DoorDash Revamps Ad Platform

Uber Eats' multi-store ordering, Domino's decent Q3, 3PD market share

Did you miss us as much as we missed you?! It’s hard to say if delivery news even happens while we’re offline, but it does look like we have some big news to catch you up on, including game-changers from DoorDash, Domino’s and Uber Eats.

Today:

DoorDash Enhances Ad Platform to Juice Growth

Domino’s Sees Light at the End of the Tunnel

Chart Time | 3PD Market Share Update

Uber Eats Launches Multi-Store Ordering

OPS | DoorDash Beefs Up Ad Platform Offerings

This morning, DoorDash announced a slew of new advertising features, including four new tools for advertisers:

Sponsored Brands – Piloting New Ad Format: Brands can drive awareness and consideration via new high-impact carousels that combine brand assets with a shoppable selection of products, similar to an in-store end cap.

Sponsored Products – New Reporting Types: To better understand campaign performance, DoorDash has released new-to-brand reporting for campaign, product, and keyword-level.

Sponsored Products – Keyword Targeting: To enable deeper control and optimize ad campaigns towards highest-performant terms, DoorDash unveiled keyword-level targeting and reporting.

Item-Level Promotions – To drive trial and increase average basket size, brands can now run item level promotions featuring “Buy 2 items from a brand, save $2”, connecting new and recurring customers with an affinity to trial or stock up.

The Big Picture: We’ve discussed ad nauseam how many 3PDs have essentially become glorified advertising machines, where the hassle of running a delivery business is essentially a loss leader to get eyeballs for the high-margin ad arm. DoorDash is really leaning into that framing, as it is now referring to itself as “the largest local commerce platform in North America, with 32 million active monthly users.” The company showcased that in a new report, surveying 1200+ customers, highlighting the efficacy of CPG advertising in quick commerce channels. The company claims a 4.1x average ROAS for DoorDash Sponsored Product ads.

1PD | Domino’s Turning the Corner in Q3

Domino’s released its Q3 financial results, and the delivery stalwart appears to be on the mend. Global retail sales grew 4.9% in the third quarter of 2023, or an impressive 5.1% when you discount the hit the company took from exiting the Russia market. While same store sales crept down 0.6% in the U.S., they grew a respectable 3.3% internationally. Net Income increased $47.2 million, or 46.9%, compared to the year prior, thanks in part to a $28.2 million pre-tax unrealized gain associated with the re-measurement of the company's investment in DPC Dash — its Chinese master franchisee.

The Big Picture: While 2022 was rough for DPZ (with sales down 1.3%), 2023 is looking brighter, as the delivery giant replenishes its driver staff, builds on its Uber partnership and keeps growing internationally. While the company was once famous for doing all its delivery in-house, its partnership with Uber is driving growth, and is set to expand to Houston, Miami, Detroit and Seattle in the coming quarter. The company also keeps cooking up novel promotions to improve customer loyalty / frequency; see its “free emergency pizza” campaign. Lastly, there’s still a big world out there that isn’t yet saturated in Midwestern-style pizza pies. The aforementioned Chinese market is a boon for the company, and the Michigan-based company also has plenty of blue sky in recent expansion markets like Uruguay and Latvia. (Guess which country’s menu highlights kebabs as toppings, and which one puts the Americana pizza ahead of the Italiania pie…)

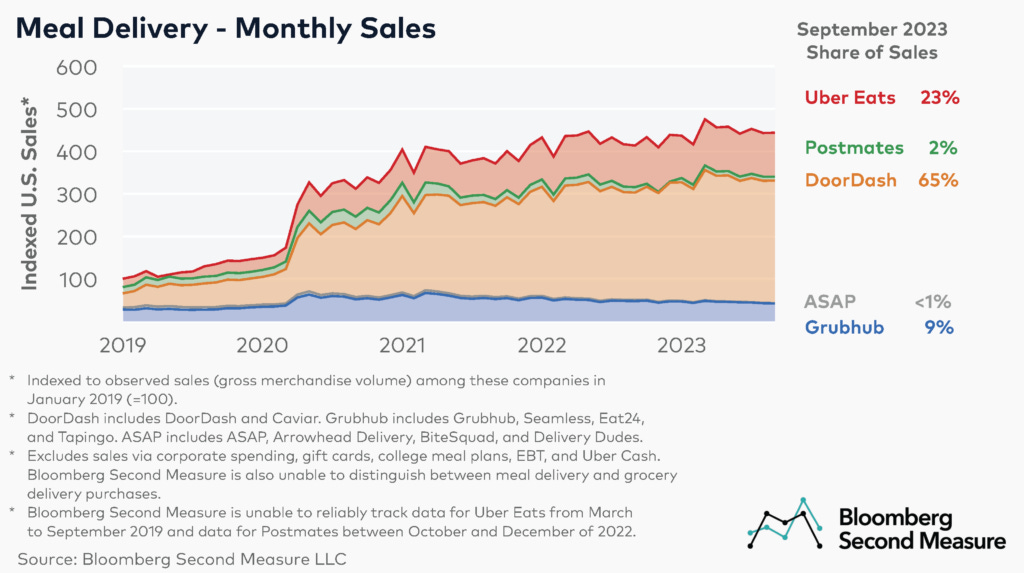

CHART TIME | September 3PD Market Share Update

Time for the ol’ Second Measure check-in on which 3PD is winning the race for American hearts, minds and bellies. Uber Eats, Postmates, DoorDash, and ASAP are all effectively steady compared to last month, but Grubhub has lost a point, settling at 9%. As for DashPass retention, 66% remain after one month, 35% at six months, and 29% at twelve months — showing some meaningful improvements compared to August’s numbers, perhaps as its co-branded credit card with Chase works its way through the system.

3PD | Uber Eats Launches Multi-Store Ordering

Want some chicken masala with that burrito? Or better yet, perhaps a 7-Eleven Slurpee to wash down that Domino’s pizza? Well you’re in luck, as last week Uber Eats launched multi-store ordering. From a consumer’s perspective it’s simple: after placing items in-cart at the first storefront, shoppers hit “bundle another store” at the bottom of the menu” to add in the additional items, before heading to checkout. From a merchants’ perspective, it’s even easier, as there appears to be no additional on-boarding necessary.

The Big Picture: This feature is quite similar to DoubleDash, which competitor DoorDash rolled out in August 2021 (bonus points to DD for the cuter name.) This functionality really highlights the versatility of 3PD and its ability to handle orders that in-house delivery cannot. If routing and order combo-ing is tasked well, it also is more sustainable than having two separate drivers handle two orders. That said, it’s up to the customer to think about if their cuisine will handle the longer drive-time well; perhaps it’s best not to combine fried food with another restaurant known for long prep times. We’d love to see some data from DD and UE to check if customers are also tipping drivers well for these longer, more complicated tasks.

A Few Good Links

DD clarifies deactivation policies in response to media scrutiny. JET highlights new tech initiatives, additional celebrity partners. Denny’s hires first CTO / Chief Digital Officer, former Brinker CIO. Experts expect virtual brands to outgrow current pains. Grocer Hy-Vee gets into microfulfilment for online orders. Amazon’s new supply chain program needs to gain merchant trust. Maersk opens LA cargo hub. Feds pick seven new hydrogen hubs. Sexual harassment claims against Uber consolidated into multi-district litigation. Edible Arrangements launches new ad campaign — “there’s an edible for that” — we thought this was about them getting into the CBD category… NationalGrid readies Northeast for EV trucks. This is your captain MrBeast speaking, C3 puts virtual brands on jets. C3 also brings food hall to Atlanta airport. Swiggy raises platform fees 50%. Olo launches Catering+. Teamsters strike hits Amazon in LA and IE during October Prime Day. AirAsia Superapp expands partnership with Foodpanda. An exploration of meal kit customer churn. Rite Aid files for bankruptcy. California cities large and small top list of “food-forward” locales.

Curbivore named one of Restaurant Dive’s “9 restaurant industry events to attend in 2024” — do you have your ticket yet?

Got a tip, feedback, or just want to say hi? Reply back to this email.