Delivery's Expensive Ups & Downs in Canada, India, France and UK

DoorDash + Walmart, Just Eat Takeaway delists, FTC probes Uber One, Zepto & Zomato raise funds

Thanksgiving may be a very American holiday, but at this point Cyber Monday is a worldwide phenomenon. But before we get into those juicy sales stats, we’ve got all sorts of other big news from across the globe: DoorDash partnering with Walmart Canada, JET jettisoning its French operations and British listing, Uber in trouble with the FTC and a very expensive battle in India. Let’s dig into it!

This week’s edition is brought to you by Curbivore 2025’s 2-for-1 Cyber Week sale. Register now for just $97 per ticket!

Today:

DoorDash Scores Walmart Canada

Just Eat Takeaway Exits France, London Stock Exchange

Chart Time | Uber One in Trouble with FTC

Swiggy, Zepto & Zomato Add Funds, Keep Launches Coming

3PD | DoorDash Partners with Walmart Canada

DoorDash has a huge new partnership in Canada, teaming up with shopping giant Walmart at more than 300 Supercenter (Or “supercentre” as they would say in Canadian English) locations across all 10 provinces: Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Quebec and Saskatchewan. While this represents about 75% of the Walmart Supercenters nationwide, they match up with roughly 80% of DoorDash’s Canadian customer footprint.

The Big Picture: Walmart Canada is really flirting with all the 3PD players… back in 2022 it kicked off a 30-minute delivery service dubbed Walmart Now with Instacart; a year later it teamed up with Just Eat Takeaway’s SkipTheDishes on a dark store pilot in Western Canada. DD has been on a roll up in the Great White North, having just onboarded new retail partners like Michaels and Spirit Halloween, as well as hot restaurants from the Gusto 54 group. On the operational side, the 3PD recently added a $0.99-2.99 CAD regulatory response fee in British Columbia.

CYBER WEEK SALE | 2-for-1 Curbivore Tickets — Just $97 Each!

We’ve got a special Cyber Week sale of our own, offering two Super Early Bird tickets to Curbivore for the price of one! Join the world of delivery, mobility, restaurant/retail-tech and the curb’s movers and shakers this April 10th and 11th and bring a friend — meaning each ticket works out to just $97.

OPERATIONS | Just Eat Takeaway Bids Adieu to France, LSE

Just Eat Takeway.com continues to shrink its footprint, both operationally and financially. On the delivery side, the 3PD has confirmed its intentions to cease operations in France, winding down by December 9th. On the purely financial side of things, the Dutch-headquartered company is delisting from the London Stock Exchange, “in order to reduce the administrative burden, complexity and costs associated with the disclosure and regulatory requirements of maintaining the LSE listing, and in the context of low liquidity and trading volumes of the Shares on the LSE,” effective December 24th.

The Big Picture: The French exit (frexit?) is no great surprise, coming after a perfunctory consultation period that caps off a move first announced at the beginning of the year. France had proven to be so minor a market for the 3PD that the wind down will only impact about 100 jobs. The delisting is a bigger deal; paired with the sell-off of Grubhub to Wonder, it marks the end of JET’s global ambitions. The company killed off its Nasdaq listing in early 2022, despite that still being a go-go era for money losing tech cos, and in December ‘22 downgraded its LSE listing from Premium to Standard, in a bit that should have lowered its compliance costs. When the British delisting is complete, Just Eat will float solely on the Amsterdam Euronext exchange, where its stock has been trending upwards the past few days.

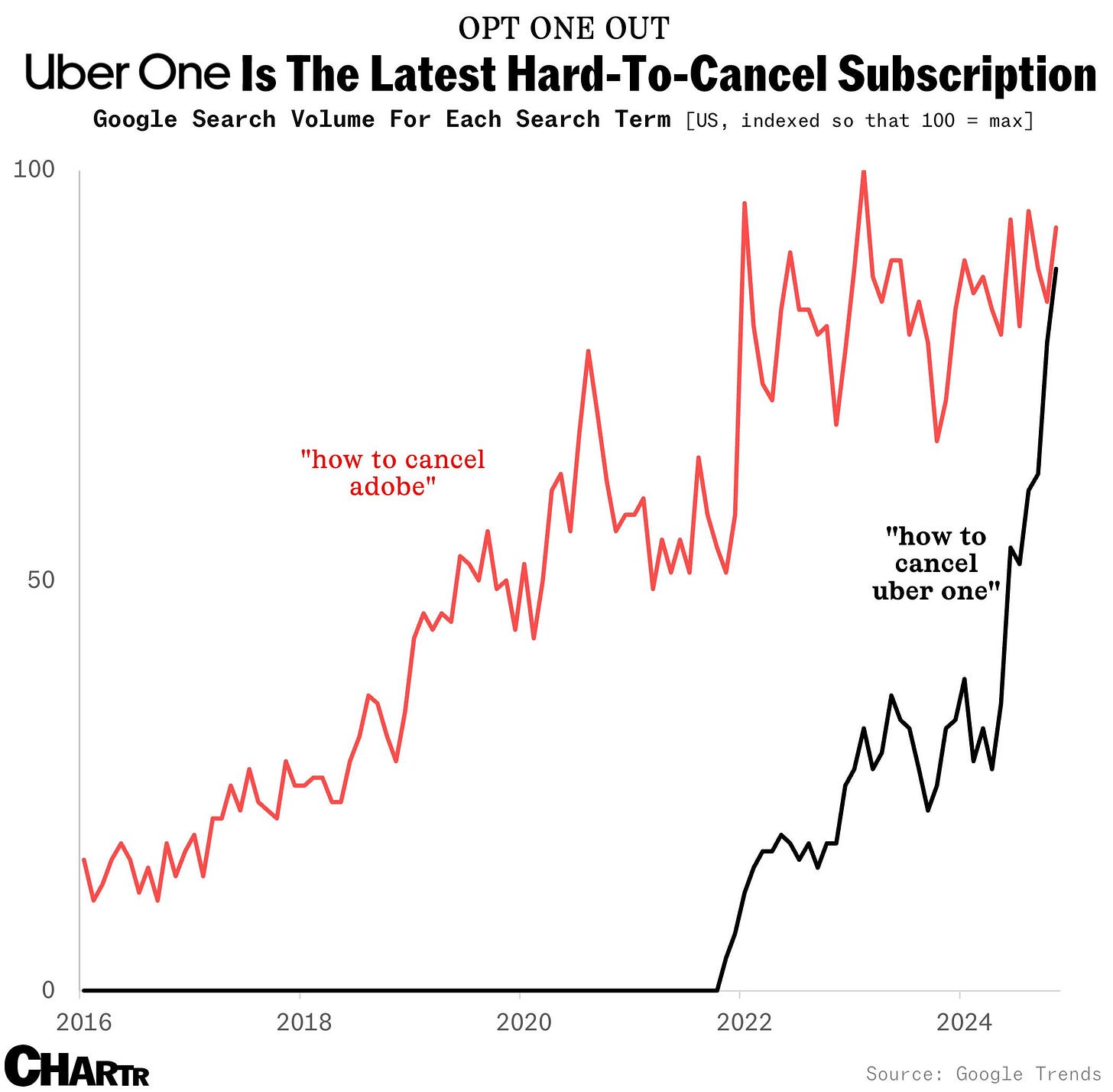

CHART TIME | Feds Look to Cancel Uber One’s Cancellation Issues

The US Federal Trade Commission is looking into whether Uber’s premium membership tier, Uber One, violates consumer protection laws. The FTC’s “click-to-cancel” rule means companies must make it easy to unenroll from recurring programs; a Chartr analysis of Google Trends suggests Uber might have missed the mark.

FINANCE | Zepto, Swiggy & Zomato Battle for India

India’s booming instant-delivery market continues to soak up big dollars, as each major player restocks its war chest. Zomato just raised $1 billion from institutional investors, its first big fundraising event since its 2021 IPO. Not to be outdone, Zepto pulled in $350 million in new funding at a $5 billion valuation, its third round of private financing in half a year. And Swiggy is looking to stay one step ahead: expanding its 10-minute delivery service — Bolt — to 400+ locales, partnering with chains like KFC, Starbucks and McDonald’s.

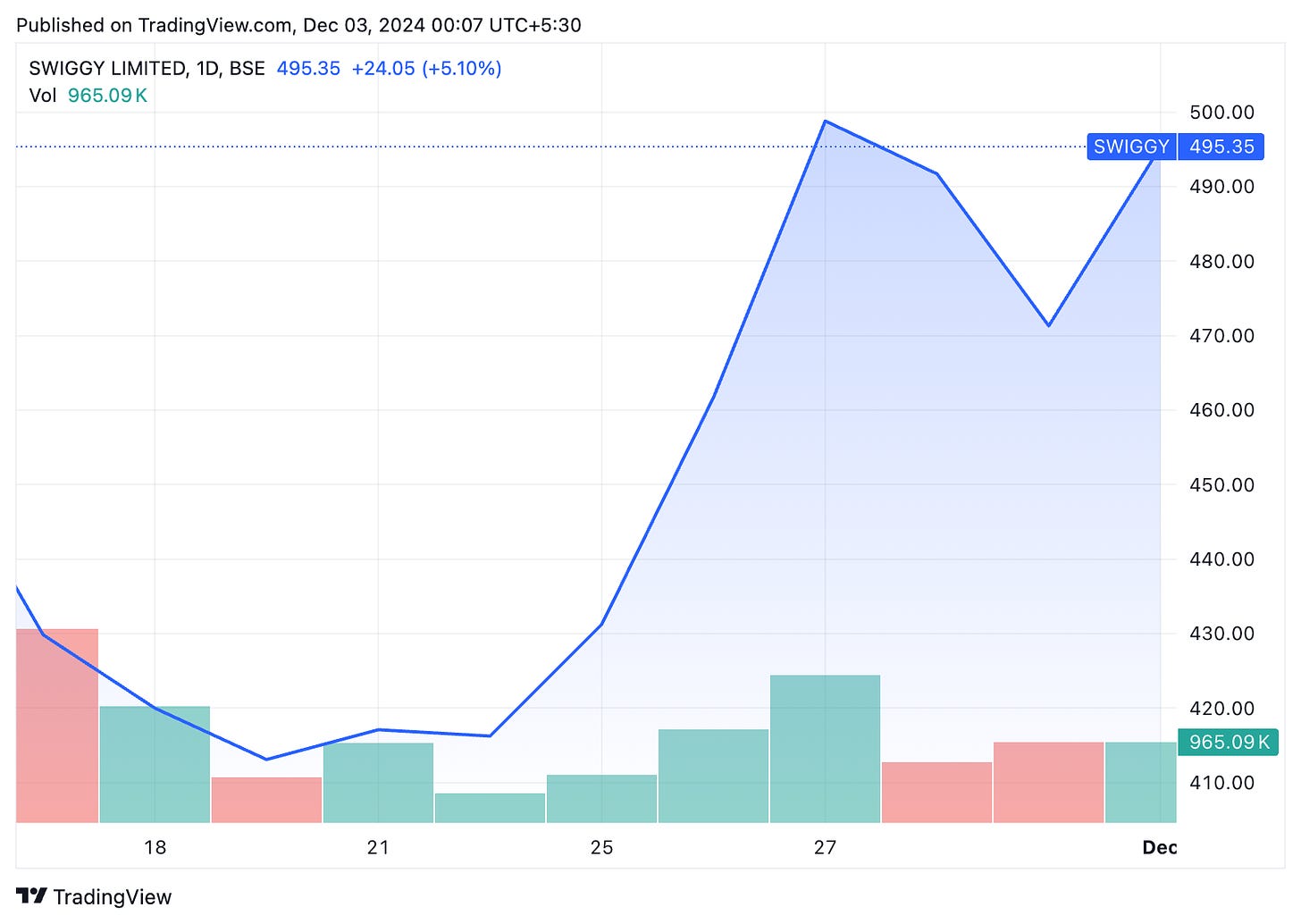

The Big Picture: This level of competition may seem unfathomable to Western audiences, but the Indian market seems to be the one place where q-commerce works: Swiggy’s stock has continued to rise since its hotly watched November IPO. Indian investors large and small continue to jump into the sector, with Zomato’s latest raise mostly backed by local mutual funds; pushing foreign ownership below 50% allows the company to more closely control its inventory and warehouse management practices. Zepto’s new funds also come largely from Indian investors, as the still private startup looks to broaden its investor base in the run up to an IPO.

A Few Good Links

LA county mulls delivery fee cap change for unincorporated areas, replacing 20% cap with 15% + extras for marketing and other services; DRA opposes the change. Cyber Weekend sales rise 9%, with discounts falling 2%. Black Friday sales top $10.8 billion. Shoppable TV ads drive Amazon sales, after Q2 rollout. Yandex launches Lavka instant-delivery service in Uzbekistan. E-commerce growth powers air cargo expansion. TuSimple co-founder petitions for liquidation. Walmart rolls back DEI program in face of conservative pressure. Uber starts new gig marketplace for AI data labelers. Judge orders Empower to shut down DC ridehailing service. Swiggy adds restaurant support programs. Urban Sharing finds second lives for retired bike fleets. Kroger previews holiday savings. Kroger and Albertsons sued over no-poach agreements. WeGotGroceries launches, aiming for online health food market. Whole Foods hopes to make small format markets work. Zeekr EV sales up 106% YoY. Instacart and Danone donate food. Circle-K wants to eat QSRs’ lunch. Q3 winners and losers. Subway loses CEO. Restaurant liquidation grows. Trump’s Labor Secretary nom deemed relatively pro-union. H-E-B, Wegmans and Trader Joe’s named most trusted grocers. Deliveroo partners with Accessorize. Blue Yonder ransomware attack dings retailers. Bolt offers zero emissions update. Wolt offers courier insights.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.