Craveworthy Brands' Crowdfunding Stalls

Zipline signs big new brands, DutchX + DeliverZero, off-premises dining data

Nothing like starting the week off with a bit of sleuthing… that’s what we’ve got for you, as we analyze why despite its executive star power, Craveworthy Brands seems to be struggling to raise fresh capital. On the flip side, Zipline and DutchX both have some big name new partners to celebrate…

Today:

What’s Slowing Down Craveworthy’s Crowdfunding Push?

With New Partners, Zipline Hits 1 Million Deliveries

Chart Time | Off-Premises Successes

DutchX & DeliverZero Double Down on Sustainability

FINANCE | Craveworthy Brands’ Crowdfunding Push Stalls

The LinkedIn message seemed innocuous enough… sure it’s obviously coming from an automation tool, but who wouldn’t want to connect with Gregg Majewski, famed for his stint leading Jimmy John’s to national dominance, and now CEO of Craveworthy Brands? But as the follow-up messages (plus those coming from other execs at the company who were now suddenly so eager to connect) kept pushing Craveworthy’s crowdfunding campaign, we thought we’d go take a closer look at the initiative. Announced on February 15th, Craveworthy is hoping to raise $5 million by June, and the initial press release noted it had already secured “nearly” $450,000. But as of 4/5, the total raised on Issuance Express was sitting at just $425,464.20; one week later it was still only $428,614.20. Checking back in today it’s crept all the way up to $429,139.20. That means in the last 11 days it’s raised a whopping $525 dollars, just a hair over the $500 minimum investment per person.

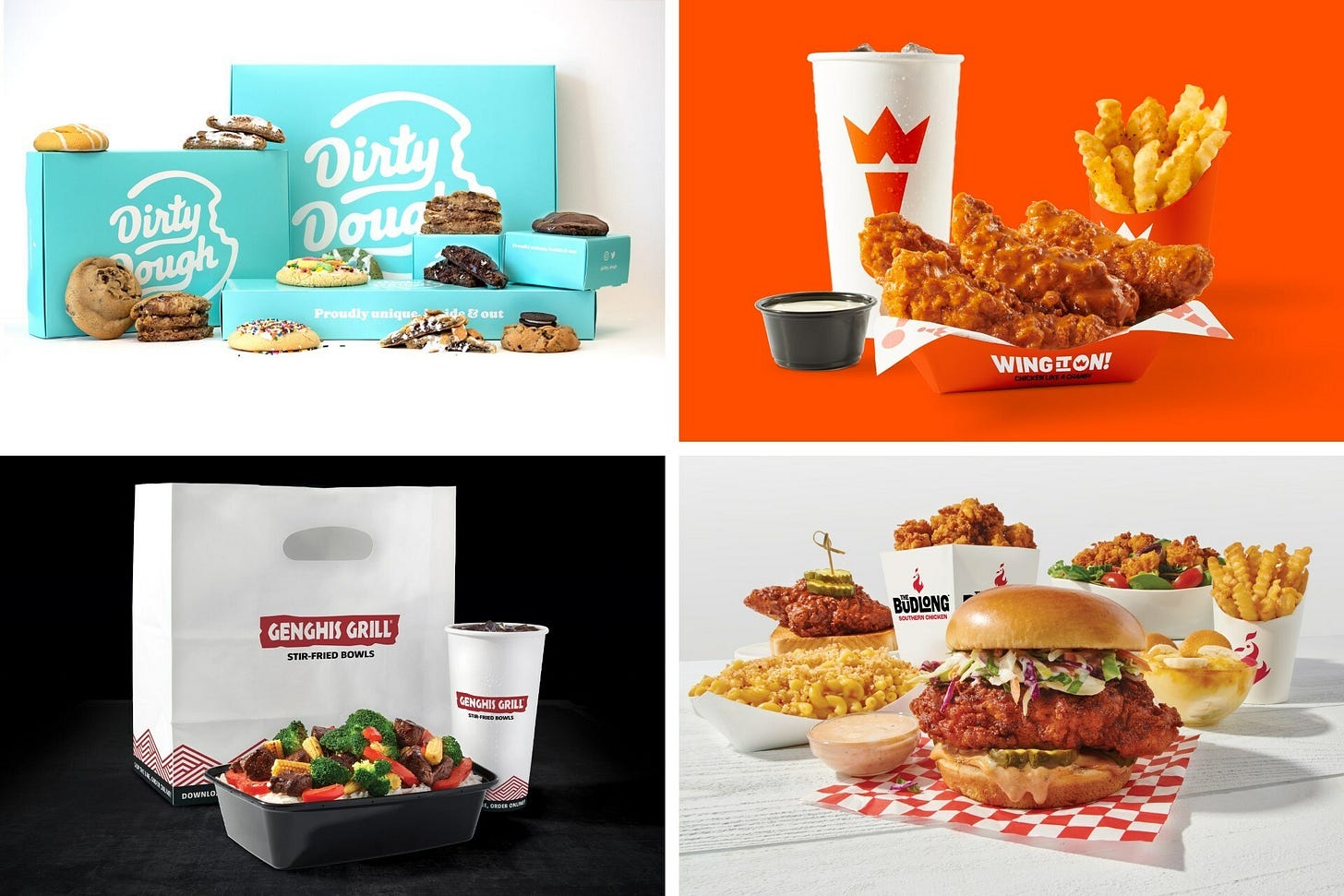

The Big Picture: Craveworthy’s business model is rolling up a number of franchise-friendly and delivery-optimized brands, including Budlong Southern Chicken, Lucky Cat Poke Co, Wing It On!, Soom Soom, Pastizza and Genghis Grill. But the company has millions in debt from its acquisitions and investors are actually buying into a special purpose vehicle, as opposed to the company directly. Investors’ appetites may also be suppressed due to this type of crowdfunding having a pretty spotty record as of late: if the deal is so good, why won’t larger accredited investors add capital so the company can avoid all the legal and compliance expenses associated with this route? Given the recent travails of other crowdfunding darlings like Piestro, Miso Robotics, Arrive and more, we’ll be watching this one closely.

AUTONOMY | Zipline Signs New Partners, Hits 1M Deliveries

Autonomous delivery drone player Zipline is taking a number of new brands to the sky. First up is Panera Bread, via its Seattle-region franchisee Flynn Group. Customers will be able to place orders for items like the Chicken Bacon Rancher and Ciabatta Cheesesteak via the Zipline app. Fancy pizza instead? You’re in luck, because Zipline is also teaming up with Jet’s Pizza, in the Detroit metropolitan area; each P2 drone can carry up to two large Detroit-style pies. And here’s a delivery that you’ll hopefully never need: Zipline is also partnering with Memorial Hermann Health System, to move medical supplies and specialty subscriptions to patients’ homes in Greater Houston.

The Big Picture: This new wave of big partners comes as Zipline celebrates a big milestone: one million commercial, autonomous deliveries. The BVLOS-certified deliverer has a number of other meaningful brands in its stable, including Walmart, GNC, and the Cleveland Clinic, not to mention its long standing work moving medical necessities in developing countries. One million deliveries means some true, meaningful benefits to people the world over: 140,2455 blood transfusions, 15,546,782 vaccine doses, 16,825 grocery orders, 46,038 textbooks, with even more on the way.

CHART TIME | 3PD’s Positive Points

New data from DoorDash and Technomic — “Growing Off-Premise Profitability” — shows why restaurateurs turn to third party delivery, and what techniques operators can use to boost their profitability. Of those surveyed, a whopping 87% said 3PD has increased their profitability and most merchants on DoorDash saw a 30% or greater increase in revenue after their first year on the marketplace.

LOGISTICS | DutchX To Handle Logistics for DeliverZero

Reusable packaging innovator DeliverZero is turning to zero-emissions delivery player DutchX, as it looks to green up its logistics. Starting in NYC, DutchX’s electric bikes and quadcycles will bring reusable food containers to corporate clients around Manhattan; DutchX will also handle reverse logistics, picking up empty containers and returning them to DeliverZero’s sanitation centers.

The Big Picture: Both companies have been on a roll lately: DeliverZero broughts its partnership with Uber Eats to the West Coast a few weeks back at Curbivore, and is now ramping up its involvement with DoorDash as well. DutchX is making a big push into reverse logistics, and is also beefing up its executive suite. The company recently welcomed Peter Lee on as VP of Corporate Development; Peter previously co-founded Urb-E / Llama, which makes the innovative cargo e-bikes that DutchX uses, alongside its other hardware partners like quadcycle-maker Fernhay.

A Few Good Links

Getir rumored to be exiting UK, Germany and Netherlands (given that half of Istanbul is in Europe, it definitely feels a bit racist that half the headlines read that the company is “exiting Europe.”) Waymo starts testing robotaxis in Atlanta. Chipotle raises prices but fans don’t mind. Meanwhile the burrito pusher is heading to Kuwait, its first new market in a decade. Speaking of the Gulf nation, Deliveroo’s local operations recently added Joe & The Juice, Al-Khaldiya Co-op market, and new Ramadan-themed desserts. Shared e-biking overtakes pedaling in Britain. Olo partners with Sparkfly. Why Domino’s ended its 30 minutes or better guarantee. Wireless EV charging via highway project moves ahead. Papa John’s pushes franchisees to open more units via reduced ad contribution obligations. How Schneider National is dealing with the Baltimore bridge collapse. Port of LA cargo up 19% YoY. Ecommerce fulfiller ShipBob eyeing year-end IPO at $4B. TikTok ban would hurt 7M U.S. small biz. Heineken and streetwear retailer Bodega debut “boring phone.” Shein teams up with Flexport. Marco’s Pizza launches new “But wait, there’s Marco’s” ad campaign. Kroger announces it’ll divest 166 add’l stores; former FTC chair voices concerns about lawsuit. USPS struggles with reliability amidst facility consolidation.

Got a tip, feedback, or just want to say hi? Reply back to this email.