$10 Taco Bell Pass Boosts First Party Delivery

Dunzo Co-Founder out, Gelson's Recharge, Restaurant labor stats

Tomorrow is the most solemn of American holidays… National Taco Day! And Taco Bell is celebrating in a way that any deliverer can learn from. Meanwhile, Gelson’s is moving in to convenience stores as part of the transition to EVs, Dunzo’s Co-Founder is done-so, and the labor market is looking healthier. Read on!

Today:

Taco Bell’s Taco Lover Pass Returns

Dunzo Sheds Leader, Raises $30M

Chart Time | Restaurant Labor Health

Gelson’s Premium Convenience Store

APPS | Taco Bell’s $10 Subscription Returns

Taco Bell is celebrating “National Taco Day” in a big way, with a return of its ephemeral Taco Lover’s Pass. Today and tomorrow only, Taco Bell app users can opt in to the subscription program for $10, although 100 rewards members will also have the chance to access the program for free. Once enrolled, customers get one free taco a day, choosing from Crunchy, Soft, Spicy Potato, Doritos Locos, Supreme Tacos and a brand-new option: the Toasted Breakfast Taco.

The Big Picture: Taco Bell has rolled this program out from time to time since 2021 as a way to boost installs of its app. While the program itself is a loss leader, customers stopping by in-store are likely to complement that taco with a Crunchwrap or perhaps a weird Mountain Dew gelato. More importantly, once users have T-Bell on their phones, they’re likely to use that app to make delivery orders, saving the restaurant plenty of fees and commissions versus 3PD orders. Yum Brands-owned Taco Bell is also using this opportunity to kick off its expanded breakfast menu, which will shortly have a few more creative options joining that aforementioned Toasted Breakfast Taco.

QUICK COMMERCE | Is Dunzo Donezo? Co-Founder Out

India’s superfast delivery startup Dunzo is seeing some executive turmoil, as Co-Founder Dalvir Suri is exiting the company. Dunzo has recenly transitioned from using its own dark stores to delivering inventory from existing markets, c-stores and competing ghost stores like Reliance JioMart; Reliance, one of the country’s largest conglomerates, now owns 26% of the company. Suri had recently spearheaded the company’s efforts to grow out its B2B arm, with business-oriented sales expected to account for 70% of revenue.

The Big Picture: After six years with the company, Suri stayed on long enough to see the startup close its latest $30-35M financing round, which should address the deliverer’s cash crunch. To secure the money Dunzo cut its burn rate in half, slashing its head count to 200 employees and exiting less profitable markets. At the start of the year the company had 1,000 employees, and has raised a total of $467 million (including debt) from investors that include Google and Lightrock Ventures. With other quick commerce players like Getir finding stability via a partnership with Uber Eats, might Dunzo opt for a similar pact with Indian 3PD Swiggy?

CHART TIME | Restaurant Labor Stats

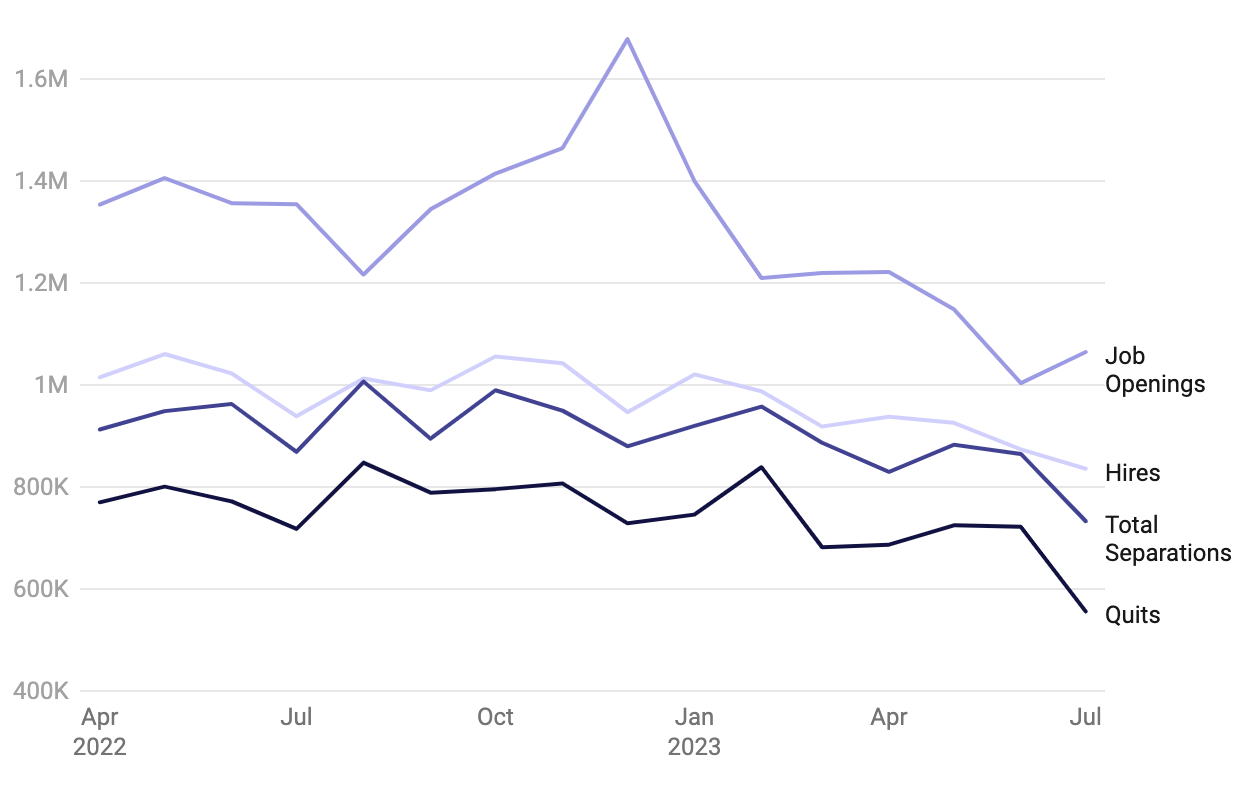

Restaurant Dive has some key stats on the state of the restaurant labor market, and overall they paint a picture of an industry returning to full health. Job turnover has come down (as charted above,) while wages have improved mildly, total employment has just about caught up with where it stood pre-Covid and the unemployment rate is holding steady.

GROCERY | Can C-Stores Move Upmarket? Gelson’s-Rove to Test Waters

When you think of a 7-Eleven or gas station convenience store, we reckon the first word that comes to mind is *not* “luxury.” Well, that may change as Gelson’s and Rove are teaming up to launch Gelson’s Recharge, with six locations scheduled to open across SoCal in the next year, and 20 by 2026. Rove will handle the EV charging aspect of the partnership, while Gelson’s — which operates 27 upscale supermarkets — stocks the merch, set to include poke bowls and sushi, sandwiches and wraps, salads, charcuterie and cheese plates.

The Big Picture: As electric vehicles slowly replace gas-powered cars, the businesses and real estate that live off the old business model are in flux. Who’s gonna stop in for snacks as they refuel, if the car is always fully charged up at home? While we likely won’t need as many Level 3 charging stations as we do full-service gas stations, those that do emerge may end up going to totally new brands, as this partnership attests. But existing c-stores are not asleep at the wheel; brands like 7-Eleven have been big movers in the delivery revolution, with products like super fast 7NOW. Will we see Gelson’s start delivering gas-free gas station sushi?

A Few Good Links

Domino’s turns to Microsoft for smarter pizza ordering. McDonald’s Egypt looks to Roboost to automate delivery dispatching. Consumers want to “shop the show” - why haven’t restaurant brands jumped on this the way large retailers have? Burger size lawsuit dismissed. Restaurant tech provider SpotOn sells sports / entertainment division to Shift4. Pilot names new COO. NorCal-based Subway operator found to have violated so many labor laws that the DOL orders them to close forever. Artisanal delivery service Jingle raises $3M.

Got a tip, feedback, or just want to say hi? Reply back to this email.