Improved Loyalty Program Fixed Domino's Woes

FTC sues to block Kroger-Albertsons merger, Xiaomi premieres first EV, Uber Eats earnings dip in Seattle

We were halfway through this morning’s newsletter, gathering up juicy news from Domino’s, Xiaomi and Uber Eats in Seattle, when the news broke: the FTC is suing to stop the Kroger-Albertsons merger. Given the implications that tie-up (and the success or failure of the lawsuit) could have on the grocery landscape, it’s a development worth truly digesting.

This week’s we’re publishing M-F, thanks to our partners at Woolpert.

Today:

Emergency Pizzas Turn Things Around for DPZ

Feds Sue to Stop Kroger-Albertsons

Chart Time | Seattle Deliveries Falter

Xiaomi’s Second EV Matters More Than Its First

FINANCE | Retooled Loyalty Program Boosts Domino’s Sales

After a tough few quarters, things are looking up for Domino’s; DPZ 0.00%↑ stock is trending skywards this morning after a strong FY 2023 release. Global retail sales were up 4.9% in Q4, 5.4% for the year (excl. f/x impacts.) U.S same store sales grew 2.8% YoY in Q4, and the pizza giant added 711 new locations over the course of last year. Overall, total sales hit a whopping $18.276 billion for 2023, that’s a lot of pizza!

The Big Picture: The company pointed to its relaunched loyalty program as the source of much of its success. Starting on October 9th, Domino’s retooled its Rewards program by lowering the minimum order threshold, adding new redemption tiers, and offering its fun, free “Emergency Pizza” promo. That was enticing enough to drive 2 million new members to Domino’s Rewards, which over enough time should improve infrequent customer loyalty, even if it means a short-term hit to margins. “Emergency Pizza was just a resounding success,” claimed CEO Russell Weiner on this morning’s earnings call.

PARTNER | Struggling with Last-Mile Chaos? 61% of Businesses Feel Your Pain

Is your last mile delivering headaches instead of packages? You're not alone. A staggering 61% of delivery businesses struggle with outdated tech, delays, inefficiencies, and skyrocketing costs.

Exploring strategies around making address entry easier and more accurate, providing your drivers with routing and task support, and overall fleet visibility and insights can be small changes with big impact.

If those tips piqued your interest, it's time to have a conversation. Meet with us at Curbivore or contact us today to see how Woolpert Digital Innovations’ location-based strategies fit into your last mile solutions.

POLICY | FTC Sues to Stop Kroger-Albertsons Merger

This morning, the Federal Trade Commission and nine states sued to halt Kroger and Albertsons proposed merger. “This supermarket mega merger comes as American consumers have seen the cost of groceries rise steadily over the past few years. Kroger’s acquisition of Albertsons would lead to additional grocery price hikes for everyday goods, further exacerbating the financial strain consumers across the country face today,” said Henry Liu, Director of the FTC’s Bureau of Competition. “Essential grocery store workers would also suffer under this deal, facing the threat of their wages dwindling, benefits diminishing, and their working conditions deteriorating.” The FTC also found the planned divestiture of a few hundred stores to C&S Wholesale Grocers to be inadequate, noting that currently C&S only operates 23 markets, and would struggle to “stitch together” a functioning business.

The Big Picture: Kroger is the nation’s largest pure-play supermarket chain, with $141 billion in sales and over 2,700 stores. Albertsons is not far behind, with $72 billion of sales at ~2,300 locations. If combined, this behemoth would significantly shift the grocery landscape, both online and off. Should the FTC lawsuit fail, we’ll see one company operate the Fred Meyer, Fry’s, Harris Teeter, King Soopers, Kroger, Quality Food Centers, Albertsons, Haggen, Jewel-Osco, Pavilions, Safeway, and Vons banners, employing a whopping 700,000 employees (at least until the “corporate efficiencies” of the merger start whittling away at headcount…) While both grocers have released statements reiterating their belief that the merger is necessary to compete with the likes of Amazon and Walmart, recent financial results from both Albertsons and Kroger have been highly profitable.

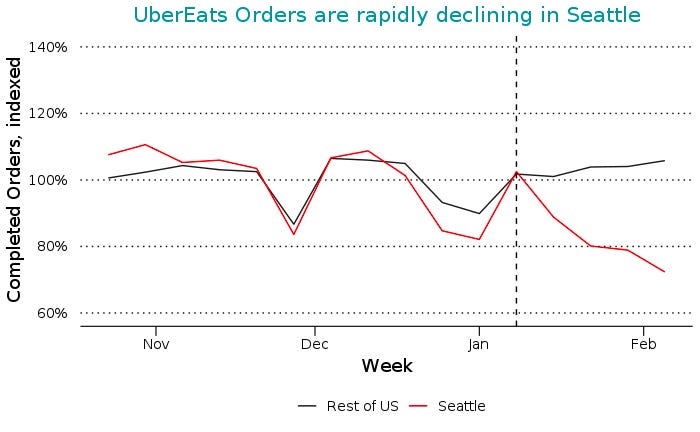

CHART TIME | Higher Fees Impact Uber Eats in Seattle

Seattle’s enhanced PayUp legislation has been in effect for about a month now, which among other things raised driver minimum wages and added rules around deactivations. Now Uber has data showing how the increased costs are impacting the marketplace, with reduced orders cutting into driver efficiency. In particular, Uber disagrees with assumptions the City of Seattle made about vehicle cost and depreciation, as most drivers use small and efficient vehicles, not panel trucks. The sentiment among workers and local politicos seems to be mixed.

VEHICLES | Xiaomi’s First Car Means More Cheap EVs Coming Soon

Much of the tech world is gathered at the Mobile World Congress in Barcelona this week, checking out the latest 5G chips, folding cellphones and… electric vehicles?! Chinese tech giant Xiaomi has released a real head-turner, as the global handset maker just debuted the SU7 EV. The high-end car features “five core EV technologies: E-Motor, CTB Integrated Battery, Xiaomi Die-Casting, Xiaomi Pilot Autonomous Driving, and Smart Cabin” and Xiaomi’s spent $10 billion developing it thus far.

The Big Picture: This car is pure brand halo, meant mostly to signal to the world that Xiaomi can make something as attractive as a Porsche, and sure maybe a few of its 20 million “premium” customers will plunk down some RMB for the vehicle. But the company didn’t get to ~$41 billion USD in revenue from the luxury market; the 146.4 million smartphones it sold last year were largely budget models. And that’s what has Detroit and Stuttgart worried — an assault of low-priced EVs in an industry already seeing prices come down thanks to the efforts of other Chinese OEMs like BYD and Huawei. Those smaller EVs are not only better from an energy consumption standpoint, they improve the odds that delivery workers (especially in developing economies) can afford the leap to electrification as well.

A Few Good Links

Walmart lowers store-to-home delivery costs 20%. Figure AI raising $675 million for humanoid robots. FedEx says more rest and meals (oh no) for truckers will raise costs. Bloomin’ Brands closes 41 stores as Q4 net income hits $43.3M. Spain planning to ban short flights when a train-based alternative exists. Microlino Lite is a car-like bike. Which AV freighters are still truckin’?

Got a tip, feedback, or just want to say hi? Reply back to this email.