1-800-F-Lowered-Expectations

Popeyes Up & BK Down, DoorDash Driving Insights, grocery delivery motivations

We keep rolling along through quarterly earning season, with plenty of lessons to be learned from purveyors of flowers, Whoppers and chicken alike. Plus, we’ve got new data on improving gig driver safety and on why shoppers choose delivery.

This week’s edition is brought to you by Cambridge Mobile Telematics.

Today:

1-800-Flowers.com Tightens Quarterly Loss

RBI’s All Chicken, No Beef

Chart Time | Grocery Delivery Motivations

DoorDash Unveils New Safe Driving Tools

FINANCE | 1-800-F-Lowered-Expectations

Flower and gift basket delivery company 1-800-Flowers.com dropped its quarterly update, and its a bit of a mixed bag. Revenue dropped 11.4% YoY to $269.1 million, but the company improved its margins and cut costs enough to whittle its adjusted EBITDA to a loss of $22.5 million, compared to $28M the year prior. CEO Jim McCann added “Most notably, our gross profit margins are expanding as we had anticipated, rising primarily on lower ocean freight costs and a decline in certain commodity costs.”

The Big Picture: While the company might have flowers in its name, in recent years its diversified to delivering gift baskets, Harry & David prepared foods, popcorn tins, personalized swag and more; combined with its wholesale marketplace, that accounts for nearly half the company’s revenue. Despite diversifying in that direction, phone orders (1-800…) and other old school channels still account for 22% of sales. While the company should return to quarterly profitability come holiday season, the company has real uphill battle if it hopes to return to the revenue and profit numbers it saw in 2021.

PARTNER | Save Money and Make Drivers Safer

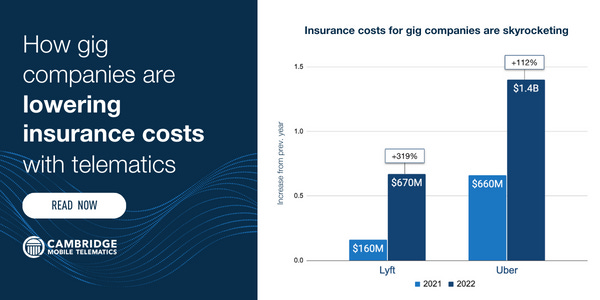

Insurance costs are skyrocketing for gig companies. In 2022, Uber’s insurance costs increased by $1.4B from 2021. Lyft’s insurance costs increased by $670M, contributing 90% to its increase in cost of revenue. To help reduce insurance costs, companies are turning to telematics. They’re making drivers safer through real-time feedback and rewarding their safest drivers.

FINANCE | Burger King Dethroned, All Hail Popeyes

Restaurant Brands International, the parent company of Tim Horton’s, Burger King, Popeyes Louisiana Kitchen and Firehouse Subs, reported its Q3, and it looks like there’s some turmoil in Toronto. While revenue hit $1.84 billion, up 6.4% YoY, that fell short of analysts expectations, which were $1.87B. Profit fell from $360 million to $252M. BK’s same store sales grew 7.2%, short of the 8.6% expected. Popeyes’ 7% growth topped the 5% that Wall Street was looking for. Tim Horton’s comparable sales were up 6.8% and Fire House Subs grew 3.4%.

The Big Picture: It’s been a tough few quarters for BK, as the company is dealing with the predictable results of years of under investing in its brand and technology systems. While it’s now a year into a plan to invest $250M into updating its restaurant technology, when’s the last time you heard talk to you about the Burger King App? Things are rosier at Popeyes, which last month overtook KFC as #2 in the nation’s chicken wars (Chick-fil-A currently reigns supreme.) If anyone ever invents a system for delivering fried food that doesn’t arrive gross and soggy… it’s game over!

CHART TIME | Convenience & Pricing Drive Delivery

A recent report from PYMNTS looks at the motivations of consumers who are eschewing in-store shopping for grocery delivery. No surprises here, but the top reason was “convenience.” Following that was high prices, and then complaints about selection. Interestingly, a good 17.9% of shoppers are still worried about getting sick in store, which is a good reminder that the pandemic isn’t really over.

PRODUCT | DoorDash Promotes On-Road Safety

DoorDash is rolling out a new safety tool, Driving Insights, that monitors acceleration and braking data to assess Dasher driving behavior. Based on that data, Dashers will be shown their driving history and given easy hints about how to avoid hard braking and rapid acceleration, ideally leading to improved driving practices. DoorDash has been piloting this program in Phoenix and Salt Lake City, and is now expanding it to Atlanta, Houston, Dallas, Detroit, Cleveland, Miami, Charlotte and Palm Beach. The company is also boosting the visibility of speed limits in its in-app navigation, to further improve road safety.

The Big Picture: Driver safety is a growing issue for basically every gig platform, with insurance costs eating into their bottom lines. In is 2022 annual report, DoorDash noted “Order management costs also increased due to an increase in insurance reserves…” as it increased its insurance reserves from $143 million to $418M. Given that DoorDash’s app already tracked driving patterns (many apps do, given your phone’s built-in GPS and accelerometer) it’s simple enough to start surfacing this data to drivers, and nudging them towards safer behavior. As our partner Cambridge Mobile Telematics notes, a number of gig companies are exploring telematics tools to reduce crash rates and insurance costs.

A Few Good Links

GLS partners with Bettermile in last mile logistics. OpenTable gives out Uber vouchers for SF Restaurant Week. U.N. investigates gig work wages. Domino’s continues China expansion. Maersk cuts jobs as global shipping rates tumble. Shopify revenue surges 25% as its payment tools nibble at Amazon. Walmart stock hits all time high. In-store coffee sales dip as consumers opt for delivery. BNPL Klarna avoids strike. Premier Bulk Systems buys 3PL Ark Traffic Solutions. Bankrupt Rite Aid seals deal to keep getting Rx supplies from McKesson. TNCs, scooter cos push EU govs to strengthen air pollution standards.

Got a tip, feedback, or just want to say hi? Reply back to this email.