Hello? 📞 DoorDash Adds Automated Phone Ordering

Assessing Instacart's S-1, Walmart Spark's identity issues, retail's real estate struggles

What a way to start the new week! Not only do we have some insights from Instacart’s public filing that are required reading for any delivery exec, but Walmart and DoorDash have some important news to digest as well.

Today:

DoorDash Adds Phone Ordering Tools

Top Takeaways from Instacart’s Public Filing

Chart Time | Retail’s Urban Struggles

Walmart Spark’s Growth-Induced Identity Crisis

3PD | Pick Up The Phone, It’s DoorDash

DoorDash is rolling out a new AI-enhanced phone ordering tool for merchants, allowing restaurateurs to offload telephone sales to DoorDash’s mix of machine learning and human-powered agents. Depending on how busy the restaurant is, customers calling in will either be greeted by the existing in-house staff, DoorDash’s third party human agents, or a computer. Customers will not only be able to order via voice in multiple languages, but returning callers will be prompted to reorder previous favorites. Additionally, the solution integrates with DoorDash Drive, the 3PD’s white-label delivery product.

The Big Picture: As old school as it is, voice ordering is still a big business: 20% of customers state they prefer ordering over the telephone. At peak times, up to 50% of phone calls to restaurants go unanswered, as swamped staff instead deal with in-person issues. Offloading to a third party solution (even without the AI element) allows restaurateurs to more efficiently spread the peak load across a call center that can work multiple timezones, as opposed to having to over-staff just for the dinner rush. The integration with DoorDash’s existing tech stack should have specialized AI-phone ordering providers like SoundHound and PopMenu looking over their shoulders…

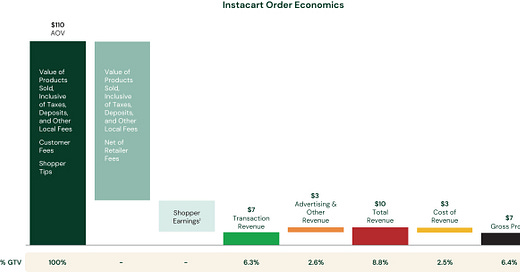

FINANCE | Scouring Instacart’s S-1 for Insights

Well it’s official, after weeks of rumors (and months if not years of waiting) — Instacart filed its paperwork to go public. (SEC doc here.) While Instacart’s private valuations have sunk since it scuttled a previous shot at an IPO, it looks like this Nasdaq listing (symbol: CART) may have a bit of juice to it. Norges Bank, TCV, Sequoia Capital, D1 Capital Partners, L.P., and Valiant Capital Management have agreed to buy up to $400M in stock, while PepsiCo (a big advertiser) is buying in with a $175M private placement.

The Big Picture: Instacart going public while already profitable is a big milestone for the industry. It’s managed to take an ancient behavior (grocery shopping) that consumers had long implicitly thought of as “free” (because each shopper preformed his or her own labor) and put a price tag on it, and consumers have shown they’re willing to pay it. Now that the company has built a huge meta-marketplace, it’s shown that the biggest value it can derive is actually charging CPGs to access those eyeballs, more so than taking a cut of grocers’ razor-thin margins on commoditized transactions. Additionally, Instacart has shown it has serious customer loyalty, as GTV actually increases for cohorts as they mature.

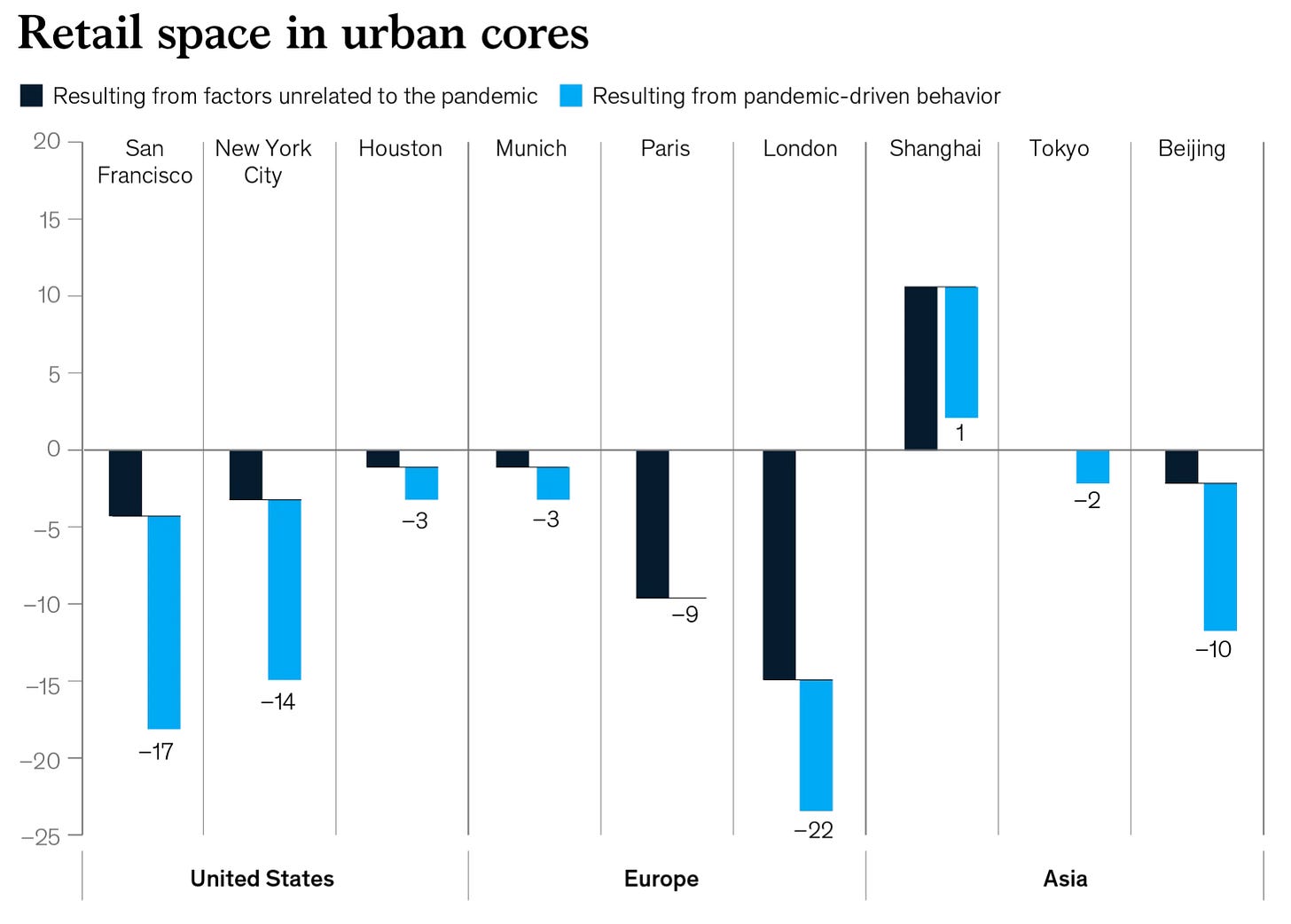

CHART TIME | Falling Demand for Urban Retail Real Estate

While Covid certainly exacerbated it, urban retail was going to have a tough time regardless. New data collected by McKinsey shows how cities the world over are facing an oversupply of retail-oriented real estate, as changing technology and consumer expectations mean folks would rather have the goods come to them, than schlep themselves to the goods. Of course, retail is far from dead (outside of perhaps a few blocks in San Francisco,) its just incumbent on operators to create shopping experiences worth traveling for.

TRUST & SAFETY | Walmart Spark’s Identity Crisis

Walmart Spark, the Bentonville giant’s gig-labor powered delivery platform (not to be confused with Walmart GoLocal, which allows other brands to access Walmart’s delivery network, including Spark Driver labor) is having some growing pains. While the platform reported tripling its workforce in the past year, there’s some doubt if all those users are unique. Both employees and drivers are flagging that not all Spark Drivers are who they say they are, as certain users create multiple accounts to claim more orders or grab special incentives.

The Big Picture: As Spark has grown to cover 84% of the country, issues like these can be expected to grow alongside the platform’s scale. In response, Walmart is rolling out facal recognition and ID-scanning systems, to better verify identities. Just two weeks ago, DoorDash also pushed out some new user identity tools; nothing can scare off customers quite like having the stranger stopping by their house not match up with the photo on their phone.

A Few Good Links

Zepto becomes India’s first 2023 unicorn, in an encouraging sign for the instant delivery space. Kiwibot comes to University of Southern Indiana and University of Maine. Rite Aid preparing for bankruptcy as it struggles to keep up with CVS, Walgreens and high-dollar opioid lawsuit. Uber raises minimum driving age in Calif. to 25 as it looks to lower insurance costs. Hormel Foods shares corporate insights into automation. U.S. News ranks meal kits, top two are Green Chef and Blue Apron (sorry color blind customers.) Neato, it’s an autonomous, electric tractor! Dog Haus appoints Kitchen United’s Michael Montagano as CEO, as virtual brands hit 20% of hotdog franchisor’s sales.

Got a tip, feedback, or just want to say hi? Reply back to this email.

Great articule! Can I order any other human-powered AI BullShip, for customer's sake, please?