New Pay Laws Drive NYC Courier Wages Up 56%

Delivery saves Houston, eGrocery sales slip, SNAP users choose delivery

Let’s finish the week strong with some big findings out of NYC, which may prove pivotal as more cities look to pass pay laws for food delivery workers. Then we’ve got trouble in Houston, new sales data, and a look at food stamp users’ delivery preferences.

Today’s edition is brought to you by Locale.

Today:

NYC Courier Pay Laws Proving Effective

Delivery A Lifeline in Flooded Houston

Chart Time | eGrocery Sales Slip

SNAP Users Opt for Delivery

POLICY | NYC Couriers See 56% Rise in Wages

Now that New York City’s new pay rules for food delivery workers has been in effect for about half a year, the Department of Consumer and Worker Protection has new data showing the impact it’s made to worker’s livelihoods. In Q1 2024, pay jumped to $19.26, including tips, up 56% from the prior quarter and 64% YoY. Base pay more than doubled, while tips fell 47%, in keeping with the policy’s goals. NYC delivery workers as a whole took home $28.3 million per week, a 22% increase from the previous quarter, while the number of couriers working fell 8%. Essentially, the work became more efficient, with the amount of time workers were on call falling, while time spent on working trips rose. Overall, the number of deliveries per week rose 5% to 2.77 million, showing that consumers weren’t all that sensitive to rising prices, even though their fees rose 36% in Q1.

The Big Picture: There are a lot of ways to interpret these findings, with outlets like Staten Island Live and Hell Gate trumpeting it as a win for workers: “Raising Delivery Drivers' Minimum Wage Made Them More Money, World Didn't End.” Others like Bloomberg choose to frame it as “New Yorkers See 58% Rise in Food-Delivery Fees,” with Verdict Food Services striking a similar tone. Whether you see it as a boon for labor or an albatross for orderers, the results are certainly less of a “devastating” disaster for the industry than what the 3PDs have tried to portray. Meanwhile, the delivery apps and city leaders are still fighting over a similar initiative in Seattle.

PARTNER | Locale Reinvents Food Delivery

Microwave meals have long promised huge time savings but have always been a let down when it comes to quality. Locale is rethinking this and instead of making food in a factory, partners with California's top restaurants to create microwavable versions of their dishes. Meals are produced in restaurants, then packaged in special, airtight packaging so they stay fresh for a full week in a fridge. All meals are $11. They've attracted a lot of buzz, raising $14M from Andreessen Horowitz and serving thousands of busy Bay Area professionals. Turns out their CEO is a fan of this newsletter and agreed to give our subscribers a week of free lunch to try it out.

Go to shoplocale.com and use code: MODERNDELIVERYXLOCALE50 for $50 off.

OPS | Food Delivery Proves to Be a Lifeline in Houston

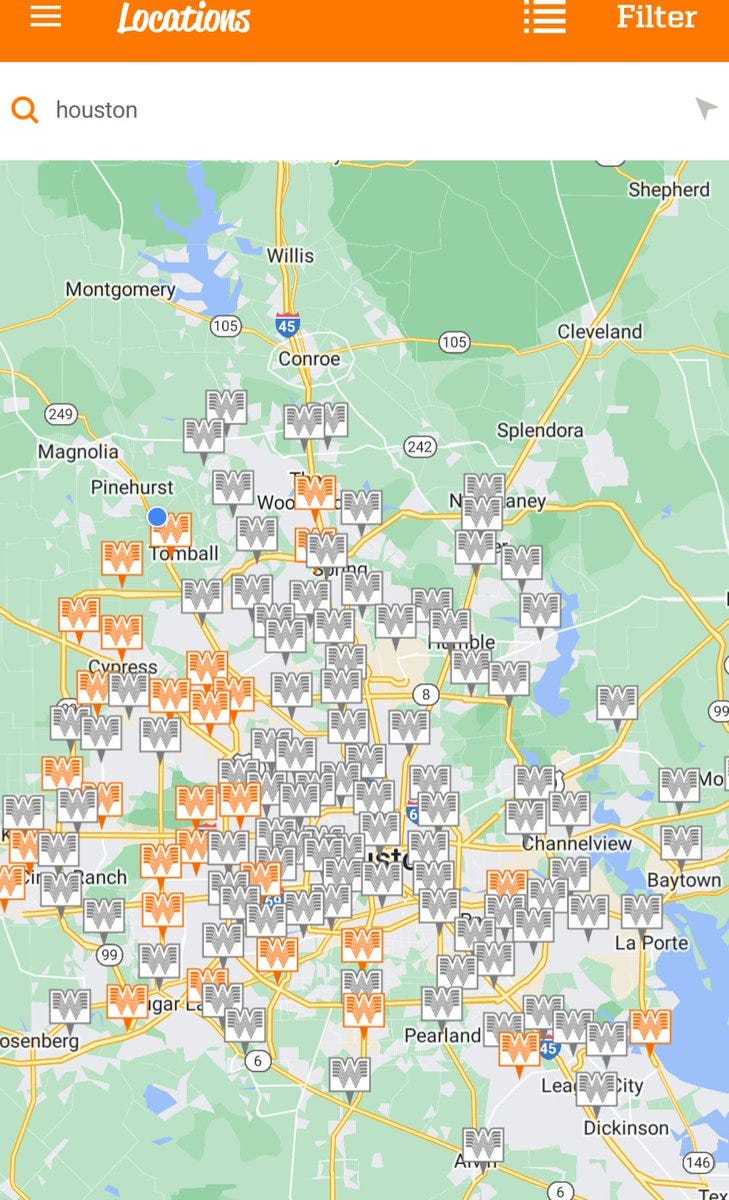

It’s been five days since Hurricane Beryl first impacted Texas, and Houstonians are still suffering from unprecedented flooding and blackouts. While an estimated one million customers are still without power, local utility CenterPoint Energy doesn’t offer a live map, leading locals to turn to makeshift solutions like the Whataburger delivery app, noting which stores nearby are open or closed. As of publication, 49 of the Texas chain’s ~1,000 locations are still listed as closed. Delivery workers are once again proving themselves to be frontline heroes, with couriers not only bringing food to folks with long inoperable kitchens, but with one truck driver literally saving a baby’s life.

The Big Picture: Restaurants have long served as a lifeline of sorts in the infrastructure-starved South, with operating status of Georgia-based Waffle House often used as a way to gauge a natural disaster’s impact. But with the rise of food delivery, folks no longer need to venture across damaged roads and stupefying heat to grab an emergency meal, they often instead opt to outsource that dangerous job to a courier, at least once the apps have ended their severe weather protocols. Maybe it’s time that the apps make mega tipping mandatory in the aftermath of a disaster?

CHART TIME | Online Grocery Sales Slip $100M

Today we’ve got a two-fer! First, the latest data from Brick Meets Click shows that online grocery sales fell $100 million year over year, but were perfectly flat compared to last month. That dip was driven by pickup, down $200 million, while delivery and ship-to-home inched upward. Meanwhile, a new report from Ipsos shows that Walmart and Target are winning the grocery delivery wars, while Albertsons is making meaningful gains.

POLICY | Delivery a Costly but Useful Lifeline for SNAP Users

In the past year or so, online acceptance of food stamps has really taken off, guided not only by federal policy changes, but a race among supermarkets and 3PDs to accept the vital form of payment. DoorDash added the option for select retailers in June, Instacart became the first to go nationwide with it in August, and Uber followed in September. Massachusetts was one of the earlier states to allow delivery for SNAP purchases, rolling it out in the face of the pandemic. New data from the state shows its swift growth in popularity, hitting 4.2% of all SNAP grocery transactions in 2023.)

The Big Picture: Consumer advocates worry that the rising use of delivery fees means cash-strapped customers will have to spend more money on delivery fees, which are generally not covered by the government subsidy. That’s a point in favor of delivery by the grocers themselves: Amazon Fresh offers free delivery for SNAP users on all orders of $100 or more, as do certain regional grocers like Meijer. Still, some SNAP users say it’s worth paying a modest fee to avoid the stigma of paying with the benefits card. “They don’t feel embarrassed about using it,” adds Sueli Shaw, head of social impact at DoorDash.

A Few Good Links

Maine-based CarHop delivery expands to Washington State on zero-fee for restaurateurs model. Alibaba, JD.com in bidding war for UK parcel deliverer. Jordan Chirico, who recently joined troubled food group FAT Brands as their Head of Debt Capital Markets, sued for fraud at earlier fund. Rise of Shein and Temu deliveries gives rise to new gig-based courier networks. Mr Gatti’s Pizza opening 92 locations in Walmartss. Jinya proves to be top ramen chain. $5 deals drive traffic to McD’s. KFC Japan changes hands. What drove higher trucking costs. Maersh, Hapag-Lloyd agreement in trouble. Walmart turns to automated grocery DCs. Not so sure about this AI-generated recipe tool from eGrowcery. H Mart rebuilds online grocery portal with VTEX and VML. Lidl expands NYC footprint as Stop & Shop retreats. Flipkart adds bill pay tool. Thoughts on Uber Eats + Instacart. FreightTech exec sentenced to 20 years. Port of LA finishes rail expansion. Zomato lets users delete order history. London gains shared e-bikes. Mavi.io wants you to order from your car. Do delivery bots help or hinder sidewalks? Interview with Populus CEO.

Got a tip, feedback, or just want to say hi? Reply back to this email.