2024 may feel like a distant dream at this point, but we’re still getting constant reminders of the past thanks to a slew of new financial reports. Today’s we’ll break down the performance of Instacart, Grab, and Just Eat Takeaway.com; plus DoorDash has some hot new data on two-wheeled deliveries, and a tip-related settlement in NY State.

This week’s edition is brought to you by Gridwise.

Today:

lnstacart Adds 11% in 2024

DoorDash in Tip Trouble

Chart Time | Two Wheelers Take Off

Grab & JET’s Very Different 2024s

FINANCE | Instacart Growth Slows to 11% in 2024

Instacart released its 2024 financial results, with GTV up 10% to $33.4 billion and orders up 9% to 294 million. Revenue climbed 11% to $3.378 billion, while GAAP net income hit $457M. Advertising grew 10% to $958 million — soooo close to breaking a billion! — and delivered 15% sales lift for advertisers, while new ad products like sponsored recipes pushed 35% new-to-brand sales.

The Big Picture: Despite adding 1,400 new retailers, including beauty giant Ulta, and launching an Express Delivery product with Kroger, Instacart’s growth slowed considerably, down from 11% the year prior. The number of orders grew, likely influenced by Instacart+ lowering the free-delivery threshold, pushing customers to order more often but with smaller baskets. Still, with Uber Eats growing GBV 15% and DoorDash doing 21%, it’s clear Instacart needs to rethink its strategy if it wants to get back to hyper-growth mode. On the easier side would be an international expansion (maybe Australia, where it’s started shipping its shopping carts?) or perhaps something more ambitious like merging with Lyft.

PARTNER | Ride Share and On-Demand Deliveries Changing, Here’s What You Need To Know

Ride Share and On-Demand Deliveries Changing, Here’s What You Need To Know

The rideshare and on-demand delivery landscape is evolving rapidly—with rising costs, shifting consumer behavior, and a surge in retail and grocery delivery redefining how people and goods move. The 2025 Gridwise Annual Gig Mobility Report reveals key insights for restaurants, grocery stores, retailers, mobility firms, and investors.

Rising Costs & Consumer Behavior: Rideshare fares are up 7.2%, and 72.3% of consumers may cut back if prices keep rising.

Delivery Demand Surge: DoorDash retail deliveries up 34.1%, Uber Eats up 46.6%, and Macy’s retail deliveries skyrocketed by 4,500%.

Driver Earnings Under Pressure: Uber drivers are down 4% at $23.33/hr, and Lyft drivers are down 6% at $23.23/hr.

The Gig Mobility industry is at a turning point.

Get the full report now and discover what’s next for on-demand delivery and rideshare.

LEGAL | DoorDash Repays Workers $16.8M in Tips

DoorDash reached an agreement with the New York attorney general’s office, with the 3PD agreeing to pay $16.8 million in restitution to its couriers. Spread across 63,000 gig workers, that works out to about $1,200 per person, but some Dashers will receive as much as $14k. This settles claims against the deliverer for its prior tipping policy, ended in 2019, whereby DoorDash guaranteed minimum payment for workers, but could use generous customer tips to offset its own contributions. New Yorkers placed 11 million orders while the old tip policy was in place.

The Big Picture: This isn’t DoorDash’s first settlement related to its prior tipping practice; it paid out $11.25 million in Illinois late last year and $2.5M in D.C. back in 2020. While the old tipping system is no longer in use anywhere in the country, DoorDash’s compensation system in NYC has gone through especially large changes, as the city’s hotly-contested new law requires that couriers make $19.56 per hour, plus tips, while making deliveries. That rate will jump to $21.44 on April 1st.

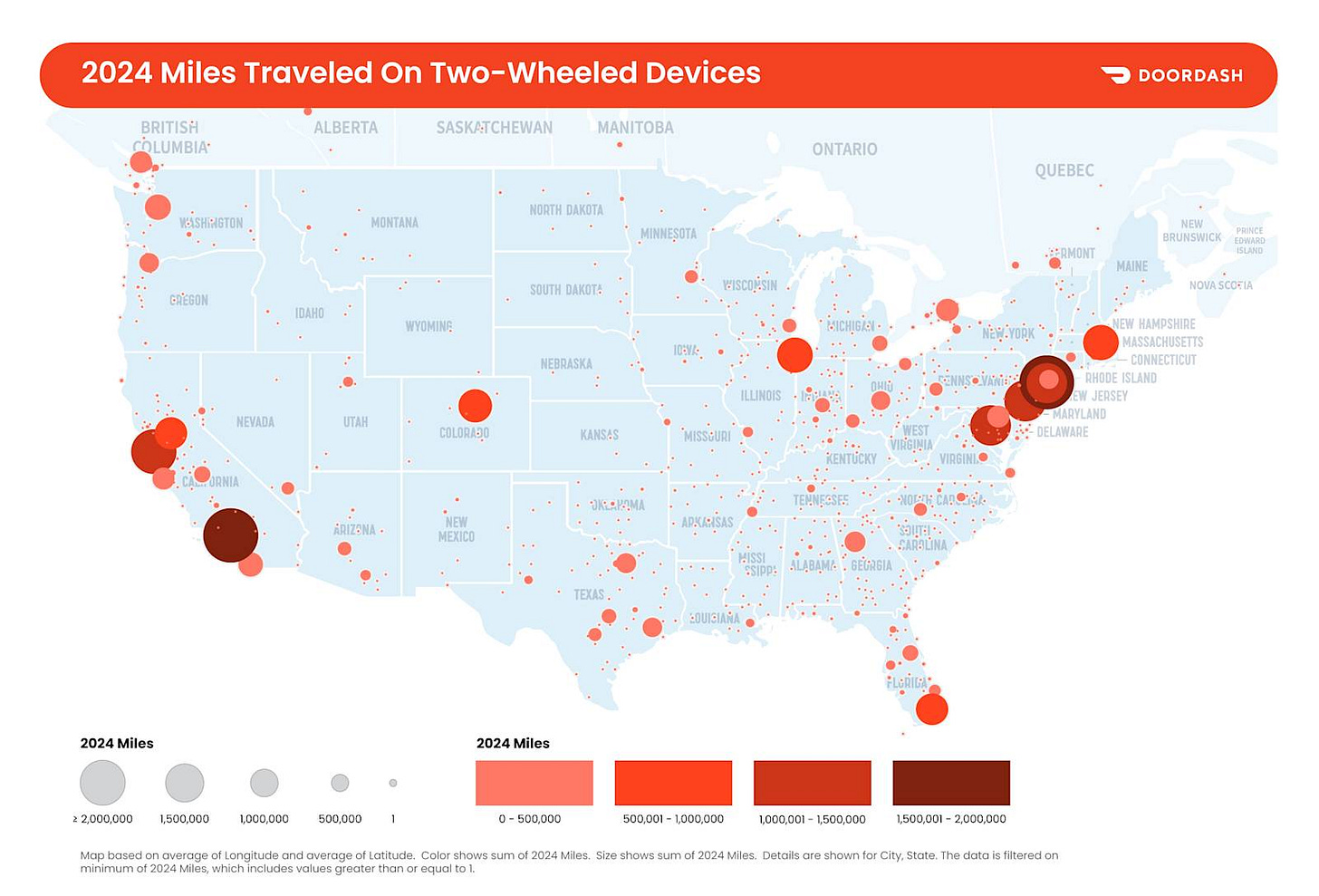

CHART TIME | Two-Wheeled Deliveries Take Off

DoorDash has a new report out, charting the surge in two-wheeled deliveries: think bicycles, scooters, mopeds, motorcycles and e-bikes. Two-wheeler usage has trebled across the U.S. and Canada since 2022, saving tens of millions of gallons of gasoline. NYC, LA, SF and San Jose all saw over one-million miles of two-wheeler delivery travel, while the share of deliveries taking place on these sustainable vehicles exceeded 50% in SF, NYC, DC and a handful of Bay Area suburbs.

FINANCE | Grab & Just Eat Takeaway Show International Divergence

International 3PDs are also posting their 2024 results, and seeing very different performances. Grab saw its overall GMV climb 16% to 18.364 billion, while revenue was up 21% to $2.797B, resulting in an operating loss of $168 million. (But it did eke out an $11 million profit in Q4!) Looking at just deliveries, which outweigh mobility at the company, GMV grew 13% in Q4, to $3.2B, while revenue climbed 14% to $407 million. Things looked a bit bleaker at Just Eat Takeaway.com, where total orders shrunk 5% to 879 million, GTV fell 1% to 26.3 billion euros ($27.6B USD) and revenue fell 1% to 5.085B euros. The company managed to trim its loss to €1.645B, down from €1.846B in ‘23, by cutting marketing and operational expenses.

The Big Picture: This is really a story of geography, with growing Grab concentrated in Singapore, Malaysia, Cambodia, Indonesia, Myanmar, the Philippines, Thailand, and Vietnam. Just Eat Takeaway.com instead sprawls across North America (although Wonder now owns its U.S. holdings), the U.K. and Ireland, Northern Europe, plus Southern Europe and Australia. Amongst that motley crew, performance was quite varied, with GTV up 7% in the U.K / Ireland, up 4% in Northern Europe, down 9% in North America and off 11% in Southern Europe and Australia. Best of luck to JET’s new owner Prosus as it creates a “European tech champion.”

A Few Good Links

NYC DOT Freight Mobility Unit seeks summer intern or college aide. Grubhub celebrates 20 years of community giving. Cava’s same store sales soar 21.2%. Werner tests side-view cameras. ILA ratifies six year contract. 65% of consumers live paycheck to paycheck. Not so grand slam… Denny’s adds egg surcharge. SoundHound AI adds omnichannel ordering. Taco Bell debuts Caliente Cantina Chicken. Chipotle premieres short film on Roblox. Lucid shipped 9,029 cars last year. Upfitter Shyft announces collab with Isuzu. Deliveroo asks UK gov to protect delivery workers. Hudjo launches courier-oriented bike parking across London. Meet Common Good strategies. Alexa+ can order your groceries.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.