Delivery Hero Halves Losses, Stock Tanks

Mercedes' EV van, Del Taco goes digital, Walmart grabs grocery sales

We’ve got something for everyone today: a financial update worth learning from via Delivery Hero, a legacy QSR trying to push into delivery, a splendid but pricy new electric van, and some hot Walmart grocery stats. P.S. Labor Day is just around the corner and this newsletter will start celebrating early — see you again on Tuesday!

Today:

Delivery Hero Disappoints Market in H1

Dibs on that Digital Del Taco

Chart Time | Walmart Gobbles Up Grocery Delivery Marketshare

Mercedes’ eSprinter Van Now Available

3PD | Delivery Hero Trims Losses, Gets Spanked by Investors

Multinational delivery giant Delivery Hero released its half-year trading update (PDF) this morning; despite metrics trending in the right direction, the stock market was very much not happy with the results. GMV hit 22,282.7 million euros, up 11.3% from H1 ‘22, total segment revenue climbed 21.3% to 5,075.6 million euros. Volume fell slightly in Asia — the company’s largest market — where it operates brands Foodpanda and Woowa’s Baedal Minjok, due to resumption of in-person dining in markets that recovered from Covid outbreaks. Volume was up about 16% in LatAm (where it operates PedidosYa) and MENA (Hungerstation, InstaShop, Talabat, Yemeksepeti) and more than doubled in Europe due to the company’s recent acquisition of Glovo (joining Foodora, Foody, and Efood.)

The Big Picture: The real problem was that while Delivery Hero trimmed its overall H1 loss to €832 million ($909M USD) from €1.496 billion a year prior, analysts had been projecting an even stronger improvement. Similarly, while gross margins improved to 6.5%, that came in below analyst expectations of between 6.6 and 7.4%. The company’s headcount has shrunk approximately 10% since EoY, as it continues to trim expenses. As such, Delivery Hero is still projecting it will be adjusted EBITDA positive by year’s end. At the time of publication, shares were trading down 10.33%.

RESTAURANTS | Del Taco Opens First Digital / Delivery Focused Location

Number two Mexican QSR Taco Bell opened its first seating-free Fresh Flex location, pioneering the new concept in Albuquerque. The 1,200 square foot store is 1/2 the size of a traditional location, and supports a drive-thru lane, walk-up window, and pickup lockers for 3PD couriers and mobile app users.

The Big Picture: The smaller format cuts build-out costs, making Del Taco more attractive to the franchisees it’s currently courting as it tries to grow out of the Southwestern region. “This design allows us to reduce the overall footprint of the building which creates more real estate flexibility and the potential to reduce total buildout costs which will allow us to further accelerate the growth of our brand,” said Tim Linderman, Chief Development Officer. Beyond adapting its footprint, Del Taco (and parent company Jack in the Box) need to improve their investments in the digital and delivery spaces; currently the Del Taco app sits at a lowly #107 in the iOS Store’s Food & Drink Category, compared to #6 for Taco Bell.

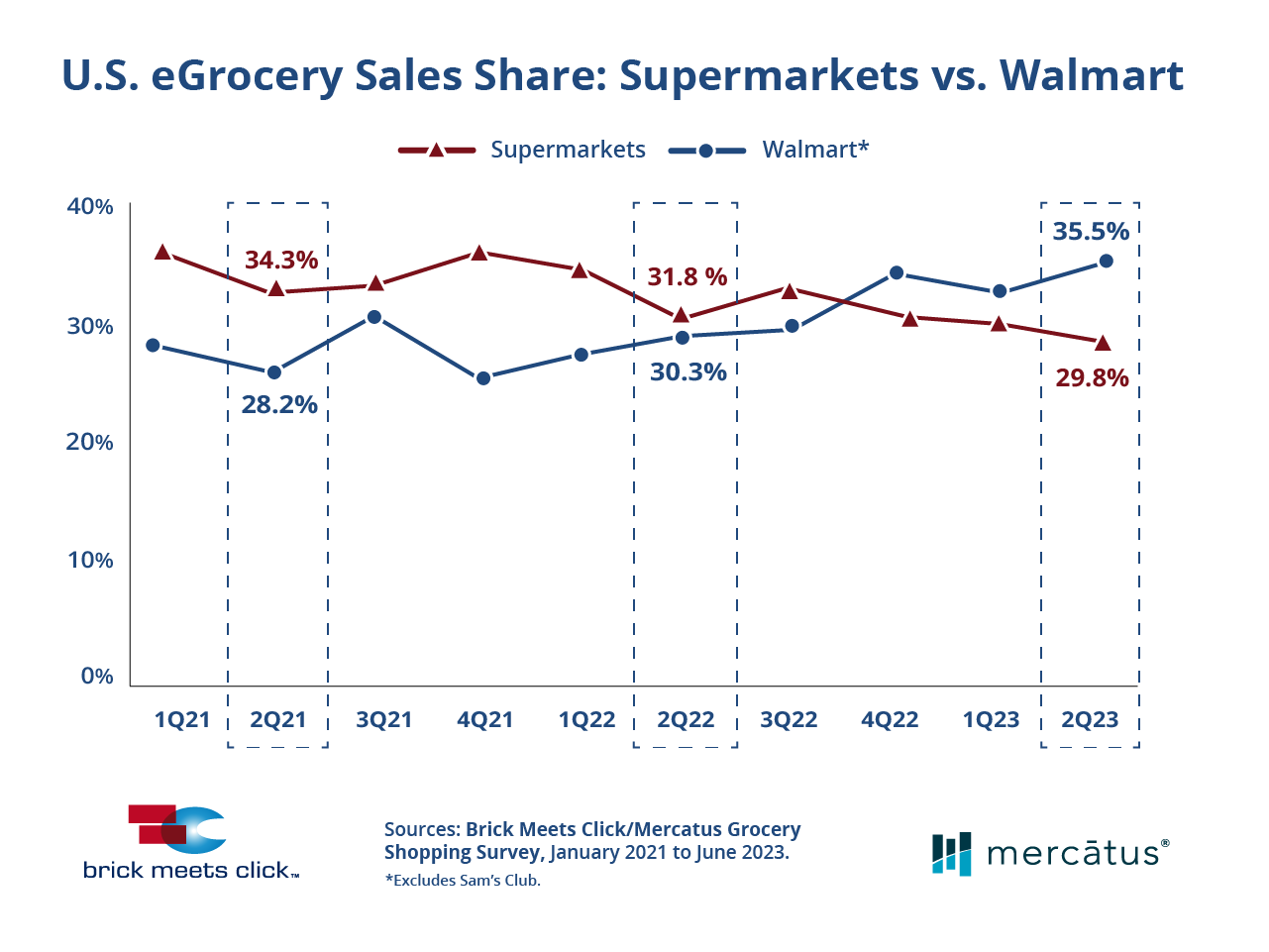

CHART TIME | Walmart Dominates eGrocery Sales

New data shows that Walmart is taking a commanding lead in the grocery delivery and pickup space. The retail giant captured a record 36% of U.S. eGrocery sales in Q2, up 5 percentage points from the year prior. Traditional supermarkets are stuck around 30%, while other discounters like Target sit at 7%.

VEHICLES | An Electric Van with a Mercedes Price Tag

After months of teasing, Mercedes-Benz opened up its eSprinter electric van for orders via its U.S. dealer network. The 170-inch-long wheelbase cargo carrier comes with a high-roof config and a 113 kWh battery that Mercedes says will do 249 miles per charge (although EPA estimates may come in slightly lower.) All that ain’t cheap — the van starts at $71,886. But given that it’s manufactured in South Carolina, expect federal incentives to apply, meaning a potential $7,500 in rebates, with even more savings in states like California.

The Big Picture: German engineering isn’t cheap, but Mercedes’ premium price point does get fleet users some nice perks. While Ford’s E-Transit retails around $51,890, that has only about half the battery capacity, and a relatively cramped 148-inch wheelbase. Mercedes’ gas-powered vans tend to cost more than a Ford of comparable size, so once you throw in the cost of the larger batteries, the premium doesn’t seem so eye-watering.

A Few Good Links

Subway introduces flying blimp-staurant. Talitha unveils D2C coffee with a focus on consumer education. Burger King faces class action lawsuit over Whopper size. Taco Bell testing Baja Blast flavored gelato. DOL may raise overtime pay salary threshold. TGI Fridays elevates CMO to CEO as chain pushes virtual brands. Snack POS teams with PAX for EMV payments in restaurants. Ryder’s east coast pet food deliverers join Teamsters union. Packaging provider Liviri launches grant program for independent egrocers. Walmart Marketplace adds new fulfillment options. Restaurant365 sees operator sales rise 5% YoY.

Got a tip, feedback, or just want to say hi? Reply back to this email.