DoorDash Orders Climb 19% off New Partnerships, Products

Just Eat Takeaway improves margins, NYC hits 8k battery swaps, automaker sales split

With the market taking a real swan dive this morning, we’re going to focus today’s edition on some big financial updates, with DoorDash, Just Eat Takeaway and automakers all reporting rather divergent results. And since we’re still on a limited summer publishing schedule, let’s throw in one different piece — progress on NYC delivery ebike battery safety — for you policy heads.

Today’s edition is brought to you by ChowNow.

Today:

DoorDash Revenue Rises 23%

Just Eat Takeaway.com GTV Up 3%

Chart Time | Auto Revenue Revs Up for Some

Battery Safety Progress for NYC’s Ebike Couriers

3PD | New Features, Partnerships Drive DoorDash Growth

DoorDash just dropped its Q2 ‘24 financial results, and the SF-based 3PD is looking mighty healthy, setting new quarterly records for orders, GOV, and revenue. Total orders were up 19% YoY to 635 million, with marketplace gross order value climbing 20% to $19.7 billion. Put together, that drove revenue up 23% to $2.6 billion — marking the 10th consecutive quarter where rev growth exceeded GOV growth, meaning DD’s take rate is improving — while Adjusted EBITDA jumped from $279M to $430M. DoorDash still had a GAAP net loss including redeemable non-controlling interests of $158M, due to $85M in litigation reserves and $83M in office lease impairment expenses. Investors liked the story, with the stock now up 11% over the past five days.

The Big Picture: Company leadership was particularly excited about growth in its CPG ad business, as well as the addition of new retailers driving up order frequency. “Our goal is to drive overall order frequency up. We're not trying to drive just the restaurant order frequency up or the new vertical product frequency app. In fact, looking at the order frequency on a blended basis is not how we think about the business. It's truly a cohorted business. We are adding selection in restaurants. We are definitely adding more selection on the grocery side, as well as international,” noted CFO Ravi Inukonda. DoorDash has plenty of new initiatives in the works to keep the growth coming, including an expansion of its partnership with Chase: adding new card types to its DashPass promo, as well as adding two $10 discounts per month for those with spendier cards. On the product side, DoorDash now lets restaurateurs add lunch specials and happy hour discounts, while Project DASH just hit 100 million charitable meals delivered.

PARTNER | Switch to ChowNow and Save Big

Take orders all across the web, including your site, the ChowNow app, Google, Yelp, and 20+ popular sites. Integrate with your POS so every order runs smoothly, and take on more business with less effort. Launch your own branded apps and custom marketing campaigns to boost customer loyalty and reorders. Get it all with ChowNow, while averaging $16K a year in commissions savings.

Try it now and get one month free.

FINANCE | Just Eat Takeaway.com GTV Inches Up 3%

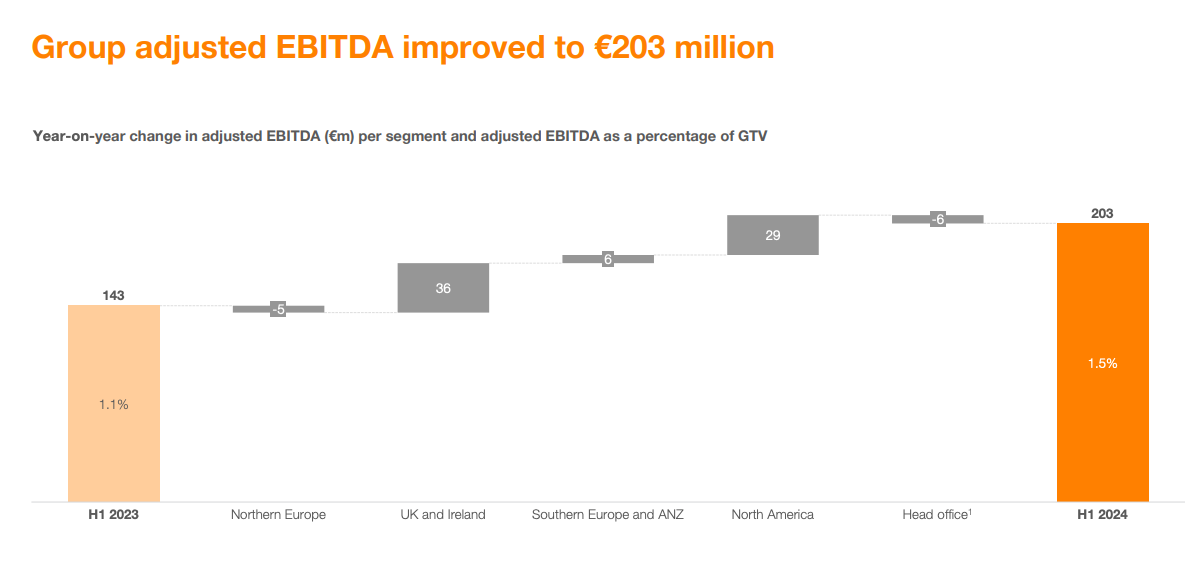

Over in Europe, Just Eat Takeaway.com put out its Half Year 2024 results, showing laudable improvements, but not DoorDash-style dominance. Gross transaction value was up 3% in constant currency, in line with the company’s earlier guidance. Revenue slipped less than 1% to €2,570 million ($2.816B) while Adjusted EBITDA climbed 42% to €203 million. Free cash flow before changes in working capital finally went positive, hitting €38 million, while the company’s net loss for the half sat at €301 million.

The Big Picture: As usual, JET’s results vary widely depending on which region you dial in on. Northern Europe looks pretty good, with GTV up 5%, although the company’s investment in new markets, wider delivery zones and more operating hours did squeeze Adjusted EBITDA compared to the year prior. UK and Ireland saw GTV grow 6%, with lower delivery costs per order and growth to the grocery biz improving margins. Southern Europe and ANZ are still a mess, with the company recently exiting France and New Zealand as it hopes to concentrate on its remaining markets down under. In North America, Grubhub continues to shed market share, with GTV falling 9% YoY, although company leadership is hopeful that its expanded partnership with Amazon, and its overdue entrance into the grocery space, will turn things around. Even without growth, the division is cutting its way towards profitability, with Adjusted EBITDA up 57% to €80 million. JET also just announced €150M in share buybacks, showing the company’s plan for its languishing stock price is awfully simple, as opposed to say investing in more growth.

CHART TIME | More Cars for Some, Not All

Automakers showed rather mixed results in Q2, with Tesla’s sales growth slowing to just 2% YoY, hitting $25.5B for the quarter. That’s better than Stellantis, which put the truck in reverse, seeing revenue drop 14% to $92 billion. EVs, fleet sales and connectivity drove stronger results for America’s big automakers, with GM rev up 7.2% to $48B and Ford up 2.9% to $47.8B.

POLICY | NYC Couriers Make 8,000 Battery Swaps in Five Months

NYC’s push to improve ebike battery safety looks to be slowly paying off, as the city’s Charge Safe, Ride Safe pilot hit 1,000 charging / swapping locations and 120 participating delivery workers. Those couriers have now swapped their UL-certified lithium-ion batteries over 8,000 times, with more than half reporting they no longer charge their bike batteries at home.

The Big Picture: New York City has over 60,000 delivery workers, so this pilot is just a drop in the bucket. Fortunately, there are other, complementary efforts afoot to get couriers onto safer and more sustainable modes. DoorDash is backing the Equitable Commute Project, which offers couriers up to 2/3s off the list price of a UL-certified ebike. At the state level, Governor Hochul recently signed a slate of bills that banned the sale of substandard li-ion batteries, while adding new requirements for user education and safety messaging.

A Few Good Links

Instacart Caper Carts come to Davis Food & Drug. Buca di Beppo files Ch. 11, closes some locations. More restaurants coming to Walmart. Veho expands in Midwest. Amazon moves up Black Friday seller deadline, misses on Q2 revenue. Mars eyes Kellanova. Contactless payments surge at Olympics. Wendy’s net income falls to $54.6M. Marco’s adds new marg pizza. Work truck upfitter Shyft to pay dividend. Toyota Mobility Foundation gives $260K to San Jose, that’s about enough to buy one traffic light. Shipt partners with Allison Holker on back-to-school promo. Seattle, Baltimore and Austin chart divergent paths for micromobility regulations. NYC MTA chief worried about system finances. Deliverect debuts Pulse. Yelp’s head of product talks AI. Used Peloton marketplace is a logistics master play. Tesla looks to build AI supercomputer. Women gig workers in India struggle. Remember Famima!!? Blackbird launches payment platform. PREP opens commercial kitchen space in Dallas. Grubhub celebrates new moms. Paris Baguette bakes up new rewards program and app. Wingstop net income up 70%. Shake Shack surges. Retailers push to lock up products is killing in-store shopping. Hacked Tesla FSD computers show how bad Autopilot really is. Aurora raises $483M. Supply chain funding freezes. Chicken Republic chooses Chowdeck. FAA to allow dueling drone operators in Dallas.

Got a tip, feedback, or just want to say hi? Reply back to this email.

— Brought to you by the Curbivore Crew.