giver, DD now lets you buy physical and digital gift cards from hundreds of retailers. For the lazy non-gift giver, a new grocery list import feature lets shoppers paste lists right in the app, or sync from the iOS Reminders app. On the equity front, DashPass pricing has dropped to $4.99/mo for SNAP/EBT users. And then the most important update of all is one we’ve been kvetching about for some time… there’s now unified product search, first rolling out to the alcohol category. That means if you want to search “cheap vodka” to deal with the headache of your relatives, you can now compare prices across all retailers, as opposed to having to compare the prices one by one by one.

The Big Picture: Beyond app features, DD has a few other announcements adding holiday cheer. On the deals front, a new holiday savings event means shoppers get discounts from the likes of Best Buy, Dick’s Sporting Goods, Sally Beauty, Edible, Party City, Lowe’s, Michael’s, Staples and Victoria’s Secret. On the caffeination battle front, DoorDash is now powering delivery within Starbucks’ own app, across the U.S. and anglophone Canada, building off of lighter partnerships kicked off in January and March 2023.

EVENTS | Delivery & Mobility Comes Together at Curbivore 2025

Industry Dive just called Curbivore one of the “9 restaurant industry trade shows to attend in 2025.” Returning to the Downtown LA Arts District this April 10th and 11th, Curbivore brings together the world’s foremost fleet operators, restaurateurs, regulators, retailers, startups, technologists and policy makers to discuss the intersection of transportation systems, small business, urban design and commerce.

Score your Early Bird Tickets now and save.

FINANCE | Instacart Strong in Q3, Weak in Q4?

Instacart dropped strong Q3 results, with GTV climbing 11% YoY to $8.3 billion and revenue climbing 12% to $852 million. GAAP net income swung into positive territory, at $118M, while adjusted EBITDA rose 39% to $227 million. And ads continued to pay off, with “advertising and other revenue” climbing 11% to $246M, representing 3% of GTV. Even though that beat expectations, stock watchers were evidently hungering for more: shares dropped 14% on a weak outlook for Q4, with the company expecting adjusted EBITDA between $230-240M.

The Big Picture: GTV (or GMV/GOV, depending on your accent) growth in the teens seemed to be the norm this quarter. Remember that Uber saw delivery gross bookings climb 16%, while DoorDash GOV jumped 19%. Things looked weaker on the international front, Delivery Hero GMV was up 9% YoY and Deliveroo gained 5%, while Just Eat Takeaway.com was dragged down 2%. At this point, all the major 3PDs now have their sights set on crushing their Q4s…

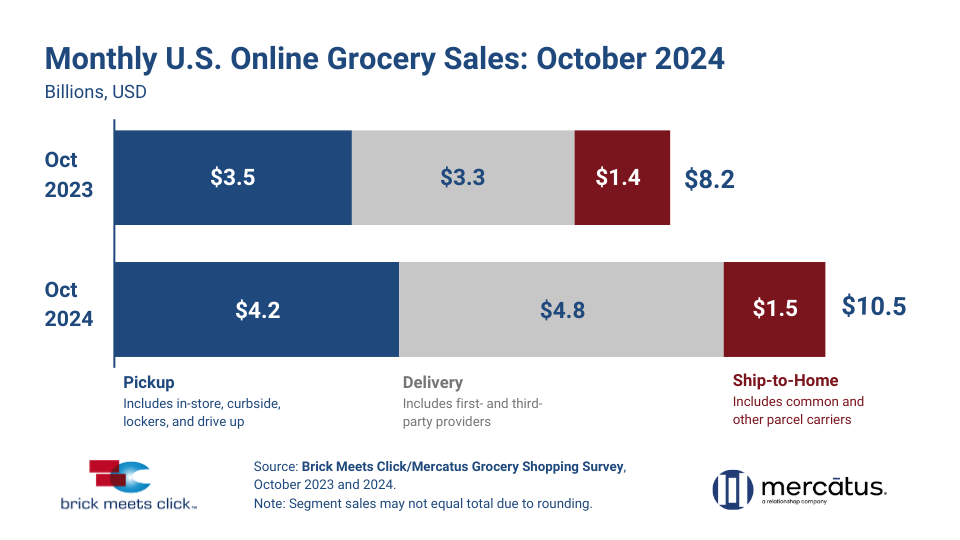

CHART TIME | Grocery Delivery Booms in October

Is there something in the air? Brick Meets Click shows that in recent months, online grocery sales are booming like we’re back in the pandemic. Total sales hit $10.5 billion last month, up 28% YoY, with delivery driving most of the gains, thanks to a 16% rise in monthly active users. Sales were up a cool $1 billion from September as well. Meanwhile, total U.S. grocery sales climbed just 0.1%, to $75.28 billion.

FINANCE | Swiggy Pops On IPO, Whither Grubhub & Talabat?

Shares of Indian quick commerce darling Swiggy soared on its Wednesday debut, rising 10.67% to ₹455.95 (~$5.4.) Since then, shares climbed as high as ₹470, before settling back down around ₹425, valuing the firm at over $11 billion USD, a bit under half that of competitor Zomato. Investors Prosus, SoftBank and Accel are sure to be pleased with the results, as are the 5,000 or so employees that have shares. Q-commerce has grown 77% annually in India since the pandemic, with Morgan Stanley estimating the sector will be worth $42 billion by 2030.

The Big Picture: Swiggy isn’t the only deliverer trading hands; Delivery Hero has dribbled out more details on its Talabat spin out, with the Middle Eastern brand targeting a $9.4-10 billion valuation. Meanwhile, there’s drama with Wonder’s $650M buyout of Grubhub, with the latter company’s founder Matt Maloney saying he twice offered to buy back his baby for $1 billion plus, but he was rebuffed by JET management. There’s another family food fight in Japan, with 7-Eleven / Seven & i’s Junro Ito, son of founder Masatoshi Ito, also looking to buy back the company instead of allowing its sale to Circle K.

A Few Good Links

Uber Eats scores Northeastern grocery darling Stew Leonard’s. Grubhub partners with Incognia on security / identity solutions. Pony AI preps for IPO. LOXO debuts European autonomous delivery van. DoorDash researches food insecurity for college students. Texas judge (it’s always Texas…) strikes down Biden’s DoL rule that had expanded overtime pay to an additional 1 million workers. Craveworthy Brands buys Fresh Brothers Pizza. USPS tweaks Amazon order processing for holiday crush. Amazon deemed lowest price online retailer. 160-location The Fresh Market signs on with Shipt. Loblaw misses Q3 earnings estimate. Costco sales up in October. Amazon Prime Air adds 21 Air. Lightspeed debuts new KDS. GreenPower ships EV vans to University of St. Louis. Kroger reveals holiday habits. USPS looks to up Ground Advantage pricing by 3.9%, Parcel Select by 9.2%. Lexus adds EV crossover. Shipt debuts holiday deals. So does iFood. NY hopes to implement congestion pricing by 1/5. Otherlab shows off solar-powered cargo scooter (looks like an April Fools’ joke.) Uber Freight intros Capacity-as-a-Service. Biden admin won’t OK new LNG permits through end of term. Trump looks to kill EV tax credit. Bolt talks safety. Chinese immigrants run Temu shipping centers from their garages. Amazon launches Haul, its Shein clone. India’s HealthKart hits $500M valuation. Grab is building a Google Maps competitor for Southeast Asia.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.