Delivery Hero Grows 9% Despite Asia Headwinds

NYC maritime delivery, Amazon comes for Instacart, October 3PD market share

Well, well, well… if it isn’t time for Delivery Hero’s third quarter results. Overall, lookin’ pretty good, but Asia continues to struggle. NYC also has a wacky plan to move goods by boat, Amazon’s looking to eat Instacart’s lunch, and we’ve got our monthly 3PD market share update. Oh ya — see you at tonight’s DTLA happy hour?

Today:

Delivery Hero Grows 9% — Asia Weak, Nicaragua Strong??

NYC Looks to Maritime, Aerial Deliveries

Chart Time | October 3PD Market Share

Amazon Wants Instacart and Shipt’s Lunch Money

FINANCE | Delivery Hero Up 9%, As Asia Growth Stalls

Multinational 3PD Delivery Hero released its Q3 results, showing overall strong growth, albeit with some meaningful regional deviations. All in all, GMV came in at 11.69 billion euros ($12.50 billion) for the quarters, beating analyst estimates of 11.57B euros, and up 9% (constant currency) from the year prior. Revenue grew 16.2% to €2,712.9 billion, with the company calling out improved monetization coming from both adtech and service / subscription fees. DH confirmed it was on track to reach an adjusted EBITDA/GMV margin of more than 0.5% for the full year and greater than 1% for the second half, meaning an overall improvement of 850 million euros. The Berlin-based company expects it will end 2023 with GMV growth of 5 to 7 percent.

The Big Picture: While Asia is Delivery Hero’s largest market — representing 54% of gross merchandise value — the company is struggling to maintain its advantage, with GMV falling over 6% YoY. Competitors like Coupang are cutting into subsidiary Woowa’s dominance of the South Korea market down to a 77% market share. Deliery Hero is shopping around some of its Asia assets, with the Foodpanda markets of Singapore, Malaysia, Philippines, Thailand, Cambodia, Myanmar and Laos perhaps worth as much as 1 billion euros to a competitor like Grab. Delivery Hero also noted strong growth in markets that include Saudi Arabia, Turkey, Dominican Republic, and Nicaragua.

POLICY | NYC Trials Maritime, Aerial Delivery

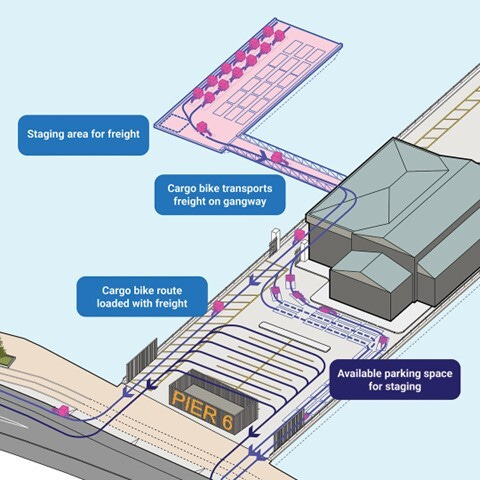

NYC Mayor Eric Adams shook off his FBI investigation to make some pretty wild announcements on Monday, with the Big Apple looking to get into both maritime and aerial delivery. The idea would be to turn the Hudson River into a “marine highway” whereby boats replace trucks on congested city streets — goods would then be taken to a pier-side staging area, where cargo bikes pick them up for the last mile. The city has an active RFEI for relevant vendors and solution providers (go get that money!) Currently, waterways carry less than 10% of the city’s freight.

The Big Picture: While the announcement focused on the Downtown Manhattan Heliport, NYC is also looking to roll these changes out to Stuyvesant Cove (Manhattan), Pier 36 (Manhattan), Oak Point (Bronx), 29th Street Pier (Brooklyn), and 23rd Street Pier (Manhattan), thanks to $5.2M in federal funding. Mayor Adams also looked to the sky, with the city looking to retrofit its helicopter facilities to accommodate electric whirlybirds and eVTOLs (see RFP.)

CHART TIME | October 3PD Market Share Update

Another month, another Bloomberg Second Measure datapoint on U.S. market share for third party food delivery. Compared to September, Uber Eats jumped a point, to 24%, while Postmates, DoorDash, ASAP and Grubhub all sat unchanged at 2%, 65%, <1% and 9%, respectively. DashPass retention looked to be 67% after one month, 35% after six months and 27% after twelve months.

3PD | Amazon Sets Aim at Instacart, Shipt

Amazon is retooling its grocery ambitions, so Instacart and Shipt better be worried. The company is now offering all of its customers delivery from partner brands that include Bristol Farms, Cardenas Markets, Pet Food Express, Weis Markets, and Save Mart. By and large, those retailers already have agreements with Instacart and Shipt, so Amazon is muscling in on some competitive turf. Compare SoCal grocer Cardenas’ page on Amazon, to its Instacart and Shipt presence. For what it’s worth, Shipt appears to be estimating a single banana costs seven cents more than its two competitors do.

The Big Picture: The 3PD news seemed to almost get lost among some of Amazon’s other expanded grocery ambitions. After a yearlong pause, its resuming expansion of its physical Amazon Fresh grocery stores, and the shopping giant remodeled its existing SoCal and Chicagoland locations to be less scifi looking and to instead nail basics like customer service and fresh baked goods. The Everything Store is also making Fresh delivery available to non-Prime members, and will soon expand that to include Whole Foods. Delivery rates are dropping as well, with orders over $100 now free for Prime members.

A Few Good Links

64% of diners plan to order holiday meal items from restos. Vianova lands contract to manage Berlin’s shared rental fleet. Sales fall 3% at Home Depot. Manhattan community board comes out against eBike licensing. Wonder closes on Blue Apron, will take delivery in-house in Tristate. Amazon scores shopping deal with Snapchat; integrates multi-channel returns with ReturnGo. Coffee chain Biggby looks to his 1k units. Geotab notes fastest growing LMD markets: Manhattan, Chicago, Phoenix, Houston. Consumers are now asked to tip five times per week (honestly, sounds low.)

Got a tip, feedback, or just want to say hi? Reply back to this email.