Today we’ve got a couple of big stories out of Europe — no don’t close this tab, you can learn something from them, as well as a huge update from that most American of brands: Starbucks!

Today’s your LAST DAY to save $400 on Curbivore tickets. Join leaders from Uber Eats, DoorDash, Wing, Serve Robotics, FDNY, City of LA, Coco Robotics, Waymo, Zoox, Sweetgreen, Starship, Shell Recharge, Wendy’s and many more — April 10-11 in Downtown Los Angeles.

This week’s edition is brought to you Gridwise.

Today:

Deliveroo’s Dinky Profit

Starbucks Hits Reset on The Third Place

Chart Time | Scooter Slow Down in South Asia

Just Eat Takeaway Gets Drugged

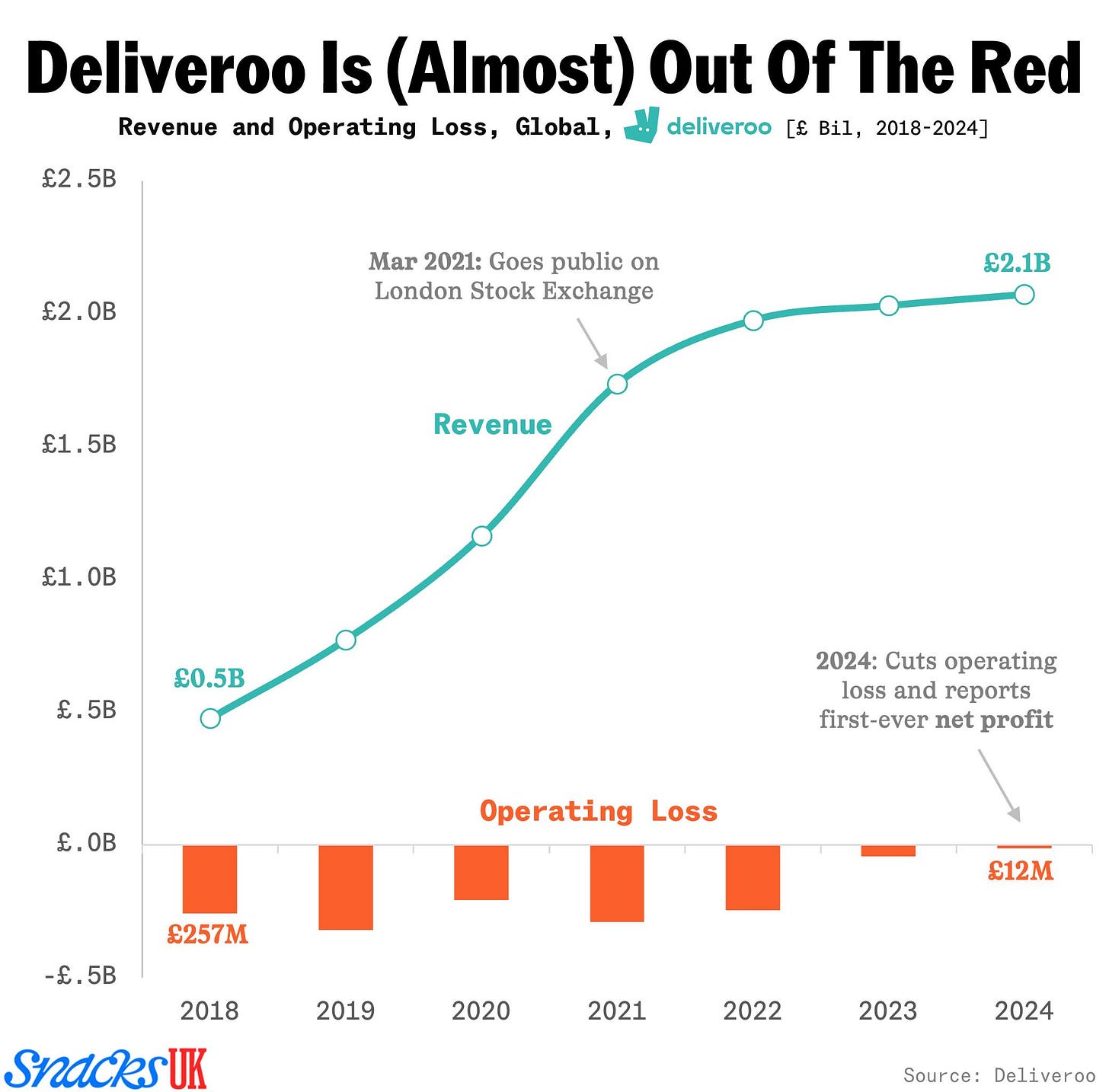

FINANCE | Deliveroo Delivers A £3 Million Profit

After 12 years, London-based Deliveroo has finally achieved profitability, bringing in a whopping £3 million ($3.88M USD) for 2024. Revenue rose 2% to £2.07 billion, and the company was free cash flow positive on 296 million orders. The company’s core operations still had a tiny loss — £12 million — but finance income of £28.5 million pushed the European 3PD into the black. GTV climbed 5% to £7.434 billion.

The Big Picture: A number of metrics are slowly moving in the right direction for Deliveroo, with average order frequency (AOF) hitting its highest mark in company history, and the company’s Plus membership logging record subscribers and higher order frequency. (The company rejiggered its membership tiers last summer in a bid to become a “Plus first” company.) Grocery sales grew to 16% of the GTV mix, and the retail vertical showed promise as well. In its quest for profitability, the company is also giving up on some of its tougher international markets, it’s recent exit from Hong Kong will require a “compliance check,” as its home turf of the U.K. & Ireland grew GTV a respectable 7%.

PARTNER | Autonomous Vehicles Are About to Transform Rideshare – Here’s What You Need to Know

Autonomous vehicle firms like Waymo, Zoox, and Cybercab are set to reshape ride-hailing and on-demand delivery. But how will these firms tackle key challenges like market selection, optimizing fleet deployment, and balancing pricing strategies to maximize demand and profitability?

Together with S&P Global Mobility, Gridwise Analytics has compiled a must-read report detailing the key insights every mobility leader needs to know.

Key Findings:

Autonomous ride-hailing trips are growing fast, but AV pricing must hit $1 per mile to scale.

Fleet efficiency is a major challenge—AV fleets need to average 12-15% dead miles, but even the best ride-hail fleets operate at 20-22%.

Demand and pricing vary dramatically between and within cities, making fleet optimization complex.

Pooled rides are making a comeback, now at 1.7% of total rides (Sept 2024)—but still far from the 12-19% pre-pandemic levels.

Get the full report now to understand where AVs are headed.

OPERATIONS | Starbucks Unveils New Retail Designs

Six months in to CEO Brian Niccol’s turnaround of Starbucks, the coffee giant has unveiled its latest initiative: redesigned cafes. The Seattle caffeinator wants to ensure “We’re working hard to ensure our coffee houses have the right vibe.” “We want to invite customers in, showcase our great coffee, provide a comfortable place to stay, and make them feel like their visit was time well spent,” said Niccol at the company’s annual shareholders’ meeting.

The Big Picture: Niccols has a mixed record on trying to turn around Starbucks’ fortunes: encouraging workers to foster “moments of connection,” (whoo….) increasing paid parental leave, laying off workers at HQ, and battling unionization efforts. Starbucks went all in on to-go orders and delivery during the depths of the pandemic, speeding up orders, forming partnerships with the likes of Gopuff and the big 3PDs. But that detracted from the in-store experience, which is still vital for a brand that brought the concept of the “third place” to the forefront of American consumers’ expectations. Starbucks now has a whopping 34.6 million active digital users in the U.S., can this new push bring those pixel pushers back into plusher pews?

CHART TIME | The Wheels Fall Off…

India’s Ola Electric is finding out that scootin’ ain’t easy… the once high-flying startup has seen moped scales crater from ~34,000 a year to 8,647 and its loss widen to 5.64 billion rupees ($65 million USD.) Ola has seen top executives leave, consumers hit it with quality complaints and legacy competitors like Bajaj and TVS step up their games. Once closely tied to TNC and erstwhile 3PD biggie Ola, the company’s slumping stock price means earlier ambitions to enter other markets are very much on the back-burner.

PARTNERSHIPS | Just Eat Takeaway Adds Phoenix Pharmacies

Just Eat Takeaway.com continues to expand into new verticals, thanks to a partnership with German drugstore conglomerate Phoenix Group. The roll-out starts in Belgium, where Phoenix’s BENU brand will show up on Takeaway.com and the U.K., where Rowlands will list on Just Eat. Phoenix operates 3,200+ locations in 17 countries, selling goods like pain relievers, skin care lotions and hygiene products. The ~47 billion euro in revenue retailer also operates under the McCabe’s, Apoteka Lijek and HelpNet brands.

The Big Picture: Much like its American counterparts, Just Eat Takeawy.com has made a big push into non-food retail, partnering with the likes of Boots, Rexall and CURE, while promising “many more to come.” Last year, retail accounted for 33% of JET’s growth in supply in Northern Europe, while orders from retail and grocery doubled in the U.K. and Ireland. “Scaling grocery and retail remains a key priority,” noted the company in its annual report, right before getting gobbled up by Prosus.

A Few Good Links

Wonder's COO Tony Hoggett talks Grubhub, Relay, Blue Apron & super app ambitions. Swiggy offers instant delivery of Crocs sandals, lol. DoorDash to join S&P 500. Flynn hits 1,000 Pizza Hut locations. NLRB member reinstated. Fast food foot traffic falls. USPS invites DOGE to cut costs. Fast fashion industry nervous about looming (get it?) Vietnamese tariffs. Grocers excited to destroy ozone layer. Mercato adds SNAP access. Kroger adds ecommerce unit. Dollar General hits $40B in sales, warns that customers can only afford “basic necessities.” Shipt sells magical marshmallow treats. JET undergoes shares transfer. Stellantis and Luvly plan micro-car. Waymo racks up parking tickets. Tern AI unveils cheapo competitor to GPS. Class 8 truck sales fall. Amazon improves workplace safety. Lyft partners with Bilt Points.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.