Ugh, we step away for one day and there’s just so much news! So let’s get right back into the swing of things, as we digest not only DoorDash’s huge quarter, but that of India’s Zomato as well. And for good measure, we’ll tear open the finances at SBUX, PZZA, WEN and Publix. Plus, with the FTC revealing more details on its suit against Amazon, what lessons are there for the broader delivery world?

Today:

DoorDash Drops A Record Breaking Q3

Learning from Amazon’s Advertising Lawsuit

Chart Time | Splitting Open Zomato’s Profit

Restaurants, Grocers Hit Stride in Q3

3PD | DoorDash Posts Record Q3

DoorDash just threw down an impressive set of Q3 results, with shares surging 10% as the market digested the unexpectedly strong performance. Customer placed a record 543 million orders, exceeding the 511M that analysts expected, and up 27% from a year prior. Marketplace gross order value rose 24% to $16.751 billion and revenue surged 27% to 2.164 billion. Net revenue margin (rev/GOV) inched up from 12.6% to 12.9% YoY.

The Big Picture: Not only did DoorDash haul in more cash, it came closer to breaking even, with its GAAP net loss (including redeemable non-controlling interests) shrinking to $75 million. The company revised its Q4 estimates upwards to $17-17.4 billion in GOV, as it expects its investments into the alcohol and grocery spaces to keep paying off. Notably, the company didn’t break out its ad revenue, with CFO Ravi Inukonda adding “The mistake companies make is they build an ads business and the underlying marketplace business is not growing, which means eventually the ads business will not grow.” We’ll see how that prediction holds up, with Instacart, Uber and Just Eat Takeaway.com set to report quarterly results shortly.

HAPPY HOUR | Join Us 11/14 in LA’s Arts District

The worlds of delivery, mobility and technology are coming together November 14th, as Curbivore, Modern Delivery and SUMC are hosting an industry meetup from 6 to 8 PM at the Arts District Brewing Company. RSVP now for free while tickets last!

LAW | Amazon Suit a Warning to 3PD Marketplaces

More details are emerging in the FTC’s lawsuit against Amazon for “illegally maintaining monopoly power,” with the government accusing the ecommerce giant of worsening the site experience for both shoppers and merchants to improve its profits. Former CEO Bezos instructed his underlings to “accept more defects” as the company deliberately crammed more ads into search results, including ones that were highly off-topic. While doing so degraded user experiences, it forced merchants that wanted to be discovered to also pay for visibility, while possibly bidding up the floor price for any ad to get viewed. Examples include “Buck urine” showing up in the first Sponsored Products slot for “water bottles.”

The Big Picture: As more and more 3PDs turn to advertising to juice profitability, they run a similar risk to the issue currently plaguing Amazon and its ecosystem. If you make money selling a meal to a customer, your objective is pretty simple — make the food good enough, at the the right price, available at the right speed. But if you view yourself as an ad platform, the incentives get a bit muddled: maybe you offer something worse because they pay you a better ad rate. There’s a tension to this — if the offering is too awful the customers might leave, taking some merchants with them. But if it’s not *too* bad, the added value of the advertising dollars offsets the negative impact of the degraded product experience. Perverse indeed…

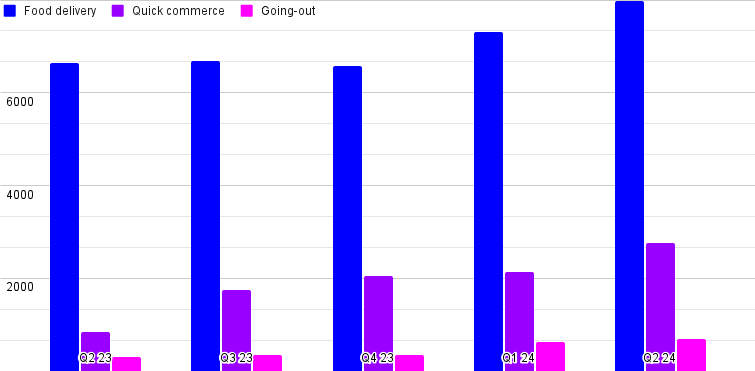

CHART TIME | Learning from Zomato’s Growth

Indian delivery giant Zomato also reported their quarterly results, and there are some interesting lessons for Western businesses. First, some maddening footnotes — the company calls the quarter that just ended “Q2 2024” and the unit of rupees measured are crores (10,000,000s.) So for the quarter that just ended the total GOV was 11,422 INR crore — equating to roughly $1.373 billion USD. While the company has been steadily growing its core food business, quick commerce has been on a tear, turning contribution margin positive for the first time. The company is also building up a “going out” arm, its term for in-restaurant dining plus events. Overall the company managed a profit of ₹36 crore.

FINANCE | Strong Quarters for Starbucks, Papa John’s, Publix, Wendy’s

With earnings season in full swing, we thought we’d take a look at three companies that really cover the breadth of the digital delivery ecosystem. Pizza purveyor Papa John’s saw profit surge 90% YoY to $15.8 million, with global systemwide sales climbing 5.1% to $1.23 billion. Starbucks saw profit rise 37% to $1.21 billion, with revenue up 11.6% to $9.37 billion. Wendy’s profit grew 15% to $58 million, off of a revenue rise of 3.4% to $550.6M. And last but not least, grocer Publix saw profit up a whopping 111.4% to $833 million, as sales crept up 7.2% to $14 billion.

The Big Picture: Each of these companies has taken a different approach to maintaining an edge as the digital and delivery spaces evolve. Papa John’s, fighting with Marco’s Pizza to maintain its 3rd place in the U.S. market, has leaned into 3PD, boosting it to 15% of sales. Starbucks continues to build its strong first-party digital presence, as it works to double its Rewards Members to 75 million in the next five years. Wendy’s grew digital sales at an accelerated 30% YoY to 13% of total revenue, with its international markets leading the charge over its domestic presence. And while Publix may be more renowned for its subs than its tech savvy, the company has shrewdly intertwined itself with Instacart, owning a sizable chunk of it since investing in its Series D six years ago.

A Few Good Links

Instacart Caper Carts head to Geissler’s Supermarkets. Uber offers details on new NY pay policies. TeraWatt breaks ground on EV truck chargers near Port of Long Beach. Favor promotes Chief Taco Officer to Chief Tasting Officer (gotta void that executive burnout…) DoorDash testing road safety features. Holiday seasonal hiring starts slow, with delivery workers yet to report. 1-800-Flowers Q3. Starbucks turns to iFood for delivery in Brazil. Yellow’s fleet heads to auction.

Got a tip, feedback, or just want to say hi? Reply back to this email.