Domino's Never Closes

Elon's Cybercab disappoints market, Wolt turns 10, looking for international growth opportunities

Where oh where can a hungry 3PD still find growth these days? We sleuth out some opportunities below. But first, Domino’s drops a hot Q3, Tesla’s autonomous vehicle reveal leaves more questions than answers and Wolt celebrates a big 10th birthday.

As a reminder, this newsletter will be off on Monday for the holiday, returning Wednesday.

PS — Don’t forget to join us next Thursday in Culver City for our LA TechWeek Mobility & Delivery Happy Hour. Ready your best pitch deck and RSVP Now.

Today:

Domino’s Tops 21,000 Locations

Tesla’s Robotic Reveal

Chart Time | Wolt Turns Ten

International Growth Hunt

PIZZA | Domino’s Growth Slows to 3%

Pizza heavyweight Domino’s released its third quarter financial results, with global retail sales up 5.1% YoY, income from operations rising 5%, int’l same store sales up a slim 0.8%, and U.S. same store sales up 3%. While that came in a bit below investors’ expectations, the market seems to be digesting the news a bit better today, with the stock up over 5%. Although CEO Russell Weiner worries that price conscious shoppers have pushed the industry into “the pizza wars right now,” that may still be a battle DPZ can win: it’s recent partnership with Uber seems to be paying dividends, with the 3PD now accounting for 2.7% of overall sales. Weiner thinks that if Domino’s can expand to all the aggregators, it can end up pulling in $1 billion from the channel.

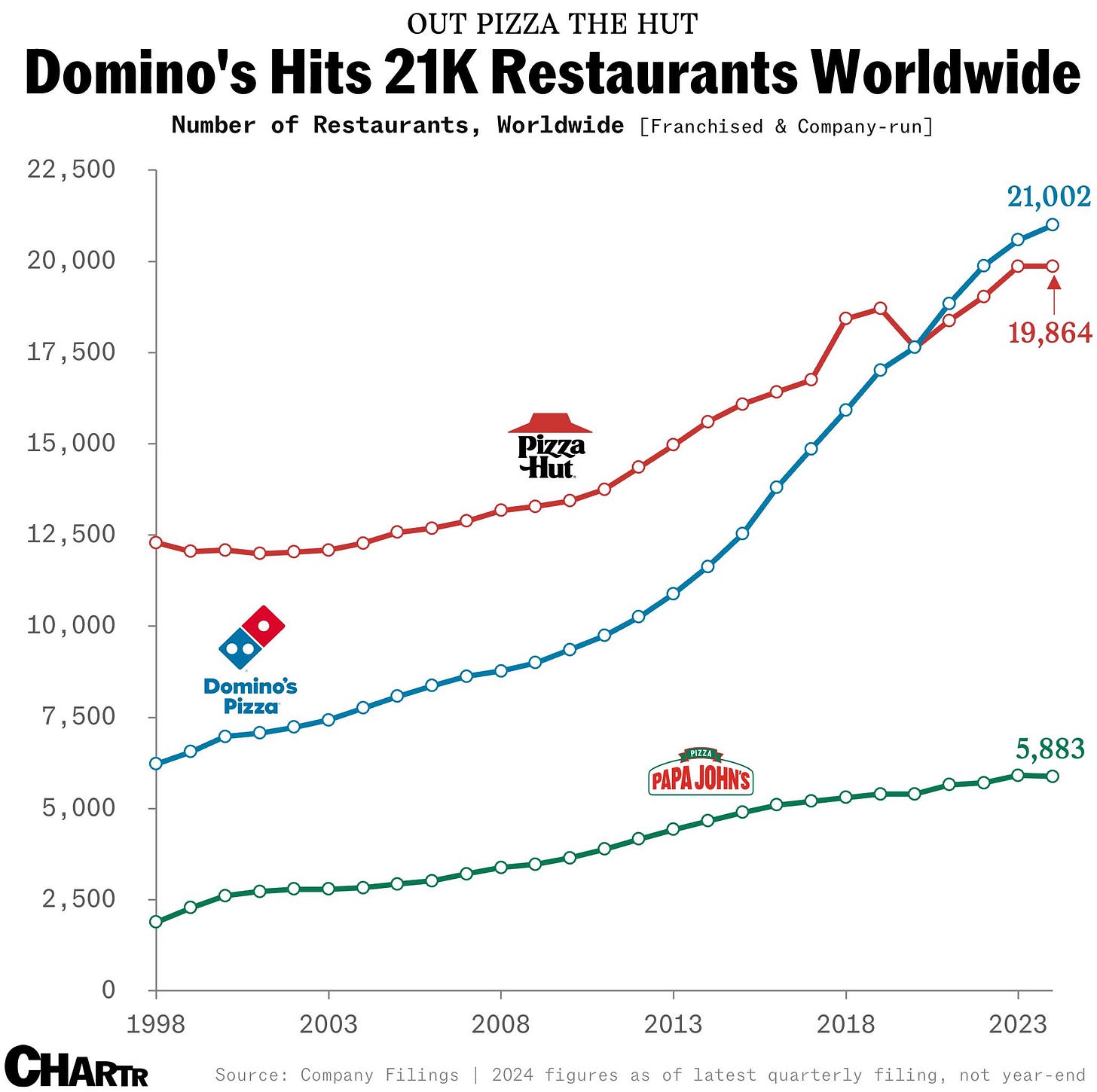

The Big Picture: Domino’s sold $4.392 billion of pizza worldwide in the quarter, coming from a whopping 21,002 stores across the globe. The company has opened 805 new locations in the past four quarters, as part of its ambitious “Hungry for More” growth plan. What’s particularly impressive, and unique, is that while Domino’s opened 24 new stores in the U.S. this quarter, it didn’t shutter a single restaurant. In fact over the past year it’s only lost 10 locations; its competitors typically churn through old storefronts at a much faster rate. No wonder Domino’s seems to have finally out-pizzaed the hut.

AUTONOMY | Tesla’s We, Robot Disappoints Investors

Last night, Elon Musk and Co. razzle-dazzled the world with its “We, Robot” event at the WB studio lot in Burbank, CA. The company showed off 20 of its two-seater Cybercabs, teased a higher capacity Robovan and distracted fans with drink-pouring Optimus robots. While Musk did tease the optimistic price of less than $30k to buy a cab, and operating costs below 20 cents per mile, other details were spare, including when exactly the vehicles will go into production.

The Big Picture: Musk has been teasing robotaxis for years now, calling it a key part of Tesla’s business plan. But the timeline keeps getting pushed back, as even this event was originally scheduled for August. While Musk painted a picture of a world without traffic and parking lots (never mind that we’ve seen time and time again that lowering the costs of driving just increases car usage) he didn’t share any specifics about how the technology would stand up to the increased regulatory scrutiny that comes when a driver is no longer supervising the vehicle. He also didn’t get into the specifics of how Tesla would operate its Uber or Waymo-like business. While Tesla bull Cathie Wood of Ark Invest said pre-event that she thought robotaxis would take the stock up 10X to $2,600 per share, investors today seem to have the opposite sentiment, with shares off about 8% for the day.

CHART TIME | Wolt Celebrates 10 Years of Delivery

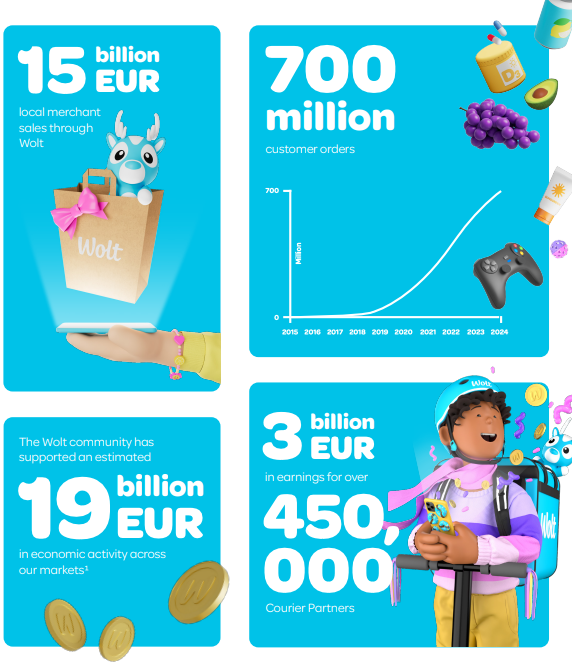

Helsinki-based Wolt is celebrating a decade of food delivery, in which time it’s marched to dominance in markets like Sweden, Germany and Japan. Since combining forces with DoorDash in 2022, the company has grown to cover 28 countries, has handled a whopping 700 million orders and now boasts over 12,000 employees.

OPERATIONS | Which International Markets Still Present Opportunities?

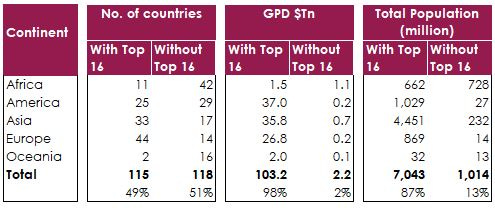

As food delivery matures, the pool of potential new growth markets starts to shrink. A new analysis of the top 16 3PDs — Bolt Food, Coupang Eats, Deliveroo, Delivery Hero, Door Dash, Ele.me, Gojek, Grab, iFood, Just Eat Takeaway, Meituan, Rappi, Swiggy, Uber Eats, Yandex, Zomato — shows that at least one of those giants operates in 115 countries worldwide. While that’s only about half the total *number* of nations worldwide, it represents 87% of the global population and a whopping 98% of worldwide GDP.

The Big Picture: It goes without saying that different countries have different potential; the Vatican may not be as juicy a prize as the United States, no matter how many communion wafers the Pope craves. The biggest potential looks to be in the Caribbean, where incomes are relatively robust by global standards, there’s familiarity with global brands thanks to high levels of tourism and operations wouldn’t be too hard to support due to ample flights to the U.S. While Rappi and Glovo have made inroads into a few markets, many of those islands are only covered by local players like 7Krave and Quickee. There’s definitely a decent-sized opportunity there, but if you look to other markets like Southeast Asia, where Gojek, Grab and Yip In Tsoi’s Robinhood have been fighting to a draw, you’ll see that there are no easy land grabs in the world of food delivery.

A Few Good Links

Ex-Amazon and Flexport leader Dave Clark launches new supply chain software startup. Lyft changes payments algorithm to ensure drivers get comped for traffic delays. Restaurant employment up by 69,400 in Sept. Starship launches at U of Minnesota. Uber launches new features for disabled riders. 7-Eleven closing 444 stores as parent co. goes through strategic review. Darden buys Chuy’s. Gopuff launches hurricane relief effort. SevenRooms adds text marketing. Lightspeed integrates with 7shifts. Dollar Fulfillment expands in Vegas. Shipt included in “Indeed’s 2024 Work Wellbeing 100.” Talking EV charging with Kameale C. Terry.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.