Pipedream Launches Underground Delivery Network

Instacart's economic impact, interview with Faction's CEO, November 3PD market share

It’s no longer just a pipe dream, you CAN get fast food delivered via an underground tube in suburban Georgia! Pipedream Labs has officially gone live, and we’ve got the details below. On the other end of the spectrum, Faction’s building an AV delivery system that makes the most of existing tech and tools — we talk to founder Ain McKendrick. Plus, new numbers on Instacart’s economic impact and 3PD market share… read on!

Modern Delivery will be off on Friday, returning Monday.

This week’s edition is brought to you by RestoGPT.

Today:

No Longer Just A Pipedream in Georgia

lnstacart’s Economic Impact

Chart Time | 3PD Market Share Update

Faction’s Lean Approach to AV Delivery

AUTONOMY | Pipedream Launches Underground Delivery Network

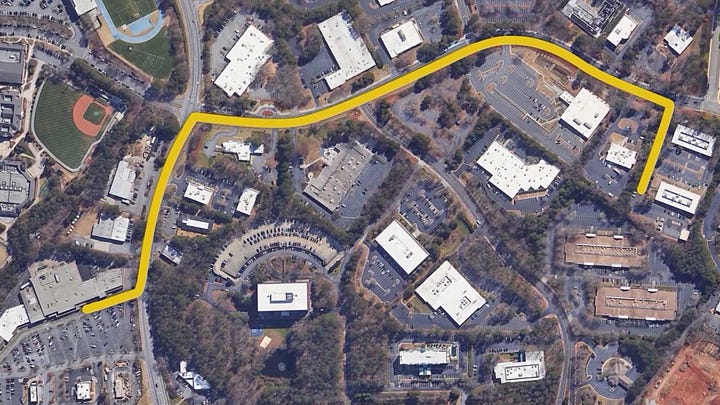

Pipedream Labs officially launched the first phase of its underground delivery network in Peach Tree Corners, a tech-focused suburb of Atlanta. Pipedream’s taking deliveries underground, where its autonomous robots can avoid traffic and double parking; the current system is 0.7 miles long and connects the Curiosity Lab office park with a shopping center that would otherwise require traversing a busy highway. Think of it as delivery bots meet pneumatic tubes — restaurant and retail partners can load their goods into the machines, which then bring it back to hungry office workers on the other side.

The Big Picture: The full launch video is fun to watch but we can’t help but notice all the custom, seemingly sensitive, moving parts. Obviously this is an early version, but getting this to be reliable and cost-effective is the name of the game; especially if the end result is moving low margin goods like Taco Bell (as demonstrated in the video.) The tunnels do of course let these machines traverse terrain that would otherwise daunt a Serve or Kiwibot, but again — that’s a lot of Crunchwrap Supremes until payback period. The Pipedream Labs team of course knows this — if anything one of the project’s main goals is figuring out how to lower the cost of tunneling / trenching — see Justin Robinson, the company’s VP of Strategy & Partnerships, discuss their innovations in this recording from Curbivore ‘23.

PARTNER | RestoGPT’s Instant AI-Powered Ordering for SMBs

RestoGPT lets SMB restaurants convert their third-party apps to direct ordering in minutes, using AI to generate orders, process payments and deliver to customers on autopilot. There are no setup fees, no commission fees and no monthly subscription fees. Give it a try now, risk free!

3PD | The Economic Impact of Instacart

Grocery delivery juggernaut Instacart released an interesting white-paper today, quantifying the economic impact of its marketplace. Some of its most impressive claims include: it’s added over 231,000 brick-and-mortar grocery jobs and nearly $8 billion in incremental revenue for the U.S. grocery industry, generated more than $15 billion in earnings for Instacart shoppers, and saved customers more than 700 million total hours since starting off in 2012. Instacart is also claiming to have a disproportionately positive impact on smaller grocers (1-49 employees) with said markets accounting for 29% of those new jobs, despite making up only 14% of the grocery industry.

The Big Picture: Grocery delivery is a different beast than restaurant delivery; with supermarkets operating off of razor slim margins (not that most restaurants are wildly profitable themselves.) Plus, while grocery delivery changes *how* consumers get their food, it doesn’t change *where* they eat it (whereas food delivery is shifting consumption off-site.) In that sense, Instacart is almost pure labor substitution: a customer is paying a worker to do something that he or she would have otherwise done for “free.” As Instacart’s margins are also pretty slim, and in general groceries cost more on the platform, this means gig workers are capturing what was otherwise a consumer’s economic surplus. Econ 101, baby!

CHART TIME | November Food Delivery Market Share Update

They say “time and tide wait for no man,” which surely is a reference to the fact that Second Measure reliably puts out a market share update every month. Compared to October, Uber Eats and Grubhub both fell a point, DoorDash gained a point, and everyone else is basically unchanged. DashPass customer retention is 64% for one month, 32% for six months, and 26% for a year.

AUTONOMY | Faction's Driverless Delivery Is Built Lean

While Pipedream may be custom building everything, Faction is taking the opposite approach, creating an autonomous and teleoperated delivery solution that rides on the back of existing hardware. Over at OttOmate, Founder Ain McKendrick shares his vision, which we’ve partially excerpted below.

So, what’s Faction?

Faction develops next generation vehicle fleets that leverage driverless technology.

What’s your tech background, and what brought you and the team together to create this solution?

I spent most of my early career in consumer electronics and got my start as one of the co-founders of Palm Computing. I entered the vehicle space about 7 years ago - first working on driverless commercial systems, then started working on-road systems. As the vehicles of the future look a lot more like rolling computers, those of us with technology backgrounds are able to pull from past experience when thinking about the digital vehicles of the future.

How would you describe Faction’s place in the larger autonomous ecosystem? Do you think of yourself as complementary to some of the larger players?

If you think of the larger players in the space, many of them bet their entire company on artificial intelligence driving and a collective $100B has been spent trying to make it work. There is a similar pitfall if you think that artificial general intelligence is only a couple years away. The reality is that artificial intelligence remains an area of active research, so Faction started out on day one with the assumption that we would have supervised autonomy for a number of years, and it is actually the more evolutionary path to full autonomy.

Who are your vehicle partners? Is the system compatible with a larger swath of OEMs, and have you been at all impacted by some of your partner vehicle manufacturers’ own struggles?

By design, Faction started with light EV platforms - notably Arcimoto and ElectraMeccanica in the early days. This accomplished two key goals - it forced us to design a system that could work on smaller vehicles with both cost and power consumption as a constraint. This means we can always expand into larger vehicles, but the more costly and power hungry implementations would have a very hard time competing with us on the same class of vehicles.

O: How do you go to market; what’s the pitch that gets someone to pick Faction over a different AV approach?

A Few Good Links

EU finalizing Platform Worker Directive — set to dramatically reshape delivery / gig worker employment rules. Amazon rolls out cargo bikes, new grocery stores in U.K. AT&T trials Rivian vans. OpenTable CEO Debby Soo talks the future of reservations. Craveworthy Brands (remember them?) signs deal with Toast POS. Urb-X teases bicycle highway. Lime to intro Coaster Cycles cargo trikes. Auto industry lobbies for rules as Cruise axes execs and workers. Driver wage growth slows. FedEx, UPS grapple with soft demand. Order cancellation costs up to 3% of digital sales. Cava hones loyalty program, a popular trend in 2023. Alabama fast food franchisees face suit over convict labor-trafficking. Papa Johns picks new ad agencies.

Got a tip, feedback, or just want to say hi? Reply back to this email.