Amazon Comes for Instacart with Lucky Partnership

Harbinger's $400M deal, 100 biggest grocers, Prop 22 wages

Today’s all about groceries, with Amazon adding a big new partner, and a must-read annual report showing not only which markets are largest, but how they’re achieving that growth. Plus, a big order of e-trucks is a very green shot in the arm, and DoorDash has new data on Prop 22.

This week’s edition is brought to you by Nickelytics.

Today:

Lucky Supermarkets Adds to Amazon’s Grocery Delivery Roster

Harbinger Lands $400M of EV Truck Pre-Orders

Chart Time | Prop 22 Wage Gains

What’s Worrying Growing Grocers

3PD | Amazon Adds Lucky Supermarkets to 2-Hr Delivery Network

Amazon is beefing up its grocery game, with the addition of Lucky Supermarkets to its roster of grocery stores it provides same day delivery. “Our goal is to build a best-in-class grocery shopping experience — whether shopping in-store or online — where Amazon is the first choice for selection, value and convenience,” noted the Seattle-based shopping giant. While the “Lucky” banner only has ~70 locations, the Save Mart-owned brand is strategically located in the SF Bay Area, a key market for the online grocery wars.

The Big Picture: Amazon is really making a move for Instacart’s turf, improving the delivery prices of not only its in-house grocery brands, but adding on heaps of new partner markets as well: last fall it added brands like Bristol Farms, Cardenas Markets, Pet Food Express, Weis Markets, and Save Mart to its stable. Interestingly, comparing the homepage merch mix between Amazon and Instacart, AZ seems to be pushing frozen and packaged items, while IC is all about fresh fruits and veggies.

PARTNER | OOH That’s Moving Forward

Nickelytics specializes in leveraging the power of car wraps, gig-economy drivers and robotics. Nickelytics offers brands and agencies a comprehensive platform to amplify their advertising reach. Transform robots into high-impact advertising assets to capitalize on events and college campuses. We make it easy to capture coveted audiences that are traditionally hard to reach - by focusing on engaging out-of-home channels and giving you the analytics to retarget smoothly. It’s time for OOH to move forward.

VEHICLES | Harbinger Lands $400M in E-Truck Orders

Harbinger, a maker of medium-duty commercial EV chassis, announced it’s sold 4,000 pre-orders, valued at over $400 million. The SoCal-based manufacturer notes that most of the orders are delivery-oriented step vans, headed to customers like Bimbo Bakeries USA and Mail Management Services. Harbinger specializes in Class IV to VI vans with a 200+ mile range, working with large fleets, dealers and speciality upfitters to supply the commercial vehicle body.

The Big Picture: Harbinger’s grabbing cash not just from customers, but from investors as well. The company closed a big $60M Series A back in September, an impressive sum for a hardware co in this environment. Evidently investors are still champing at the bit, as the Coca-Cola System Sustainability Fund just added an extra $13M to that haul, in a round extension. "While other new entrants struggle to fill their order pipelines, we have extensive pre-orders and backed-up demand for our medium-duty electric vehicles," said Harbinger CEO John Harris. "We are laser focused on the medium-duty vehicle segment, where there is a huge variety of vehicles built on chassis like ours including walk-in vans, box trucks, recreational vehicles, delivery vans, school buses, emergency and disaster response vehicles and more.”

CHART TIME | Prop 22 Pay Data

DoorDash has released new data charting the impact that California’s Prop 22 had on gig worker wages. Statewide, pay is up 41% from 2020, averaging $36 per hour. While there are slight regional variations, it sure seems like Sacramento area workers get the best deal, given how much lower the cost of living is there. Another intersting factoid: 80% of Dashers saying they currently have health care coverage via another source, such as a full-time job or spouse.

GROCERY | Meet the Country’s Biggest Supermarkets

Progressive Grocer released the 91st annual edition (wow) of its fabled PG100 report, laying out the country’s largest grocery operators by revenue, as well as the movers and shakers gaining share in the cut-throat industry. The top of the ranks stayed steady from last year, led by Walmart, Amazon, Costco and Kroger. Meanwhile, Walgreens fell from fifth to sixth and CVS jumped from seventh to fifth. Other big movers include: Rite Aid (falling from 22 to 26,) Tops Market / Price Chopper Market 32 (45 to 49,) Big Lots (55 to 59,) Raley’s (49 to 55,) Market Basket (50 to 57,) Stater Bros (54 to 61,) and HelloFresh (46 to 56.) Big gainers include The Fresh Market and c-store operator ARKO Corp.

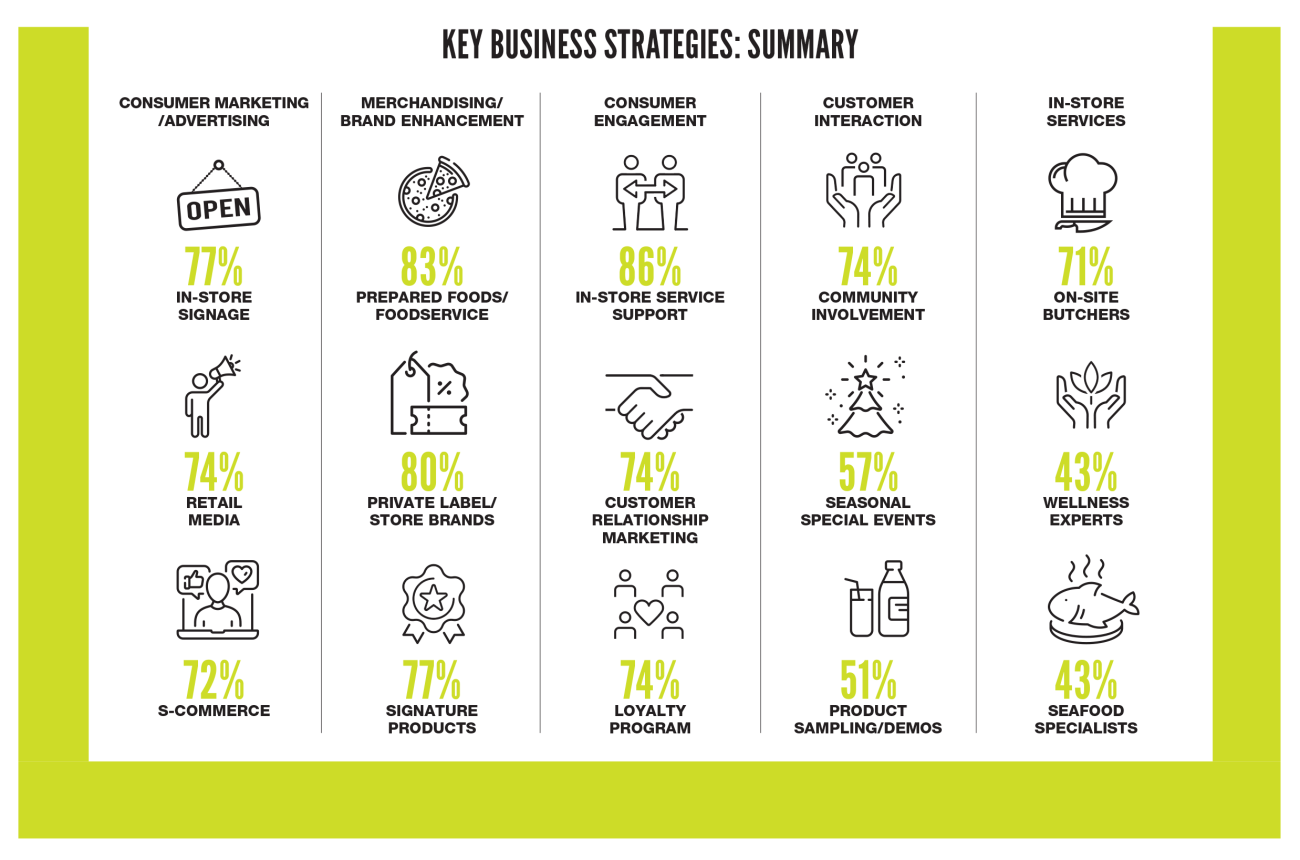

The Big Picture: But what’s giving smart brands a competitive edge, or causing laggards to fall behind? The world of the year seems to be “omni-channel,” with 43% saying they have an omni-channel strategy in development, and 23% reported they’ve fully integrated their in-store, online and digital channels. 62% of grocers offer in-store or curbside pickup for online orders, 57% have a mobile shopping app, 62% are satisfied with their third-party delivery/pickup vendor, 44% are considering building a native delivery/pickup app, 24% report they’re looking into using AVs for delivery, 26% are planning to add ordering kiosks and 71% are worried about labor.

A Few Good Links

UK passes autonomous vehicle legislation, plans for first AV to be on the road in two years. Aurora and Volvo unveil AV truck. NHTSA probes Waymo, Zoox over robotaxi behavior. Nikola sells 100 hydrogen trucks. Hoboken signs curb management contract with Automotus. Uber Freight adds spot market platform. South 8 Tech raises funds for cold weather EV charging. Restaurant365 raises $175M. Chuck E Cheese parent co adds new CFO (someone’s got to keep that rat’s spending in check!) Ahold Delhaize opens tech studio in Romania. Target cuts prices. Thrive Market named CNBC Disruptor. Shipt & Meijer launch summer savings. Kroger tauts Memorial Day deals. Shipping biggie Zim reports $1.56B in Q1 rev.

Got a tip, feedback, or just want to say hi? Reply back to this email.