ChowNow Founder Chris Webb's Got More Acquisitions in Mind

McDonald's goes green, Fisker for gig workers, Wolt's reco algo

Let’s kick the week off with something big: an exclusive new interview with ChowNow’s Co-Founder & Chairman Chris Webb, who’s got plenty on his mind after the company’s recent acquisition of POS platform Cuboh. Then read on for two new ways restaurant delivery vehicles are going green, plus insights into Wolt’s algorithm.

Today:

ChowNow’s Chris Webb Talks Acquisitions & First-Party Ordering

McDonald’s Big Green Delivery Truck

Chart Time | Why’d You Recommend That Restaurant?

Leftover Fiskers May Power Delivery Near You

INTERVIEW | ChowNow’s Chris Webb Sees a Bright Future for First Party Ordering

Jonah Bliss: Chris, thanks for taking the time. Why don’t you start by catching us up on what ChowNow has been up to these past few crazy years?

Chris Webb: We’ve been busy helping our restaurant clients adjust to life post pandemic. The average person orders more takeout due to habits that were formed during Covid, at the same time restaurants continue to be challenged when it comes to limited staffing and increased payroll costs. This has resulted in restaurants asking us to automate and integrate our platform into all areas of their operations to make life easier for them. POS, delivery and marketing integrations have been a focus of ours recently.

In addition to all our various integrations, we’ve seen our marketplace – the ChowNow app – continue to grow nicely. The big delivery apps have become very expensive for both restaurants and consumers, so people seem to like our alternative model, which doesn’t charge restaurants commissions and offers lower, in-store menu prices to diners. Word is getting out and we’re seeing more and more diners download and use our app.

In March, you acquired POS integrator Cuboh. What can you tell us about that deal – how did it come together, what’s the transition been like for the teams, what does it mean for customers?

I’ve known the Cuboh founders for years, so when we decided to double down on POS integrations they were our first call. The deal closed just over two months ago, and so far so good.

We’re building ChowNow to be the only platform restaurants need to manage their entire off-premise business. Cuboh helps us get there faster. First off they bring us direct integrations into 14 different POS systems. We’ve now checked off the POS integrations box, which is really great for us and our restaurant clients. Secondly, with Cuboh our clients can now manage all their various ordering channels - DoorDash, Uber, etc - from ChowNow. It makes life much easier for our clients and the feedback has been very positive.

ChowNow’s been in the game since 2011; what’s changed since you started? And how would you describe the company and its offering today versus that of 13 years ago?

When we launched ChowNow over a decade ago we pioneered direct ordering (aka first party ordering) at independent restaurants. The only other option for restaurants wanting to get online back then was to join a marketplace like Grubhub and pay their high commissions. Since then a number of companies, both large and small, have copied our approach and ideas, but we’re still the marketing leader at what we do. We’ve added a lot to our platform over the past decade. Now, you can manage the restaurant’s demand channels, diner engagement, communications, delivery providers, and marketing campaigns, which you couldn’t do when we first launched. The ChowNow app, our commission-free marketplace, was also launched a few years ago and continues to expand.

What’s your relationship like these days with the big third party delivery platforms?

Overall we have a good relationship with the big delivery platforms. I continue to think their marketplaces are too expensive for both restaurants and diners and that they should share the diner information with the restaurant, but I’ve been less vocal about it recently. We realize their courier networks are valuable for restaurants and so being friendly is beneficial to everyone involved.

On that note, how are things with ChowNow Marketplace? What sort of volume does that drive for participating restaurants?

Given that our marketplace, the ChowNow app, only launched a few years ago we are very pleased with its scale and growth today. Our marketplace alone will process $150 million in commission-free orders this year. It really is the best option for both restaurants and diners.

Any clues as to what we can expect to see next out of ChowNow?

We’re actively investing in sales and marketing right now, so hopefully you’ll see ChowNow at more locations across the country in the coming months. On the product front, our focus at the moment is fully integrating Cuboh into our platform.

Lastly, where do you see the industry evolving in the next few years? How do we make it work more sustainably for all parties involved?

I expect the consolidation we’re seeing in the industry to continue and in the next couple of years we’ll be left with a handful of large players. Cuboh was our first acquisition, but likely not our last.

EVs | McDonald’s Debuts Electric Delivery Truck

McDonald’s Australia — known as “Macca’s” in the local parlance — is complementing its classic red and yellow livery with something very green: electric delivery trucks. The hamburger giant is teaming up with Martin Brower, its long-term supply chain partner, to launch its first electric delivery vehicle in New South Wales. McD’s has selected a Volvo FL refrigerated truck, with 143 miles of range and 10k+ lb capacity, to replenish restaurants in the Sydney region. While the trial starts with just one vehicle, lessons learned will inform purchasing decisions as soon as next year, with McDonald’s looking to cut emissions by 50% in 2030.

The Big Picture: We’ve seen plenty of brands dip their toes into electrifying their delivery fleets, but usually they’re big logistics players — Amazon and its Rivians, for example — not restaurant groups. Given that Martin Brower drives nearly 100,000 miles per week to drop off buns and special sauce, the environmental implications are huge, especially if McDonald’s likes what it sees and scales the concept to its ~42,000 stores worldwide. Now we’ll just need the Government of Australia to shut down those coal power plants to really make this solution shine.

CHART TIME | How Wolt Recommends Restaurants

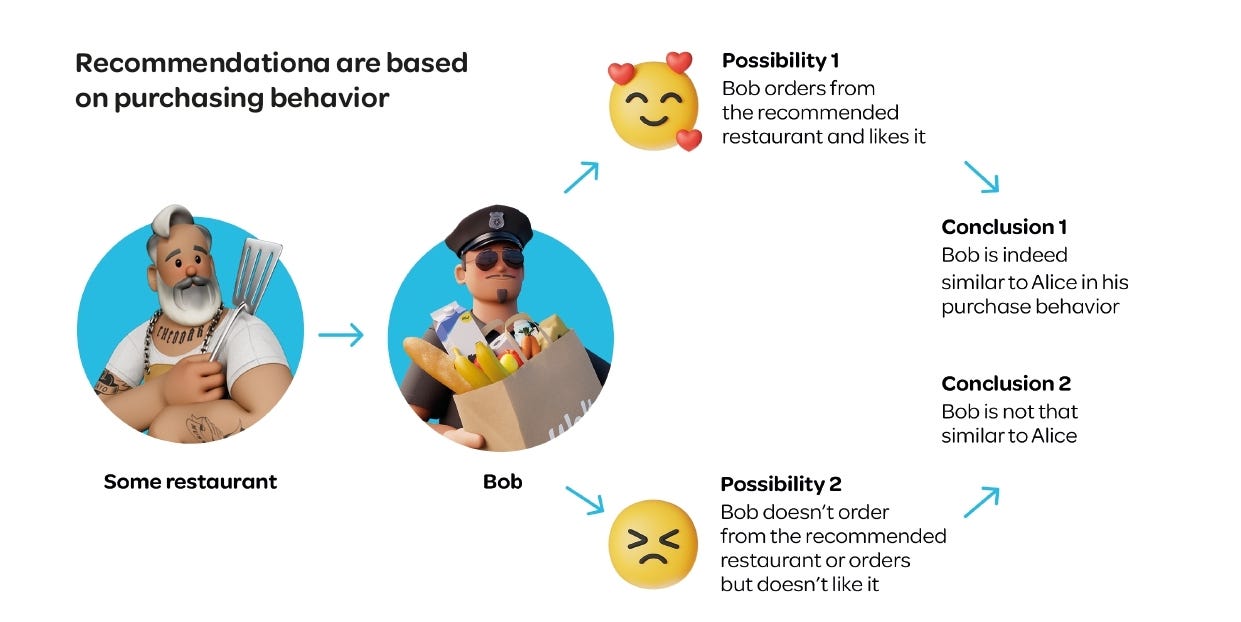

Want to go behind the scenes on how a 3PD’s algorithms work? DoorDash-owned Wolt recently released a transparency report, and now they’ve shared additional insights into how it decides which restaurants to recommend to hungry patrons. One method is to find customers with similar tastes, and recommend something new to Customer 1 that Customer 2 also liked. Other factors are overall popularity, customer ratings, and the ratio of a partner’s visibility to its sales figures.

FLEETS | Fisker Remains May Head to American Lease

Bankrupt EV upstart Fisker has a new plan to pay off some creditors, and it could mean that your next delivery order looks a little different: the Manhattan Beach-based company is reportedly looking to sell off its remaining fleet of 4,300 Fisker Ocean electric SUVs to American Lease, an NYC-based provider of leased and rental cars for gig workers. Those SUVs used to be worth as much as $61,499, but aggressive discounting brought its entry level model down to a tight $37.5k, plus incentives, meaning the company’s still going to fall short on its approximately $850M in debt obligations.

The Big Picture: On one hand, a Fisker Ocean sounds like a great vehicle choice for a delivery or rideshare worker: its 360 mile range is longer than any competitors in its segment, EVs in general sport low maintenance + fueling costs, and tight vehicle dimensions make it fairly adept for urban use cases (a contemporary Toyota Camry is actually 5 inches longer.) But the Ocean has been plagued by quality concerns — key fobs not working, power and braking issues, glitchy sensors — and that was BEFORE the company went under. We’ve seen from the Hertz + Tesla debacle that gig workers don’t exactly treat EVs with white gloves, so how are they going to handle an even less familiar vehicle, with even less of a corporate backstop to fix things when they break? American Lease also doesn’t seem like the sort of company that’s going to bend over backwards to make things work — witness its 1.4 stars on Yelp — the entire industry of offering vehicles to gig workers tends to rely on charging as much for one week with a car as a normal customer would expect to pay over a month.

A Few Good Links

Ghost Kitchen Brands metamorphosizes into Ghost Kitchens International, plans EU push. NYC considers new bill that would allow restaurants to opt in to 3PD commissions as high as 43% (current cap is 23%.) GoPuff launches McConnell’s ice cream colab. Singapore’s Shopee slows down its now not-so-instant delivery biz. UPS sells Coyote to RXO. Pizza Hut Japan debuts burger pizzas (they look way cooler than the one Papa John’s launched a few weeks back.) Hyundai previews new tech for automating EV charging, moving parked cars and delivering meals in-office. Shopify merchants can now appear on Target’s site. Target opens next-gen DC in GA. Connected TV ads deliver results for Carl’s Jr. Segway pushes new model for micromobility operators. City fees and taxes may be dissuading LEV usage.

Got a tip, feedback, or just want to say hi? Reply back to this email.