Cha-Ching: Wolt Intros Merchant Financing

Instacart's Shoppable YouTube ads, Dida Chuxing IPO, Instamart Handpicked

Let’s start the week off with big news coming from all corners of the globe: Northern Europe, China, India, and yes… even the good ol’ U.S. of A. You may not have all these apps loaded into your phone, but you can certainly learn from these new products and partnerships!

Today:

Wolt Capital Offers Restaurant Financing

Instacart Intros Shoppable YouTube Ads

Chart Time | Dida Chuxing Readies IPO

lnstamart Launches Handpicked as IPO Looms

PRODUCTS | Wolt Introduces Merchant Financing

Wolt, the European-focused DoorDash subsidiary, has announced the launch of Wolt Capital, a new merchant financing service. In partnership with Berlin-based embedded fintech provider Finmid (which recently raised ~$25M to support this initiative,) Wolt Capital is now live in Sweden, Poland, Finland and Denmark. The product consists of:

Pre-Approved Advances: Eligible merchants will see a pre-approved advance amount in their Merchant Portal.

Fast Funding: If accepted, funds can be deposited in the merchant's bank account within 1-2 business days, with no additional paperwork required.

Transparent Costs: Merchants pay a one-time fee over the advance period, with no hidden charges, recurring interest, or prepayment penalties.

Automated Repayment: Repayments are based on a percentage of Wolt sales, making it flexible according to business performance.

The Big Picture: Merchant financing is a clever play for 3PDs, making a differentiator for those who offer it, while also creating a forcibly sticky relationship with the retailer. On the banking side, Wolt may have a leg up over traditional financiers, as not only does the company have unbeatable insights into how a restaurant is performing, it can easily garnish the revenue stream to force payback if necessary. Merchants seem happy so far, as one Warsaw-based restaurateur notes “The process was incredibly quick with minimal formalities, and the capital was paid out swiftly. We used the funding to renovate and replace equipment in one of our locations, which helped boost sales and enhance customer satisfaction.” Wolt Capital first went live in Poland, after a smaller pilot in Finland, with plans to keep expanding across Europe.

ADS | Instacart Makes YouTube Shoppable for CPGs

Instacart is extending its first-party retail media data to video platform YouTube, extending its reach for big CPG advertisers like Clorox, Danone and Nestle. Targeting high-intent consumers, brands can match video ads with other units, like recently launched Google Shopping Ad units. But instead of hoping that a shopper watches the ad and simply remembers to go buy some wipes or yogurt once they dawdle over to the store, these ads allow for adding those items right to an Instacart cart, converting those sweet shopper dollars into a same-day delivery order. “Retail media networks are a meaningful channel for our CPG clients because of their high-intent audiences at the point of purchase,” said Joel Lunenfeld, Chief Executive Officer at ad giant Publicis Media Exchange (PMX).

The Big Picture: At this point, we may as well start a separate publication just focused on how online retailers are glorified advertising platforms; with all the big brands gathered in Cannes for their annual get together, we’re sure there are more ad-tastic announcements to come! While all the 3PDs are getting into the game, Instacart has the most mature product, with deep-seated integrations like last week’s launch with NYT Cooking: ad revenue hit $217M in IC’s Q1, representing 26.4% of total rev. Extending these ad data partnerships outside of the core app not only makes for a more powerful platform, it reduces risk that ad-fatigued consumers will be bothered by how cluttered with distractions some of these platforms have become.

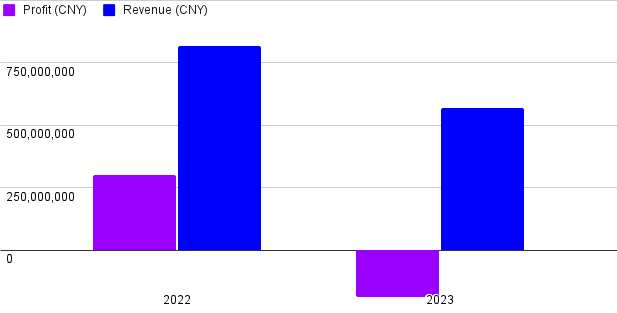

CHART TIME | Sixth Time’s the Charm for Dida Chuxing IPO

Dida Chuxing, China’s second place ridehail and carpool service, has been approved for a listing on the Hong Kong Stock Exchange, after its previous five attempts didn’t pass muster. Dida (not to be confused with its larger rival Didi) posted a net profit of CNY 300.4 million ($41.4M) in 2023, an impressive margin off of ¥815.1 million in rev. The year prior the company showed a net loss of ¥187.6 million, off ¥570M in turnover. Dida operates in 366 cities, and holds 32% of the domestic Chinese market. Earlier reports have speculated that the company hopes to raise $500M in new funding. Meanwhile, Singaporean TNC Ryde has finished a secondary listing on German stock exchanges.

Q-COMMERCE | Swiggy Instamart Launches Handpicked Service

Instamart, the quick commerce subsidiary of India’s Swiggy, launched a “Handpicked” service, starting in the country’s tech capital of Belgaluru. As CEO Phani Kishan puts it, the offering is geared towards surfacing “the best products that are fresh, local, authentic and 100% high quality,” working with local retailers and mom & pop businesses, as opposed to the fast food and CPG brands that are the usual staples of the 15-minute or faster delivery sector. Participating brands include health-conscious and upscale retailers like Iyengar’s, Sweet Karam Coffee, Blue Tokai, and The Whole Truth; Instamart plans to expand to New Delhi and Mumbai shortly.

The Big Picture: Swiggy had previously experimented with Handpicked in 2022, running the vertical for about six months, before shutting it down in a bid to conserve cash. Now the startup is back in growth mode, as it looks to impress investors in its hunt for a $1.3B IPO. Swiggy also recently relaunched Daily, which offers home cooked-style meals. Its Instamart vertical is also launching brand new partnerships, including one with multinational toy retailer Hamley’s, just in case you need a Barbie doll in 600 seconds or fewer.

A Few Good Links

DoorDash announces 5th Summer of DashPass, with biggest deals coming from Chipotle, BK, and Lowe’s. McD’s ends drive-thru voice bot trial. Foodpanda intros private label brand in Bangladesh. Zomato eyes Paytm ticketing arm. 15k Amazon Flex drivers file arb claims. Marco’s Pizza adds summer menu items. Fast-casual pizza chains wobble. UNFI may sell SuperValu after delivery and inventory issues. There’s always growth overseas: Starbucks opens 500th Thai store. Big SoCal energy: Kroger intros Cheetos Flamin’ Hot California Roll (really wish there was a photo…) Deliveroo teams up with football (soccer) player for fan fav meals. AV trucking in TX deep dive. Indian q-commerce deep dive. Rome suspends micromobility operators. Micromobility.com (Helbiz) rearranges the deck chairs. Vitamin delivery service Care/of shutters. FTC Chair Khan speaks. Ather Energy designs a sleek scooter for Indian market. Freenow cancels fixed price fares for taxis. Indian rickshaw union launches TNC.

Got a tip, feedback, or just want to say hi? Reply back to this email.