Gopuff Adds Instant Produce with Misfits Market

JET's Q1 crashes, E-bikes hit South LA, March 3PD market share

Wowowow, today’s newsletter has it all: transformative partnerships, big fundraises, market exits, industry stats, and free ebikes.

Today:

Misfits Partners with Gopuff as Flink Raises $106M

JET Q1 Sees GTV Down, New Zealand Axed

Chart Time | March Market Share Update

Free E-bikes Hit South LA

INSTANT DELIVERY | Gopuff, Misfits Partner for Grocery Delivery

Quick commerce stalwart Gopuff is adding fresh produce to its snack and booze-heavy arsenal, thanks to a new partnership with Misfits Market. Launching nationwide, this program adds 300 SKUs to Gopuff, getting fresh fruit and veggies, dairy, meat, poultry, fresh bread and more, to customers’ doors in as little as 15 minutes. Earlier testing revealed that fresh grocery items led to 20% bigger baskets and 50%+ increases in sales for produce, dairy, prepared foods and meat. The new items will also be eligible for free delivery via Gopuff’s FAM premium subscription tier.

The Big Picture: This partnership comes hot off the heels of Gopuff announcing “Powered by Gopuff” — its new platform that offers instant delivery fulfilment via Gopuff’s existing MFCs for brands via their own first party websites. Launch partners include Ben & Jerry’s, Unilever, Mondelēz International, Nestlé, The J.M. Smucker Company, Haleon, and The Ferrara Candy Company, as well as a Shopify theme that integrates with Gopuff’s API. Ugly produce purveyor Misfits Market has been on a bit of a tech crusade of its own — it launched a third-party fulfilment service back in Feb. All these initiatives will put more pressure on the instant delivery competition. Getir is already rumored to be looking at a restructuring. Berlin-based Flink seems to be under even more pressure, having raised €100 million ($106 million) from existing investors to extend its runway as it searches for suitors. Once valued at a lofty $2.85 billion in late 2021, the company hopes to be acquired by Just Eat Takeaway.com or Getir, but neither of those groups would be likely to cut a huge check at this point.

FINANCE | JET Jettisons New Zealand After Weak Q1

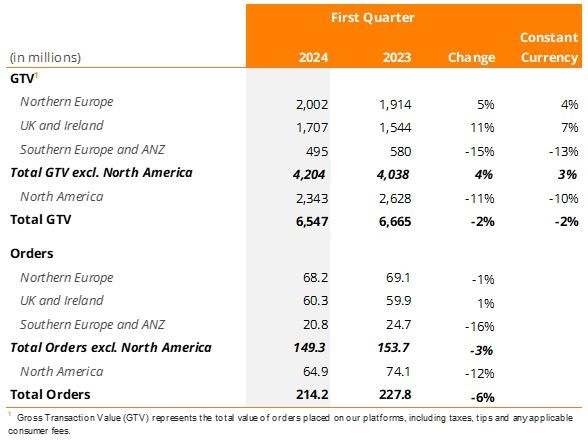

Speaking of Just Eat Takeaway.com, the Dutch delivery giant just released its Q1 trading update, showing a company undergoing a pretty severe bifurcation. GTV was up a healthy clip in both Northern Europe and UK / Ireland, albeit off of nearly flat order volume (so that’s where the inflation must be coming from…) It was the exact opposite story in North America and Southern Europe / ANZ. Its North American operations (Grubhub & SkipTheDishes) saw GTV plunge 11% (10% in constant currency,) while orders were off 12%. Meanwhile Southern Europe and Australia / New Zealand saw GTV drop 15% (13% constant currency) while orders nosedived 16%.

The Big Picture: The numbers are so off in New Zealand that Just Eat Takeaway is closing up shop, as part of its “commitment to drive efficiencies and focus on building strong and sustainably profitable positions.” JET notes that the shuttering of Menulog in New Zealand will be immaterial on its overall business, and that New Zealand is just too small a market to maintain a healthy biz in. Southern Europe + Australia & New Zealand lost €97 million in *adjusted* EBITDA in 2023, which is pretty jaw dropping when you consider just how small the order volume was. On the more positive side, JET noted its Grubhub Campus business is seeing strong growth, hitting 14.2 million orders in Q1 24, up from 11.5M a year prior. (Also, given that Kiwis also just lost Ola, that sure seems like a tough market…)

CHART TIME | 3PD March Market Share

If it’s the middle of the month, it must be time for the latest Bloomberg Second Measure meal delivery market share update! While overall sales volume was up a healthy 8% YoY, the market share of the big three didn’t change compared to February. DashPass retention showed some improvement, sitting at 69% at one month, 36% at six months and 28% at the year mark.

VEHICLES | Free E-Bikes Hit South Los Angeles

The mean streets of LA are starting to look a bit different, thanks to a new initiative — South Central Power Up — that just went live. The program is bringing 250 electric bikes, along with helmets and training, to some of the most impoverished neighborhoods in LA. The bikes are let out in one month increments, and the program promises to be fully free for the first six months, with modest fees likely to come after that. The program is funded by California’s cap and trade dollars, is in partnership with People for Mobility Justice, LACI, LADOT and CARB, and collaborates with local bike shops and community markets.

The Big Picture: While many regions have bikeshare programs (including LA’s Metro Bikeshare,) this lending library is of a different design. Instead of offering hundreds of stations to serve as a first and last mile aid, Power Up’s e-bikes are meant to be taken home and kept with the user, serving as his or her primary means of transportation. This can serve as a powerful tool of economic justice, relieving some folks from the heavy burden of car payments, while allowing those that previously lacked mobility options to partake in the broader economy. And while bikeshare programs usually forbid users from using the bicycles for work, precluding opportunities at delivery firms, we see no such restrictions at this initiative. In fact, related programs like the San Pedro Small Business E-bike Pilot specifically aim to transition delivery workers from personal autos to more sustainable e-bikes.

A Few Good Links

Curbivore 2024 recaps: recent wins on roads and sidewalks, plus Deputy Mayor Winston talks transforming infrastructure. Lending a robotic hand. Toast unveils new restaurateur suite; Olo launches Smart Cross-Sells. Robotaxi regulators say Tesla hasn’t reached out, despite Elon claiming a summertime launch. MPLS delays minimum wage jump from May 1 to July 1, gives Uber + Lyft breathing room. How Amazon became the largest EV charging operator. Wonder buys Relay, the NYC-based deliverer that’s also been subject to the city’s recent courier pay litigation. NYC debuts Office of Livable Streets. Biden-Harris Admin announces $54M in new EV charger funding, with an added emphasis for fleets. CRG taps Empower for first party delivery apps. Mod Pizza names new CMO. Pizza Hut debuts Keith Lee pie. Canada’s Freshslice opens in U.S. Ann Arbor-based Domino’s introduces New York Style Pizza (rat not included.) Fat Brands trials hybrid pizza locations. Uber’s 2024 lost and found index. DoorDash touts booze delivery stats. Instacart adds former Revlon CFO to board. How legal supports Grubhub’s biz strategy. Shipt CMO Alia Kemet named to Forbes 50 list. Top 10 U.S. restaurant rankings sees Chipotle moving up. Amazon overtakes UPS on shipping index. Flatpay POS raises $48M. Rippling may hit $13.4B valuation. ChaPanda aims to raise $330M on HKEX. UK Franchisee buys out TGI Friday’s parent co. Hy-Vee acquires Strack & Van Til. Amazon launches TV shopping experience. Aldi announces checkout-free shopping, powered by Grabango. Alibaba debuts logistics solutions for U.S. SMEs. Instacart Q1 dropping May 8. 7-Eleven shares 2023 Impact Report, acquires 204 Stripes Stores. Premier Custom Golf Carts expands. Yesterday was Ben & Jerry’s free cone day, sorry you missed it. Starbird opens 11th loc. Geek+ and Toll Group team up on S. Korea robo warehouse. Great freight recession lingers on. Swiggy takes away worker health insurance when it’s needed the most. 80% of consumers detest dynamic pricing at restaurants (unless you call it happy hour…)

Got a tip, feedback, or just want to say hi? Reply back to this email.