Instacart, Alignment Health, Stride Deliver New Healthcare Concepts

McDonald's strong Q3, truck valuations crash, congestion costs up

Did you spend the weekend putting up last second Halloween decor? If you’ve run out of candy already, we know a good handful of companies that would happily drop you off a new bag of treats…

Speaking of healthy eating, we’ve got some innovative new health plan options from the likes of Instacart, Alignment Health and Stride; plus McDonald’s is looking very spry in its Q3 results. Less plucky are the valuations of truck and van startups, as well as the continued costs of congestion across the country. Read on!

Today:

Delivery as a Healthcare Benefit, Delivery Workers as a Health Plan Customer

Digital Sales Drive McDonald’s Strong Q3

Chart Time | Trucking Startups Crash to Earth

The Rising Cost of Congestion

POLICY | Healthcare Open Enrollment Gets Delivery Flare

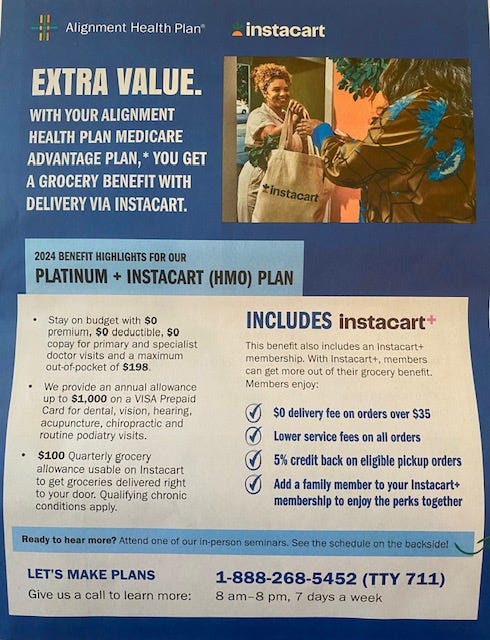

Instacart has been on a healthy kick as of late, adding Medicaid / Medicare payments for healthy foods, working with safety-net providers in Chicago and now rolling out a cobranded Medicare Advantage Plan. In partnership with Orange County-based Alignment Health, the program includes Instacart+ membership, a $100 quarterly grocery stipend and a special senior support team to help onboard new members. Given the demographics of the intended audience, the companies are doing user acquisition via newspaper inserts; we’ve sourced a copy below (the back side includes addresses for restaurants and venues hosting walk-in seminars with even more info.)

The Big Picture: November first marks the beginning of open enrollment, the period where Americans can sign up for new healthcare plans. As such, various insurance carriers are ramping up their acquisition efforts, coming up with new ways to win over customers from the competition. Besides offering delivery as a benefit for customers, we’re also seeing other health-tech companies target delivery workers as their customers. Stride Health has a number of plans for gig workers, including those that work for Uber, DoorDash, Instacart, and Amazon, as well as those associated with new partners Gridwise, Openforce and Member Benefits.

FINANCE | Digital Sales Power Strong McDonald’s Q3

The Golden Arches just finished off a golden quarter: global comparable sales were up 8.8% YoY, revenue up 14%, operating income up 16%, net income up 17% and EPS up a whopping 18%. Nine months into the year, the company has done an impressive $19.089 billion in revenue, up $6.692B from Q2 — that’s a lot of Big Macs! Global systemwide sales were up 11% for the quarter, bringing CEO Chris Kempczinski to crow, “The macroeconomic environment is unfolding in line with our expectations for the year, and we continued to deliver convenience and value for our customers. Thanks to the entire McDonald's System's outstanding execution of Accelerating the Arches, we remain confident in our future and the strategic direction of our business.”

The Big Picture: It’s not just that McDonald’s can sell a lot of hamburgers when consumers are keeping an eye on their checkbooks — it’s *how* Ronald sells them that matters. Digital systemwide sales in the company’s top six markets neared $9 billion for the quarter, representing over 40% of company sales. In Q2 22 those comparable digital sales were only $6B, showing how quickly the company is scaling those efforts: its digital sales in China, U.K, Germany and France are actually a bigger percentage of overall revenue than those in America. The company keeps delivering new users to its apps via fun promos like Free Fries Fridays, and keeps the company top of mind with brand tie-ins to properties like Marvel’s Loki. The company now has 57 million loyalty users in its top six markets.

CHART TIME | Trucking Valuations Crash

Oh how the mighty have fallen! Trucking startups seem to be a consistently bad bet, with valuations down down down from IPO highs. Rivian has fallen from a tremendous $66.5 billion to a still-lofty $16.2B; Xos’ latest round of cutbacks has the company worth around $45 million and then there are companies like Lordstown Motors which have gone out of business completely.

INFRASTRUCTURE | Congestion’s Big Costs

A new report from the American Transportation Research Institute shows that congestion had a $94.6 billion financial drag on the logistics industry, amounting to nearly $7,000 per truck in 2021. That was up significantly from $77.3 billion in 2020 and eclipsed a previous record of $87.6B in 2019. Drivers spent approximately 1.27 billion hours stuck in congestion, with nearly $7 billion of worth of fuel wasted while idling. Congestion costs grew the most in Nevada, Louisiana and Georgia.

The Big Picture: While the knee-jerk reaction to the news might be “build more highways!!!” there’s plenty of evidence showing that doesn’t work — it only leads to more traffic, congestion and pollution down the road, due to induced demand. Instead, governments can reduce traffic by tolling overloaded freeways and introducing congestion pricing cordons into busy downtowns — something about to go into effect in NYC, and being studied by other regions like Greater LA. Freight and delivery firms can also beat traffic by shifting long-distance cargo to trains and intra-city loads to cargo bikes, mopeds and other smaller-scale vehicles.

A Few Good Links

Chicken chain Bonchon to test ghost kitchens. Amazon fulfillment network beats expectations as retail giant hits $143.1B revenue in Q3. Ford delays Kentucky EV battery plant. Ahold Delhaize scoops up large European grocer. Overstock.com to revive iconic Bed Bath & Beyond coupons. Flexport eyeing Convoy’s tech. Indian cloud kitchen contender Curefoods buys Yumlane Pizza. The Restaurant Group kicks tires on PizzaExpress. Shipt surveys top Thanksgiving dishes.

Got a tip, feedback, or just want to say hi? Reply back to this email.