An NYC judge dealt a blow to the deliverers’ bottom line, as he ruled that the city’s wage increase could go into effect Monday. Meanwhile, Wonder bought itself a beleaguered meal kit maker, Alibaba’s got an IPO, and we chart which 3PD is the biggest.

Today’s newsletter is brought to you by the Curbivore conference.

Today:

3PDs Must Pay $18/Hr in NYC Starting Monday

Wonder Snaps Up Blue Apron

Chart Time | Who’s The Biggest Deliverer of Them All?

Alibaba’s Hot Delivery & Logistics IPO

POLICY | Judge Okays $18/Hr Courier Pay in NYC

Starting this Monday, delivery workers in New York City will make $17.96 per hour, as State Judge Nicholas Moyne denied an injunction sought by Uber Eats, Grubhub and DoorDash. While the 3PDs’ suit against the city can continue, they’ll have to pay the higher wage as the case progresses, with increased checks going out as soon as the next pay period. While Judge Moyne had previously stayed the raise in July, he now felt the city had “subpoenaed data from the platforms that would have enabled it to model incidence of higher pay on detailed subsets of merchants and consumers, the platforms failed to produce it” and that the companies’ concerns around on-call time had been addressed.

The Big Picture: The City of New York estimates that delivery workers currently make around $11/hr, so this will meaningfully improve the standard of living for 65,000 or so workers; even more so with the scheduled further pay increase, meant to hit $19.96/hr in 2025, should the delivery apps ultimately lose their case. Worth noting is that the Judge continued the injunction for NYC-based Relay, meaning it can continue to offer the old, lower wage. Relay does not directly take orders from customers, but instead “relays” that order directly to its restaurant partners.

PARTNER | Curbivore Conference Brings Delivery Execs to LA

The Curbivore conference returns to LA: March 28 & 29, 2024. This event brings together the entire world of delivery and curbside commerce — speakers have included Uber’s Head of Grocery + Retail Fulfillment Products David Meers, Walmart’s VP of Spark Driver Platform Nav Chadha, Kitchen United CEO Michael Montagano, Pizzana Founder Candace Nelson, Business Insider Restaurant Correspondent Nancy Luna, Wonder Co-Founder Chad Lore, Yummy.com CEO Barnaby Montgomery, JOKR COO Aspa Lekka, Nextbite CEO Alex Canter, Serve Co-Founder MJ Chun and many more. $99 Early Bird tix available for a limited time!

MEAL KITS | Wonder to Acquire Blue Apron

Meal kit maker Blue Apron has entered a definitive merger agreement to be bought by Wonder, the delivery and food hall company that formerly prepped meals in trucks outside of customers’ homes. This expedites the creation of a “mealtime super app, serving a broad range of occasions that feature cuisines from some of the world’s best chefs and restaurants,” said Wonder CEO Marc Lore. New Jersey-based Wonder is acquiring NYC-based Blue Apron for $13/share, valuing the deal at $103 million and representing a 77% premium over the meal kit co’s trailing share price.

The Big Picture: It’s been a long fall from grace for Blue Apron, initially founded in 2012. While it went public in 2017 at around a $1.9 billion valuation, the company’s shares were down a whopping 99.61% prior to this acquisition news. In May the company sold off its production and fulfillment arm to FreshRealm, as it sought to become asset-light. Evidently they became so light on assets they could be bought up with snack money! For Wonder, it continues the company’s winding evolution since it shuttered its truck business. Time will tell if consumers need to go to the same app for the meal they want right now for lunch versus the meal they plan to cook for themselves two Wednesdays from now…

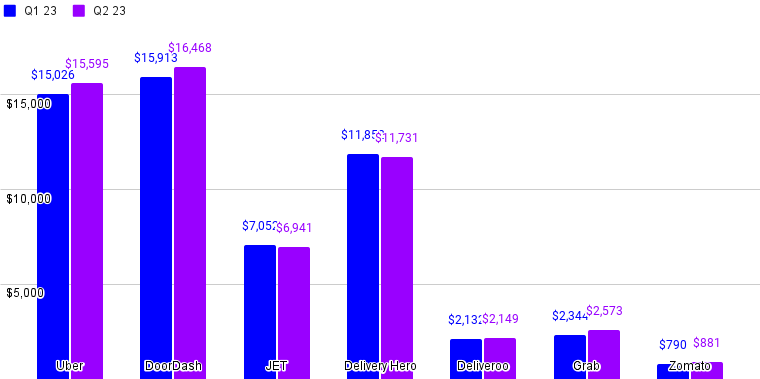

CHART TIME | 3PD By GMV

As we head towards Q3, we thought this was a perfect time to look back at Q1 and Q2, and chart up which third party delivery company was moving the most monetized meals in the past two quarters. GMV, GTV, GBV, GOV, each company calls it something slightly different, but it all refers to the same thing: the total value of the meals ordered through the platform (with most of that $ captured by the restaurants, not the platform itself.) As you can see, things are looking pretty neck and neck for DoorDash and Uber Eats, partially reflecting the value of American customers. (Note that foreign currencies converted to U.S. dollars, all figures listed in millions.)

FINANCE | Will Alibaba’s Delivery Arm Be The Year’s Hottest IPO?

Alibaba is spinning out its delivery and logistics arm — Cainiao — and Bloomberg declares it may be the hottest tech IPO of the year. The listing, on the Hong Kong stock exchange, is expected to raise at least $1 billion, with at least 50% of the shares still retained by Alibaba, which created the business in 2013 but today only accounts for about 1/3 of its parcel volume. Cainiao serves over 100,000 merchants and delivered 1.5 billion packages last year, offering delivery anywhere in China within 24 hours, and internationally in 72 hours or less. In Q2, the company made approximately $54 million in profit off of $3.2 billion in turnover.

The Big Picture: Chinese ecommerce giant Alibaba is looking to partially split up and publicly list a number of its subsidiaries, as it hopes to create additional shareholder value. Those businesses consist of its main Chinese commerce platform, the Cainiao logistics biz, local consumer and food delivery services, digital entertainment, international commerce, and cloud software. A separate IPO of its supermarket subsidiary Freshippo is being slow walked until the company believes it can hit a $6 billion valuation.

A Few Good Links

Walmart looks to grow third party marketplace volume this holiday season. Uber rolls out new Freight roadmap. Grocery shoppers cut back. DHL ups rates 5.9%, matching FedEx and UPS. Olo integrates SoundHound for AI-enabled voice-powered ordering. CA Gov. Newsom signs $20/hr fast food min wage law.

Got a tip, feedback, or just want to say hi? Reply back to this email.